Could Solana’s Whale Accumulation and DeFi Growth Signal a Potential Breakout Above $144?

-

As whale activity surges and decentralized finance (DeFi) enthusiasm mounts, Solana (SOL) seems poised for a potential breakout—traders might not want to stay asleep!

-

The recent spike in whale accumulation and the positive trends in DeFi activity could act as catalysts if the crucial resistance at $144 is breached.

-

“Solana’s foundation remains robust, poised near vital resistance points,” stated a COINOTAG analyst, underscoring the urgency for traders to monitor market movements closely.

Explore the potential upward movement of Solana (SOL) as whale accumulation rises and DeFi activity strengthens, positioning for a breakout near $144.

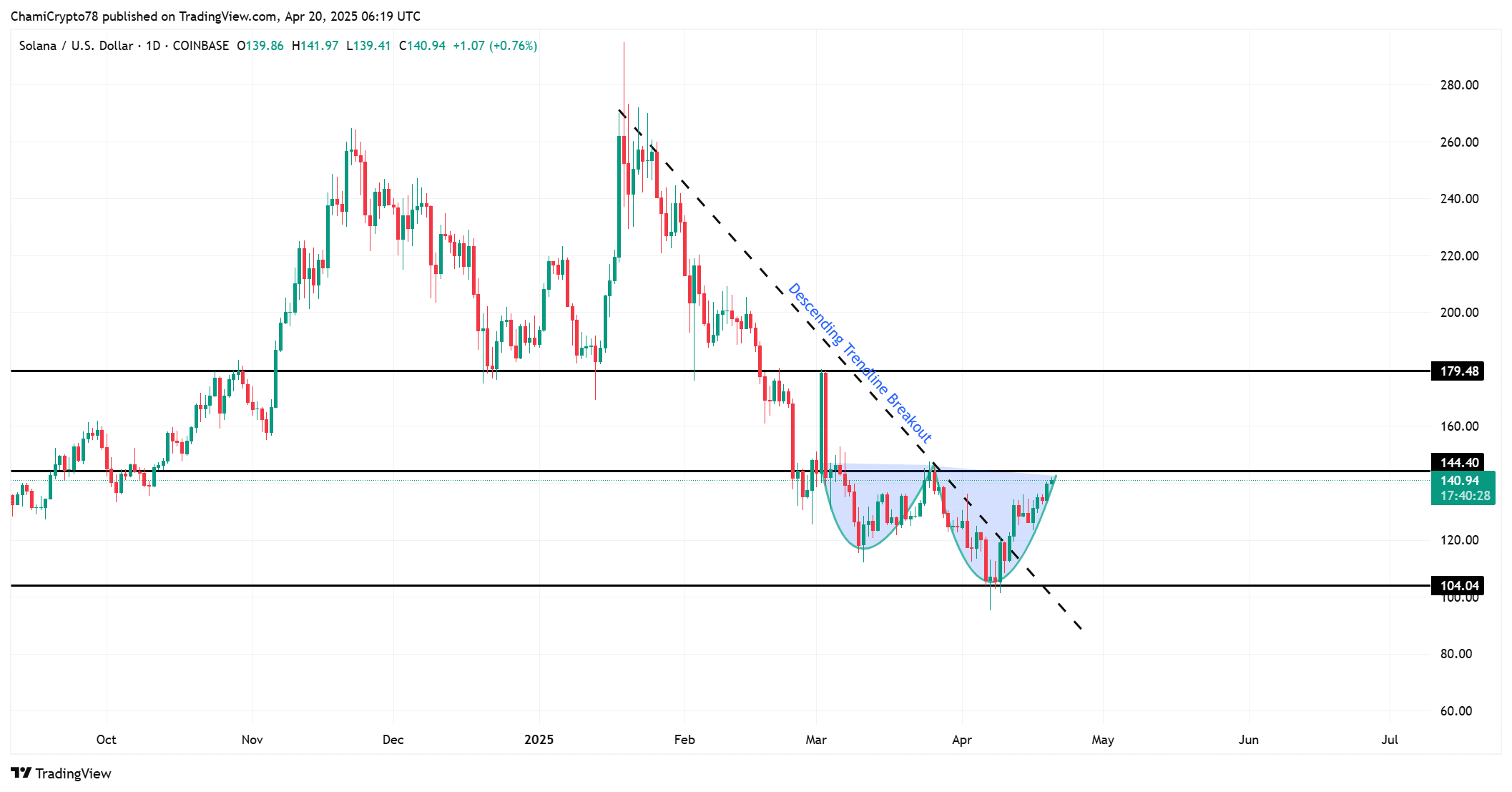

Is the cup and handle pattern preparing for liftoff?

Recent chart formations suggest that Solana’s price is forming a classic cup-and-handle pattern. This bullish pattern indicates strong underlying momentum, particularly as SOL trades around $139—a critical zone for bulls approaching the neckline resistance of $144.40.

A decisive breakout past this level could indicate sustained upward momentum, with targets extending towards $179.48. However, should the resistance hold, traders might experience an extended consolidation around $135–$140.

Source: TradingView

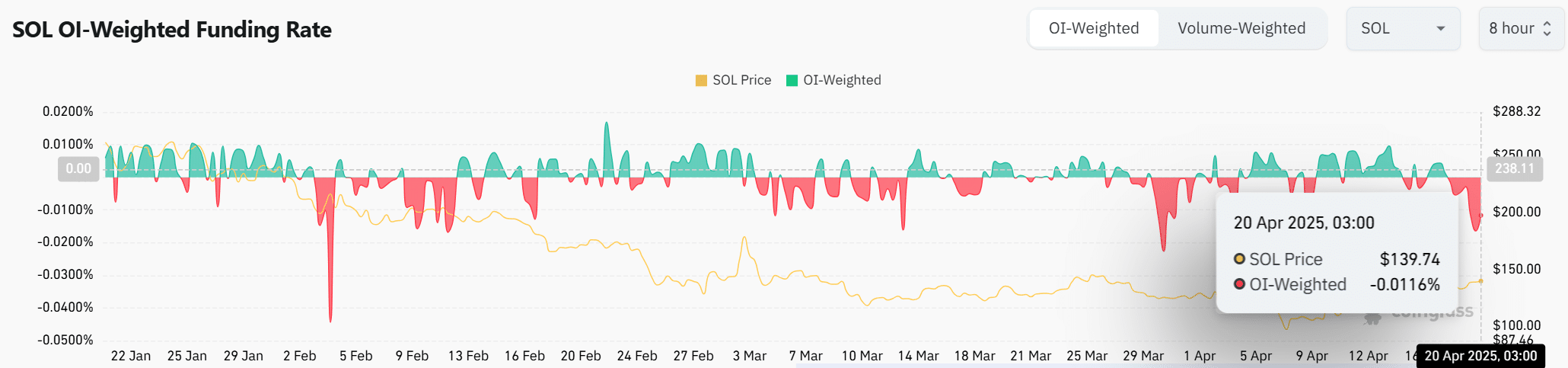

Are traders underestimating Solana’s momentum?

Despite positive signals from price action and whale activity, recent derivatives data presents a contrasting narrative. The OI-Weighted Funding Rate dropped to -0.0116% on April 20, pointing towards a dominance of short traders in perpetual futures markets.

This negative funding generally reflects skepticism towards a rally, often indicating attempts to capitalize on recent gains. However, the combination of strong spot accumulation with this funding rate creates a prime opportunity for a potential short squeeze.

Source: CoinGlass

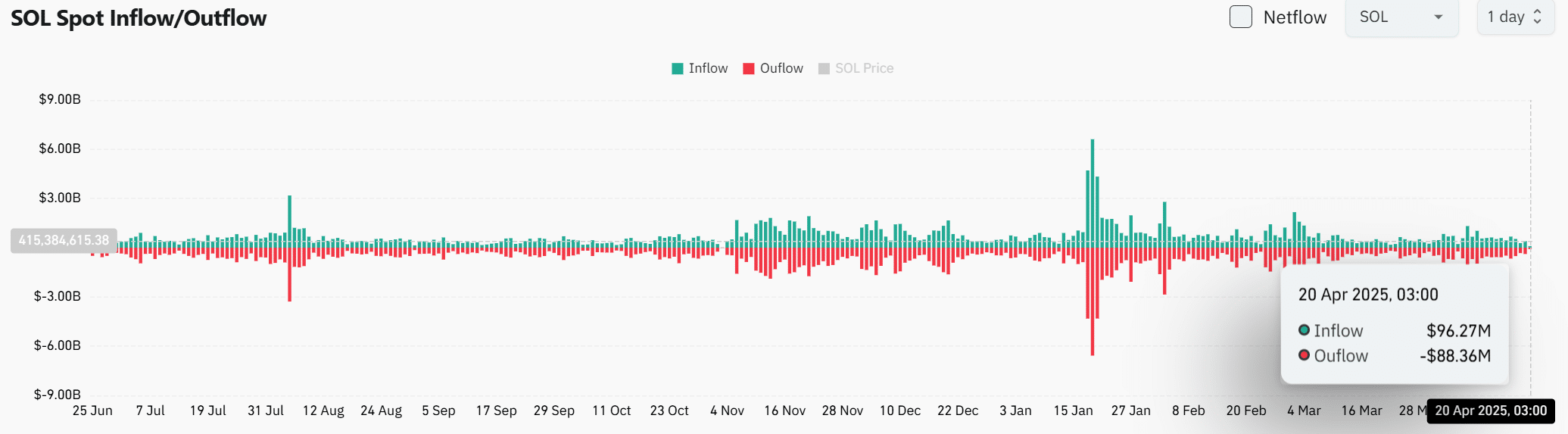

Do inflows hint at a spot-driven breakout?

Spot flow metrics reveal supportive trends for Solana’s future performance. Total spot inflows reached $96.27 million on April 20, slightly outpacing outflows of $88.36 million.

This net inflow highlights a trend of persistent accumulation among participants, aligning well with the reported whale wallet growth and chart patterns. While derivatives markets show caution, the spot participants signal strong long-term confidence.

Source: Coinglass

Can DeFi growth reinforce SOL’s breakout potential?

Significantly, Solana’s DeFi landscape has bolstered the positive outlook. The network’s Total Value Locked (TVL) surged by 3.11% within 24 hours, surpassing $9.018 billion.

This rise in activity showcases Solana’s rekindled relevance among decentralized app users and liquidity providers. As the ecosystem’s usage strengthens, it provides additional evidence for the bullish narrative surrounding SOL.

Source: DefiLlama

Will whales and DeFi momentum carry SOL higher?

In summary, the confluence of rising whale participation, sustained spot inflows, and increasing DeFi activity presents a compelling case for SOL’s potential breakout. While current funding rates suggest caution, they may become a contrarian indicator for an ensuing rally.

A successful breach above critical resistance levels could shift bearish pressure into bullish momentum, pushing prices toward the target of $179.48. However, confirming this outlook necessitates sustained trading volume and clear control by bullish traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ADA Price Breaks Key Resistance: Is Cardano Set for a Major Rally?

Cardano Poised to Recover 40% Losses From March – Is the ADA Bear Cycle Over?

Cardano’s recent 17% surge signals a potential recovery from March’s 40% loss. The key to further growth lies in breaching the $0.85 resistance and holding support above $0.74.

Pi Network is Inching Towards $1 Thanks to a Major Shift in Holder Behavior

Pi Network’s price has risen 27%, fueled by strong investor sentiment, but it faces a tough resistance at $0.78. A breakout could push the price higher, while failure to hold support at $0.71 risks a decline.

Worldcoin (WLD) Surges Amid Legal Challenges and Speculation on OpenAI Integration