Relevant Token Listings Enabling Hyperliquid To Capture Huge Slice of DEX Perpetuals Volume: Blockworks

A prominent crypto analytics firm says the layer-1 blockchain Hyperliquid ( HYPE ) is dominating the decentralized perpetual futures trading market.

In a new thread on the social media platform X, Blockworks says that Hyperliquid now accounts for nearly 80% of perpetual futures trading volume in the decentralized exchange (DEX) space.

According to the crypto insights platform, Hyperliquid is massively outperforming its competitors due to an effective token-listing strategy and top-notch user experience (UX).

“Hyperliquid’s success stems primarily from rapid, relevant token listings and superior UX for users and market makers.

Currently, it is the only DEX that has been able to compete with CEX (centralized exchange) volumes.

Over the past three months, the platform has averaged $6.4 billion in daily trading volume, which sits just above 50% of the daily trading volumes of Bybit and OKX.“

Source: Blockworks/X

Source: Blockworks/X

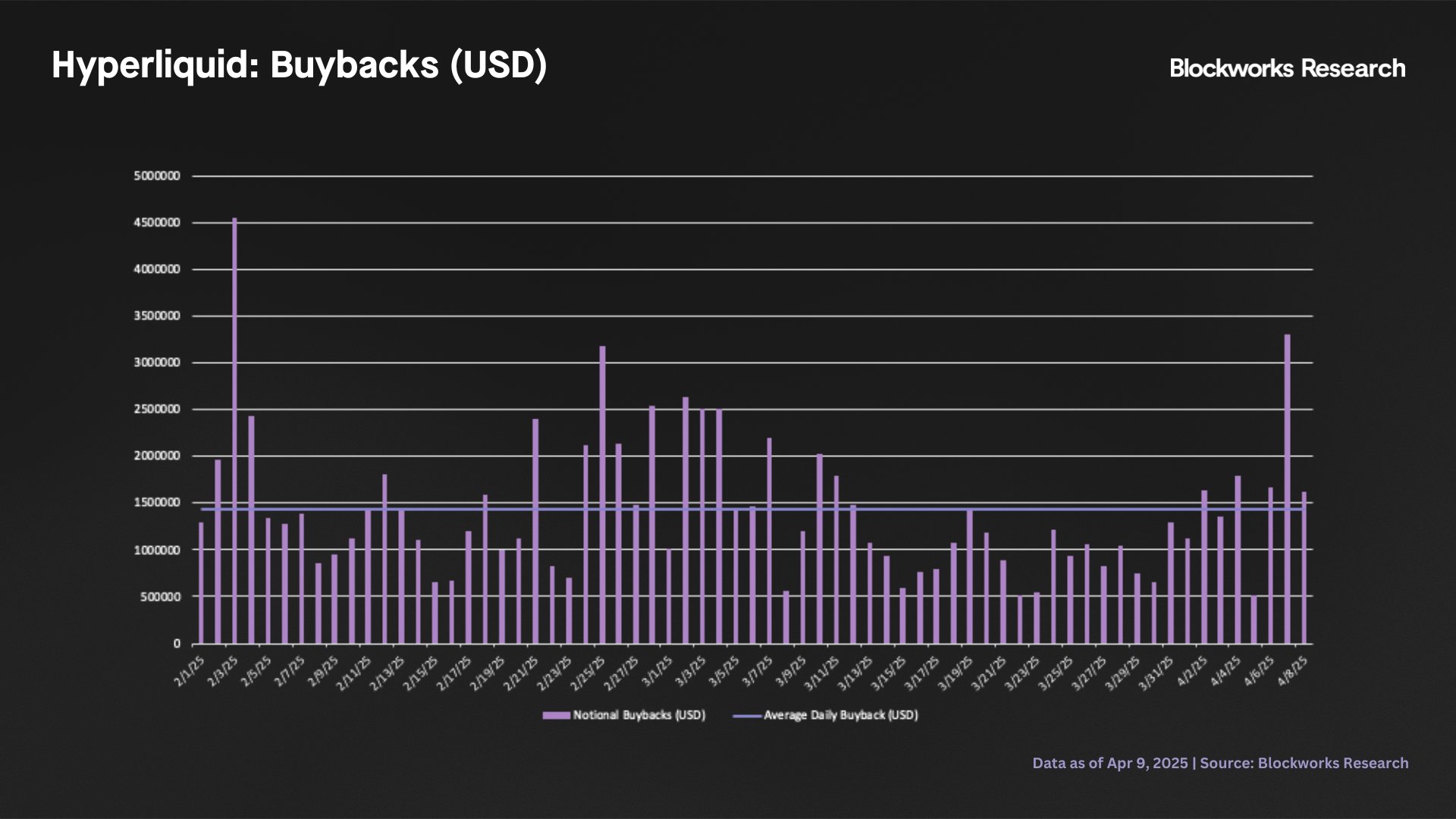

Blockworks notes that Hyperliquid’s trading engine, HyperCore, has given the project sufficient capital to initiate huge token buybacks.

“Fees generated on HyperCore are divided between the HLP (Hyperliquidity Provider) and the assistance fund. The assistance fund uses fees to buy back the HYPE token. From February until now, the assistance fund has bought a cumulative $96 million in HYPE, which is approximately $1.4 million daily.”

Source: Blockworks/X

Source: Blockworks/X

Blockworks predicts that Hyperliquid will grow large enough to take on its CEX counterparts.

“We expect HyperCore to start competing with CEXs and taking market share away from them, while continuing its dominance in the decentralized perpetuals space.”

At time of writing, HYPE is trading for $18.01.

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This week, the U.S. Bitcoin spot ETF had a cumulative net inflow of US$3.0629 billion

AAVE drops below $170

The total locked value of Ethereum Layer2 network is 31.21 billion US dollars, up 13.2% on the 7th

1inch team investment fund sold 70.76 WBTC again 30 minutes ago