XRP Price Eyes $2.40 Breakout Amid Major Partnership Speculation

XRP price forms a bullish triangle with $2.22 resistance blocking further gains. SWIFT partnership rumors position XRP for $3 and long-term price growth. Despite a weak RSI, XRP price eyes the $2.60–$3 band.

Ripple (XRP) price rallied through a weekend rise from its $2.00 critical support mark to reach $2.23.

SWIFT, a global financial messaging network made subtle hints it could introduce Ripple’s blockchain system which led to this market movement in XRP price.

The top altcoin’s price chart showed bullish signals that indicate a price movement toward $2.40 according to technical and fundamental indicators.

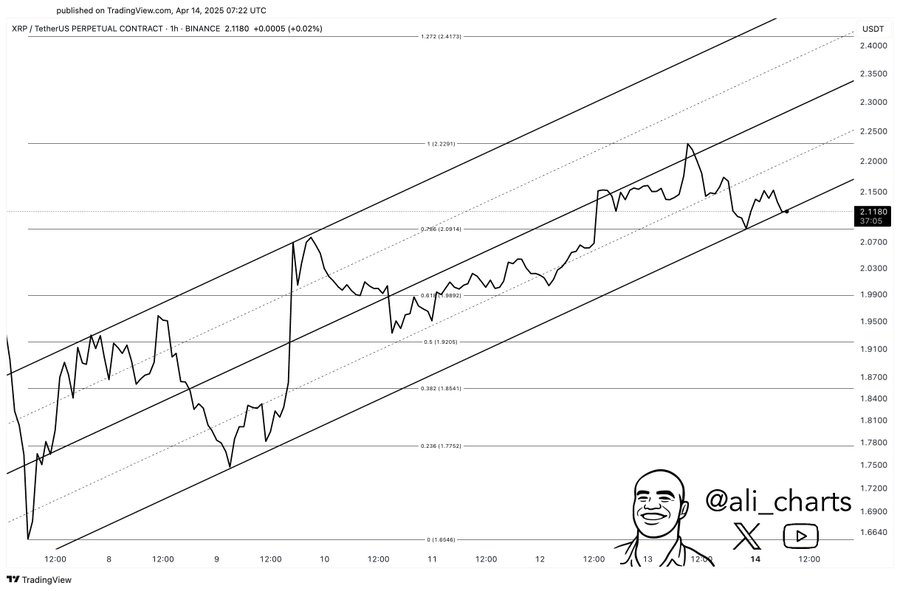

Crypto analyst Ali identified an ascending triangle formation supporting this case. While crypto commentator John Squire pointed to an imminent announcement by SWIFT regarding Ripple’s integration.

XRP Price Structure Aligns for a Bullish Breakout

Market analyst Ali shared an ascending triangle pattern on XRP’s 1-hour chart, signaling a possible breakout.

He identified $2.22 as the horizontal resistance line and emphasized the higher lows forming beneath it.

This structure often indicates strong accumulation, increasing the likelihood of an upward price movement once resistance is breached.

At press time, XRP price traded at $2.15, consolidating just under the key resistance.

The price maintained its upward trend within the triangle, and support levels near $2.10 remained intact.

Analysts viewed this structure as bullish, especially as XRP price continued to print higher lows. The price must break above $2.22 with rising volume to confirm the setup and target $2.40.

Source: Ali Martinez, X

Source: Ali Martinez, X

Fibonacci extensions placed the next technical target near $2.40, matching Ali’s breakout estimate.

The ascending triangle remained valid as long as the price did not breach the lower trendline.

The formation demonstrated consistent demand from buyers despite broader market uncertainty.

SWIFT Partnership Rumors Fuel Buying Sentiment

XRP gained momentum after rumors spread about a partnership between Ripple and SWIFT.

John Squire predicted that an official announcement would appear sometime during the upcoming week.

Ripple’s blockchain technology has reportedly started integrating into SWIFT’s messaging framework, reaching over 11,000 worldwide financial institutions.

Squire recalled Ripple’s involvement in SWIFT’s pilot programs in 2023.

These initiatives tested blockchain’s ability to improve cross-border transaction speed and transparency.

A formal agreement would mark a significant advancement in Ripple’s institutional adoption, supporting XRP’s role as a bridge asset in international payments.

Such integration can help in the expansion of ripple transactions that is very crucial when it comes to folding the values in the long run.

Ripple’s technology thus presented itself as an effective solution for high-volume cross-border payments within the banking system.

This prospect is one factor that contributed to the current sentiment of the top altcoin price.

Technical Indicators Show Early Bullish Signals

Interestingly, short-term technical indicators suggested early bullish momentum, though confirmation remained pending.

The Relative Strength Index hovered near 50, reflecting a balance between buying and selling pressure.

A move above 60 would offer a clearer bullish signal, especially if accompanied by increased trading volume.

Source: TradingView

Source: TradingView

Meanwhile, the Moving Average Convergence Divergence (MACD) indicator displayed the beginning of a bullish crossover on lower time frames.

If the MACD line crossed above the signal line, this would reinforce short-term upside potential.

However, analysts noted that confirmation required sustained price action above $2.22 and a spike in trading volume.

XRP saw its support at $2.00 hold up well, bolstered by previous price dips during volatile trading sessions.

Above this level, the ascending triangle remained intact and provided a ground for further advancement toward $2.40.

Fundamental Drivers Support Higher Valuation

Ripple further extended its coverage to the Asia-Pacific, Latin America, and the Middle Eastern regions.

These developments have further boosted the chances of XRP as the utility coin, which is currently advancing in the market.

SWIFT’s integration with Ripple could expand Ripple’s access to traditional banking systems on an international level.

More than 11,000 institutions linked to the SWIFT financial messaging system can leverage Ripple’s faster settlement.

This will establish a foundation for XRP price that is less affected by speculative market trends.

Other global factors such as the trade war and monetary policy changes are pushing investors to adopt blockchain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PEPE Dips Slightly – But Whales Are Still Accumulating. Should You Follow?

Pepe's funding rate has risen strongly in the past couple of days, one of several signals that more gains are coming.

ARK Invest Sees Bitcoin Hitting $1.5M By 2030 On Rising Institutional Demand

ARK expects institutions to allocate up to 6.5% to Bitcoin and sees it capturing 60% of gold’s market value in its bullish scenario.

Fartcoin (FARTCOIN) Price Analysis: Smart Money Selling Flashes Warning Signs

Was $1.4K Ethereum’s ‘generational bottom?’ — Data sends mixed signals

Traders say ETH price fell to a “generational bottom,” but historical and network activity data suggest that this is not the case.