Pi Network Urged to Emphasize Transparency and Caution Following OM Collapse Concerns

-

In the wake of the Mantra (OM) token collapse, analysts are urging the Pi Network to embrace transparency and stricter regulations as it transitions to Open Mainnet.

-

The Pi Network’s expanding ecosystem, which now includes Chainlink integration and Pi Ads, aims to establish a durable framework for adoption and utility, helping to mitigate risks analogous to those experienced by OM.

-

Concerns over market manipulation and risks associated with centralized exchanges (CEXs) have prompted some Pi validators to recommend that users consider withdrawing their coins to maintain price stability.

As Pi Network transitions to Open Mainnet, analysts emphasize the need for transparency to prevent risks highlighted by the recent OM token crash.

Pi Network Advised to Prioritize Transparency Post-Mainnet

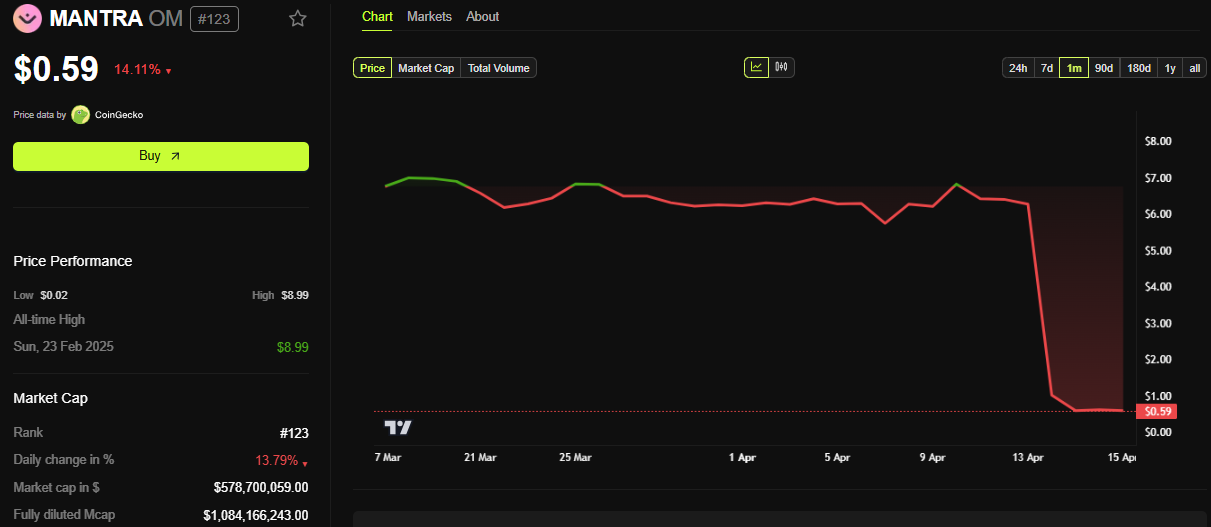

The warning follows the OM token’s dramatic fall, which saw its price plummet more than 90% in less than an hour, erasing over $5.5 billion in market capitalization.

After this downturn, the crypto sector is rife with apprehension regarding potential similar incidents in projects moving through crucial phases such as development and token unlocking. This includes Pi Network, which has recently entered its Open Mainnet phase.

Dr. Altcoin, a well-known crypto analyst and proponent of decentralized ethics, draws parallels between the OM incident and Pi Network, advocating for enhanced regulation.

“The OM incident is a wake-up call for the entire crypto industry, proof that stricter regulations are urgently needed. It also serves as a huge lesson for the Pi Core Team as we transition from the Open Network to the Open Mainnet,” he stated on Twitter.

While some members of the community defended Pi Network, citing its utility-focused roadmap and commitment to avoiding speculative behavior, Dr. Altcoin reiterated concerns over its transparency.

“One thing is clear about the PCT, they are not transparent,” he commented, stressing that accountability is crucial.

Nevertheless, the broader Pi community remains optimistic. The Pi Open Mainnet account, presented as a forefront voice, rebuffed negative comparisons by highlighting specific reasons why Pi might avert OM’s fate. These include a deliberate slow token release strategy and the absence of significant early-sell events.

“Massive community (35M+ pioneers), steady unlocks, growing utility (.pi domains, dapps), and a clean track record,” they emphasized.

Indeed, the Pi ecosystem is flourishing. The recent integration with Chainlink, along with new fiat on-ramps and Pi Ads, is fostering what the team describes as a “virtuous cycle” of adoption, as stated by a senior pioneer on Pi Open Mainnet 2025.

“These advancements form a virtuous cycle for Pi Network. Easier fiat ramps bring in more users (Pi’s community is already ~60M strong), Pi Ads drive more apps & utility, and Chainlink integration adds trust and interoperability. More users → more utility,” they elaborated.

With an ever-growing community nearing 60 million strong, many believe Pi has established a robust, user-driven foundation, contrasting sharply with OM’s centralized operations.

Is This Enough to Prevent OM-Like Fate?

Nevertheless, skepticism persists. Mahidhar Crypto, a validator for Pi Coin, has advised users to extract their Pi coins from centralized exchanges to safeguard against manipulative pricing tactics.

“We have observed what transpired with OM—how market makers exploited users. When you deposit your Pi tokens on CEX, market makers use bots to create artificial buy/sell walls, manipulating prices and liquidity,” he cautioned.

This echoes recent concerns regarding potential collusion between market makers and centralized exchanges. Mahidhar also urged the Pi Core Team to scrutinize the Know Your Business (KYB) verification processes for companies and refrained from listing Pi derivatives on CEXs, alluding to the perils of leveraged trading concerning nascent assets.

Further intensifying reservations are on-chain metrics associated with OM. Trading Digits, an esteemed analysis firm, pointed out that the “Pi Cycle Top” indicator—a pattern often hinting at market peaks—has indicated twice for OM since 2024, with the latest signal occurring merely two months prior to its crash.

“Coincidence or bound to happen?” the firm questioned.

Will Pi maintain a disciplined, utility-driven trajectory, or could it succumb to similar pitfalls that precipitated OM’s decline?

As of the latest report, COINOTAG data indicates that Pi Network’s PI coin is trading at $0.74, reflecting a decline of 1.36% over the past 24 hours.

Conclusion

As Pi Network enters this pivotal phase, the emphasis on transparency and community engagement will be key to its success. Observers will be closely monitoring the measures taken by Pi’s leadership to ensure that the lessons learned from the OM crash are effectively addressed.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

EnclaveX launch brings fully encrypted, cross-chain futures trading to retail investors

Sui Integrates Babylon’s Bitcoin Staking Protocol and Becomes a BSN

Will Paul Atkins, the New SEC Chair, Change the Regulatory Stance?

Breaking: Court Pauses Appeal in Ripple Case