XRP Market Analysis: Bearish Trends Anticipate Possible Short Squeeze as Traders Remain Cautious

-

The cryptocurrency market has been witnessing significant shifts, particularly with Ripple’s XRP, which recently broke through its long-held trendline resistance.

-

The breakout comes amid broader market trends indicating potential volatility ahead, as traders cautiously eye short-term opportunities while remaining aware of larger bearish trends.

-

According to recent insights from COINOTAG, “Traders should not FOMO into buying XRP after the break of the six-week trendline resistance,” emphasizing the importance of strategic decision-making.

Ripple’s XRP sees a significant trendline breakout; however, caution is advised as bearish signals persist amidst market volatility.

Ripple’s XRP Breaks Trendline Resistance, but Bearish Signals Linger

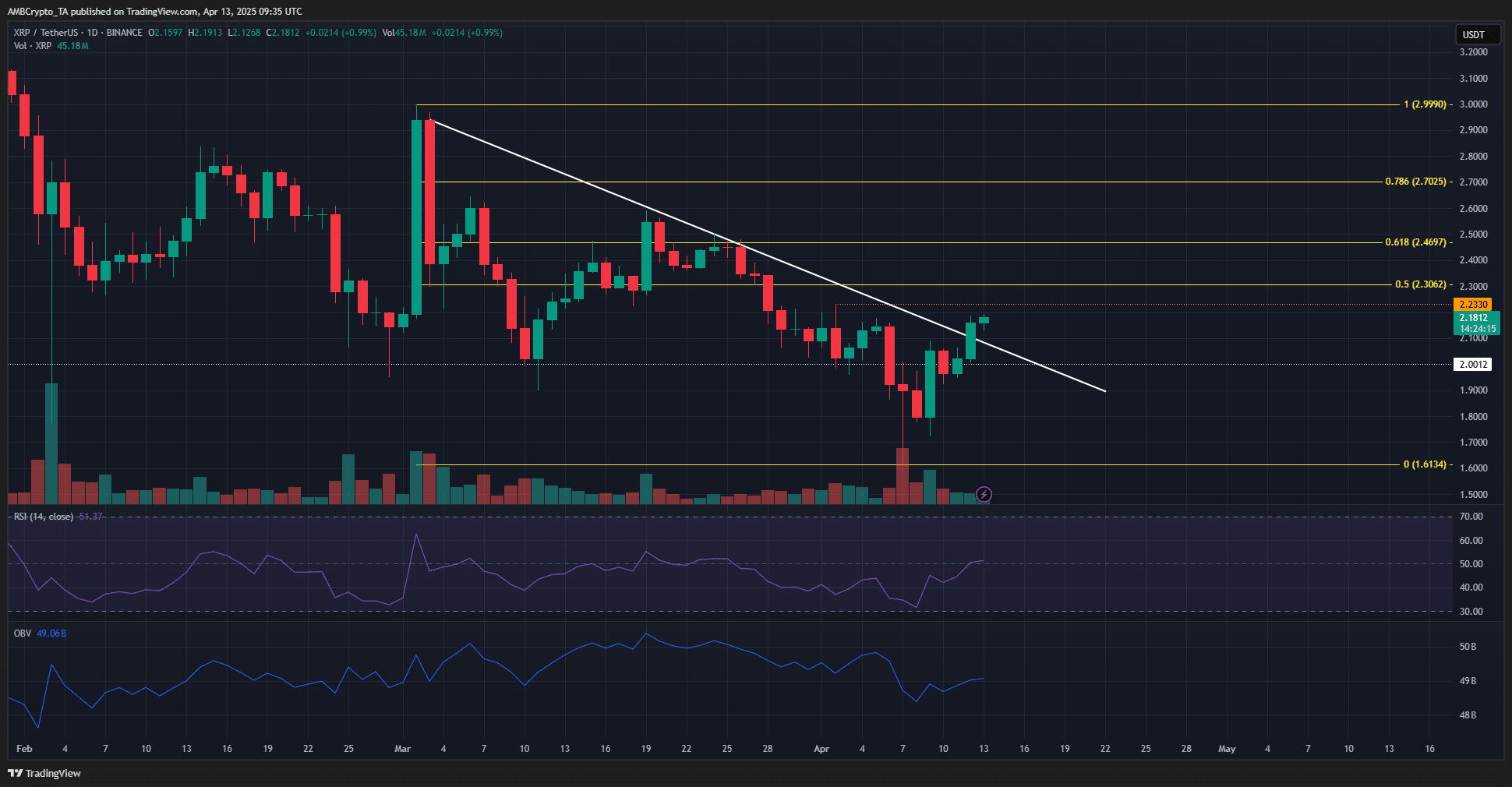

The recent breakout of XRP past the descending trendline resistance that has remained intact since early March is a pivotal moment for traders. However, it’s essential to discern that this does not indicate an end to the prevailing bearish trend. The breakthrough represents encouraging momentum, yet caution is necessary as the market dynamics remain complex.

Understanding the Current Market Dynamics and Emotional Sentiment

The current market sentiment shows a mix of optimism and caution among XRP investors. While the price has briefly surged past the psychological $2 level, traders must remain alert. The Relative Strength Index (RSI) has shifted towards a bullish momentum at 54, providing some hope. Nevertheless, it is critical to note that this positivity is tempered by the On-Balance Volume (OBV) trending downwards, suggesting that buying momentum may not be as strong as it appears.

Price Levels to Watch: Resistance and Opportunities for Traders

For traders considering short or long positions, the Fibonacci retracement levels highlight crucial resistance points at $2.46 and $2.7. The recent price movements suggest a potential bounce after a dip, presenting opportunities for shorting XRP. Experienced traders typically leverage such situations to maximize potential gains while minimizing risks.

Liquidity and Open Interest Analysis: Insights into Short Squeeze Potential

Recent analysis of XRP’s liquidity levels indicates a buildup around $1.95, creating a complex trading environment. The increase in Open Interest (OI) alongside a price rise of 6% hints at heightened speculative interest. However, an absence of corresponding buying pressure in spot markets indicates that this rally may be largely driven by derivatives, potentially setting up a shock for investors if the market reverses.

The liquidation heatmap analysis further reinforces the need for caution, indicating a concentration of high-leverage liquidations above the current XRP price up to $2.25. This implies that any sudden price movements could trigger liquidations, particularly targeting short sellers. Thus, a near-term short squeeze might occur, providing traders with a temporary window of opportunity to short XRP effectively.

Conclusion

In summary, while Ripple’s XRP shows promise with its recent breakout, the overarching bearish outlook and potential short squeeze highlight the volatile nature of the current market. Traders are advised to proceed with caution—strategically leveraging opportunities as they arise is critical to navigating these uncertain waters without falling into the traps of emotional trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Was $1.4K Ethereum’s ‘generational bottom?’ — Data sends mixed signals

Traders say ETH price fell to a “generational bottom,” but historical and network activity data suggest that this is not the case.

Bitcoin is holding above $90K, so why is ‘greed’ sentiment slipping?

The Crypto Fear & Greed Index has returned to flash “Greed” as Bitcoin has remained steady above $90,000 over the past two days.

SOL Strategies Commits $500M to Fuel Solana Ecosystem with Fresh Capital

IOTA Cofounder’s AI Firm Noxtua Raises $92M, Hints at Future IOTA Integration