Bitget Daily Digest (April 14) | U.S. grants reciprocal tariff exemptions on selected goods, Michael Saylor shares new Bitcoin Tracker update

Bitget2025/04/14 09:57

By:远山洞见

Today's preview

1.The New York Fed will release its 1-year inflation expectation for March today, with the previous figure at 3.13%.

2.U.S. President Donald Trump is expected to announce further details on semiconductor-related tariffs today.

3.Voting concludes today on the proposal to expand dYdX's buyback program to include OTC buybacks.

Key market highlights

1.Michael Saylor, founder of Strategy (formerly MicroStrategy), has once again shared an update on a Bitcoin Tracker on X, captioned: "No tariffs on the orange coin." Historically, Saylor tends to announce additional Bitcoin purchases the day after posting such updates. The market widely anticipates that he will further increase his Bitcoin holdings.

2.WLFI, a DeFi project backed by the Trump family, purchased $775,000 worth of SEI at $0.158 yesterday. Over the past two months, WLFI has spent approximately 1 million USDC across three transactions to acquire 5.983 million SEI tokens at an average price of $1.67. Currently, SEI is one of only three tokens in WLFI's portfolio not in a loss—the other two being TRX and AVAX.

3.On the evening of April 11, U.S. Customs announced that, per a memorandum signed by President Trump, "reciprocal tariffs" would be lifted on products such as integrated circuits, communication devices, smartphones, and display modules—a move initially seen as positive. However, the market has flagged two points of caution: First, Trump stated aboard Air Force One that a definitive answer on the semiconductor tariff exemption plan would be given on April 14, suggesting that the market must await his final stance. Second, White House officials revealed Trump is planning a new national security trade investigation into semiconductors, which could lead to additional tariff measures.

4.Following steep price drops in tokens like ACT, TST, MASK, and LEVER, $OM also experienced a sudden, large-scale drop early this morning, falling over 80% within an hour. The MANTRA project addressed this on its official blog, stating that the abnormal price action in OM was triggered by reckless liquidations on centralized exchanges (CEX) during periods of low liquidity. The crash occurred without sufficient warning and during low-liquidity hours in the Asian market—implying possible negligence or even market manipulation by CEXs. MANTRA emphasized that neither the project team nor its investors were involved, that OM's tokenomics remain unchanged, and that the token is still within its lock-up period.

Market overview

1.BTC rose briefly before pulling back, with the broader market in decline. New tokens FHE and $BABY showed diverging trends, while meme token $RFC (linked to Elon Musk) became a hot topic on-chain. The unusual plunge of the RWA project token $OM also drew attention.

2.The Fed signaled possible intervention. U.S. stocks rebounded last Friday, with the Nasdaq rising over 7% for the week. Meanwhile, the bond market and U.S. dollar plunged, and gold reached repeated record highs amid tariff concerns.

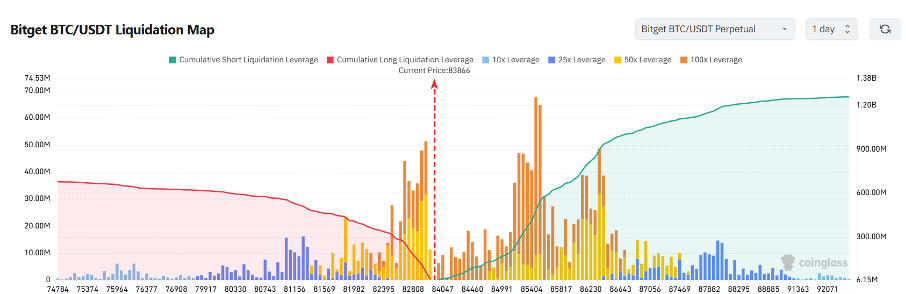

3.Currently standing at 83,866 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 82,866 USDT could trigger

over $187 million in cumulative long-position liquidations. Conversely, a rise to 84,866 USDT could lead to

more than $112 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

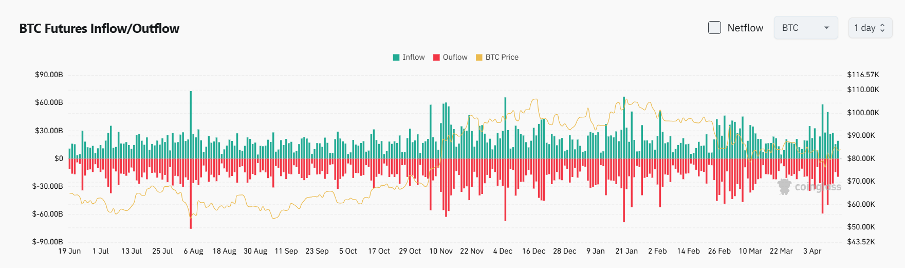

4.Over the past 24 hours, the BTC spot market recorded $19.2 billion in inflows and $19.4 billion in outflows, resulting in a

net outflow of $200 million.

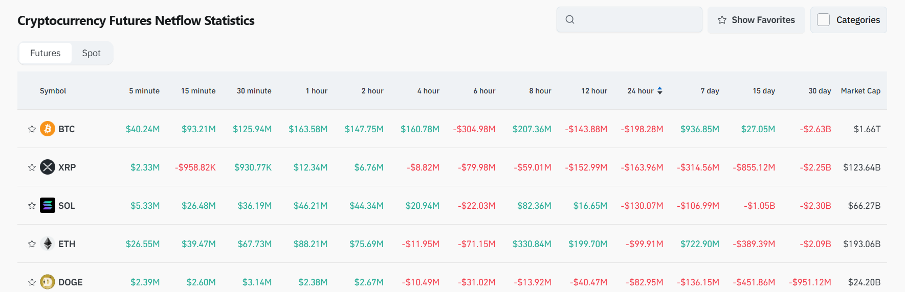

5.In the last 24 hours, $BTC, $XRP, $SOL, $ETH, and $DOGE led in

net outflows in futures trading, signaling potential trading opportunities.

Institutional insights

JPMorgan: Market disorder in U.S. Treasury bonds may prompt Federal Reserve intervention, potentially leading some investors to turn to BTC.

Read the full article here:

https://www.coindesk.com/

CryptoQuant: If Bitcoin fails to break the $84,000 resistance level, it may consolidate near the $80,000 mark in the short term.

Read the full article here:

https://cointelegraph.com/

News updates

1.U.S. Trade Representative Katherine Tai: Confident the U.S. will reach meaningful tariff agreements with several countries in the coming weeks.

2.U.S. Secretary of Commerce: Tariff exemptions on electronics may be temporary.

3.Executive Director of the White House Digital Assets Working Group: The time to accumulate Bitcoin is now—before it becomes more expensive.

4.Mayor of Vancouver: Assessment underway to convert a portion of the city's financial reserves into Bitcoin.

5.Argentina to lift its six-year currency control policy, with local stablecoin trading volume surging significantly.

Project updates

1.Michael Saylor shares another Bitcoin tracker update, potentially signaling another BTC purchase.

2.Wayfinder co-founder: A 90-day roadmap will be released next week, along with several major features.

3.Ethena Labs introduces proof of reserves for USDe, with weekly updates to follow.

4.ORCA proposal passed, with 25 million tokens to burn, and a $10 million buyback program initiated.

5.GoPlus has completed its fourth round of GPS token buybacks, with the total buyback amount now reaching 136,695,331 tokens.

6.Trump's crypto project WLFI spent approximately $1 million over two months to acquire 5.983 million SEI tokens.

7.Pump.fun: Only two graduated tokens have exceeded $1 million in market cap in the past 24 hours.

8.Ethereum's first SVM Layer 2 network, Eclipse, confirms that Grass points are locked and snapshots are completed.

9.KiloEx announces a strategic partnership with DWF Labs.

10.Musk-themed memecoin RFC briefly exceeds a $100 million market cap, reaching a new all-time high.

Highlights on X

1.@BroLeonAus: Whether a new TGE project will drive price action depends on the team's motivation and whether it’s a "soft" or "hard" project

Under current market conditions, the primary goal of most projects after their Token Generation Event (TGE) is profit-taking. Retail investors should not expect project teams to "believe in the mission" but should instead assess whether they have the intention to actively support and drive the token price. @BroLeonAus classifies projects into two types: "soft targets" (such as $GUN), where token distribution is out of control, vision is limited, and teams are reluctant to invest resources; and "hard targets" (such as $BABY), where there is strong control over token supply, sufficient funding, and willingness to take bold action. Trading strategies should be adapted accordingly, considering multiple dimensions such as project vision, willingness to manage token supply, liquidity and valuation structure, narrative appeal, and market response. Only by treating project behavior as a game of strategy can one avoid being exploited by emotional swings. At this stage, retail investors must develop discernment, position management skills, and the ability to switch between long and short positions—rather than naively hoping for benevolent price-pumping.

2.@Michael_Liu93: From technical indicator enthusiast to "bare chart" trader

–

four truths I have learned through trading

@Michael_Liu93 was obsessed with various technical indicators in pursuit of the "holy grail" at the very beginning. Now, only naked candlestick charts and trading volume are worth. For futures, funding rates and open interest, and at most, basic support and resistance levels can be added. These simple data points already encapsulate the core behaviors of the market. The essence of trading lies not in having many tools but in understanding the underlying logic: First, price and volume reflect human nature and expectations. Second, market sentiment is often misaligned, and only by going against the crowd can one generate returns. Third, liquidity determines where the opportunities lie. Fourth, position sizing and timely stop-losses are fundamental for a trader's survival. These principles apply to all forms of secondary market trading and on-chain hunting strategies.

3.@Murphy: Analyzing capitulation across three BTC downswings – signs of emotional recovery in the market

By analyzing the realized losses transferred to exchanges during BTC's three declines, we can observe changes in capitulation behavior. The first drop sees the most intense panic selling, primarily driven by institutions and large investors—especially from U.S. investors—which leads to a deep purge of market sentiment. The losses in the second and third phases of the downturn gradually decrease, indicating that market sentiment has begun to stabilize and capitulation has lessened. Based on this trend, BTC may be entering a period of consolidation or a base-building phase, and could attempt a rebound—assuming no further significant negative catalysts emerge.

4.@19ys_GGboy: On-chain analysis of "smart money" behavior – how to identify dominant market addresses and respond

Although on-chain trading has picked up alongside the broader market recovery, dominant forces remain a few typical "market rhythm setters" who manipulate price action through high-frequency stacking and instant sell-off arbitrage. Addresses such as Cented and Danny belong to pure arbitrage or fast-in, fast-out types. Their win rate is low, but their activity can easily trigger copy trading and cause stampedes. In contrast, addresses like letterbomb and Paingelz exhibit more strategic behavior and structured trading rhythms, making them useful as short-term reference points. As for veteran addresses or AI bots like lexapro, DFM, and Cupseyy, their large position sizes or stable strategies present significant price influence, and they are not suitable for strategy imitation. While the actions of the "smart money" cannot be replicated, they serve as key emotional and directional indicators of market liquidity and capital flows.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

The Ghost of FTX Past? Allegations Haunt Mantra (OM) Following Shocking 90% Drop

Coinedition•2025/04/13 16:00

FHE is live! Bullish or bearish? Join to share 24,000 FHE!

Bitget•2025/04/11 10:32

BABY is live! Bullish or bearish? Join to share 24,000 BABY!

Bitget•2025/04/11 10:26

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$84,848.71

+0.52%

Ethereum

ETH

$1,622.65

-0.43%

Tether USDt

USDT

$0.9999

+0.01%

XRP

XRP

$2.13

+0.04%

BNB

BNB

$584.54

+0.19%

Solana

SOL

$129.84

+0.46%

USDC

USDC

$1.0000

-0.00%

TRON

TRX

$0.2485

-1.88%

Dogecoin

DOGE

$0.1563

-2.65%

Cardano

ADA

$0.6230

-1.83%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now