Solana Shakes Off 12-Month Lows, Gaining Momentum for a $130 Rally

After hitting a 12-month low, Solana (SOL) is making a strong recovery, climbing 17% to $124.81. With solid support and increasing buying interest, SOL could reach $138.

Solana plunged to a 12-month low of $95.23 on April 7, marking a sharp decline amid broader market turbulence.

However, as the market embarked on a recovery this week, SOL has witnessed a rebound, with its price climbing as demand surges.

SOL Rebounds 17%, Eyes Further Gains

Since SOL began its current rally, its value has soared by 17%. At press time, the altcoin trades at $124.58, resting atop an ascending trend line.

SOL Ascending Trend Line. Source: TradingView

SOL Ascending Trend Line. Source: TradingView

This pattern emerges when the price of an asset consistently makes higher lows over a period of time. It represents an uptrend, indicating that SOL demand is gradually increasing, driving its prices higher. It suggests that the coin buyers are willing to pay more, and it serves as a support level during price corrections.

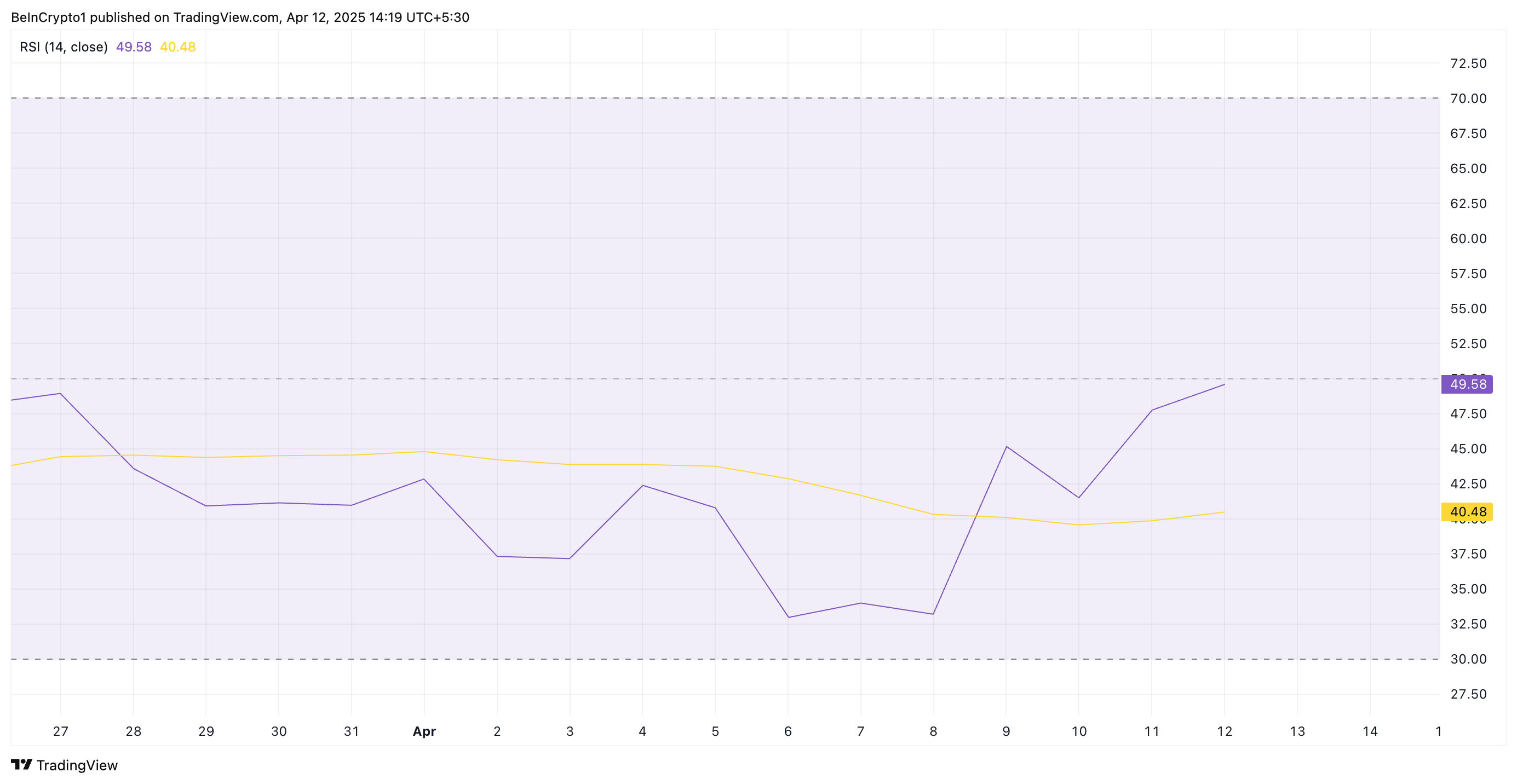

SOL’s recovery is further supported by its rising Relative Strength Index (RSI), indicating increasing buying interest. This momentum indicator is at 49.58 at press time, poised to break above the 50-neutral line.

SOL RSI. Source: TradingView

SOL RSI. Source: TradingView

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 49.50 and climbing, SOL’s RSI signals a steady shift in momentum from bearish to bullish. A rise above 50 would confirm increasing buying pressure and a potential for a sustained upward price movement.

Solana Bulls Eye $138

SOL’s ascending trend line forms a solid support floor below its price at $120.74. If demand soars and the bullish presence with the SOL spot markets strengthens, the coin could continue its rally and climb to $138.41.

SOL Price Analysis. Source: TradingView

SOL Price Analysis. Source: TradingView

However, if profit-taking commences, the support at $120.74 would be breached, and the SOL’s price could revisit $95.23.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Market Insights: Short-Term Recovery Signals for BONK, ALCH, and Bitcoin

In Brief Analyst Pseudonym identifies recovery signals in BONK, ALCH, and Bitcoin. Short-term trading strategies recommended for cautious positions. Increasing interest in meme tokens amid market volatility.

Ethereum Price Fluctuations Ignite Technical Analysis and Strategic Forecasts

In Brief Ethereum's price fluctuations shift focus to technical indicators among market players. Analysts signal potential recovery and long-term growth opportunities for Ethereum. Competition from networks like Solana raises challenges for Ethereum's market position.

Market Turmoil: Investors React as OM Coin Crashes 90%

In Brief OM Coin experiences a dramatic 90% drop, alarming the crypto market. IP Coin's price decline raises investor concerns about potential panic sales. Support levels for IP Coin are being closely monitored following recent fluctuations.

Market Moves: LINK Coin Faces Challenges as Tariff Uncertainty Looms

In Brief Market uncertainty continues to impact altcoin prices significantly. LINK Coin faces critical price thresholds that could determine its future direction. The macroeconomic landscape heavily influences investor sentiment in cryptocurrency markets.