Bitcoin And Resilience: A Law Of Nature

“We do not defend nature. We are nature defending itself.” This Indigenous proverb illustrates the capacity of the natural world to survive crises without seeking absolute optimization. It reminds us that resilience is at the heart of the living. Nature does not aim for speed or immediate efficiency but for diversity and adaptation. Certain animal species, in particular, traverse the ages by evolving in the face of threats. Similarly, Bitcoin does not rely on instantaneous performance but on its resilience due to its decentralized architecture. It follows the same laws of nature, being capable of withstanding multiple attacks and prohibitions. The parallel drawn in this article between nature and Bitcoin raises a fundamental question about the model to be understood. Should we prioritize efficiency or resilience to ensure the sustainability of a world in constant digital evolution?

Resilience versus performance

In 2024, an update error from CrowdStrike caused a global IT outage, rendering Windows systems inoperable. This incident highlighted the fragility of highly performant but homogenized systems. When everything relies on the same optimized software, a single flaw is enough to trigger a global collapse. In other words, performance, by seeking maximum optimization, creates excessive dependence on centralized infrastructures that are vulnerable to shocks. In contrast, a robust system promotes diversity and redundancy, ensuring better resistance to crises.

Like the reed that bends without breaking or a diverse forest that regenerates after a fire, a resilient system knows how to adapt, change form, and absorb shocks without collapsing completely. Pure performance, by removing resilience mechanisms, exposes systems to risks of sudden collapse in the event of an unforeseen crisis.

Resilience embodies more than just robustness. It allows a system not only to survive crises but to improve through them. Unlike performance, which focuses on a single immediate objective, resilience integrates the capacity for transformation and long-term adaptation. When a bone breaks, the fractured area rebuilds stronger than before, perfectly illustrating the concept of antifragility.

On a systemic scale, this capacity for strengthening in the face of trials is essential in an uncertain world. In contrast, performance optimizes the present moment while neglecting the capacity to react to unforeseen events. The Suez Canal, designed to optimize trade exchanges, is an example of fragility induced by excessive performance. A blockage of this strategic passage would disrupt the entire global economy, lacking suitable alternatives to geopolitical crises.

Digital performance: The enemy of resilience?

Performance and the obsession with efficiency lead to excessive “canalization,” reducing functional diversity and adaptability. In particular, in an ultra-digitized world, the homogenization of IT infrastructures increases vulnerability to shortages or systemic attacks. Post-war, computing developed around the idea of interactive and decentralized networks. But today, the quest for efficiency has led to a critical dependency on a few large players dominating the digital market. The more performant and centralized a system is, the more fragile it becomes in the face of disruptions. A resilient model, on the contrary, relies on a diversity of IT solutions and integrated information redundancy. This allows for better shock absorption. If performance seeks maximum efficiency, it overlooks the hidden costs associated with the loss of flexibility in systems. It thereby increases the risks of sudden deficiencies in the event of an unforeseen break.

The race for performance has led to exponential growth in computing power and the volume of stored information. In thirty years, we have moved from limited physical resources to unlimited cloud storage. Behind this illusion, data relies on energy-hungry servers scattered across the globe. Their environmental impact is immense: they consume 3% of global electricity and millions of liters of water for cooling. The more storage seems infinite, the more we accumulate, reinforcing an extreme centralization of the digital world. This logic of perpetual optimization therefore weakens our systems instead of making them more robust. Nature indeed prioritizes resilience, diversity, and balance, thereby ensuring its sustainability. Unlike our centralized and vulnerable infrastructures, it knows how to adapt to crises without ever aiming for maximum efficiency.

Fauna, nature, and Bitcoin: Surviving through resilience, not through performance

Thus, nature ignores performance and growth, prioritizing its regenerative power over time. In particular, the survival of fauna depends on the balance between resilience and adaptability, rather than solely on performance. For example, turtles, which have been around for millions of years, have not sought to be the fastest, but the most resilient to the challenges of time. Fauna survives shortages through adaptation and diversification. Some animals change their diet, others modify their habitat or migrate. Resilient species develop strategies such as hibernation or metabolism reduction to conserve energy. This flexibility allows them to navigate crises without disappearing.

Bitcoin , like natural ecosystems, was not designed for its performance but for its resilience. Unlike centralized infrastructures optimized for immediate efficiency, it prioritizes robustness, security, and gradual adaptability. Its architecture is decentralized, slow, sometimes inefficient, but allows it to survive attacks and restrictions. Just like certain animal species that thrive by adapting to shortages and crises. Bitcoin, like these living organisms, does not sacrifice its robustness and resilience for performance. It prefers redundancy, geographical diversity of nodes, and a gradual evolution. The leading cryptocurrency thus ensures sustainable resistance against state threats, cyber attacks, and economic crises. Here are some significant examples of animal resilience that best illustrate Bitcoin’s philosophy.

Bitcoin’s resilience: birth and metamorphosis of the butterfly

Since its birth in 2009, Bitcoin, like a fragile caterpillar, has been driven by a revolutionary but largely unknown idea. In its cocoon phase, it has faced many challenges: skepticism, emerging regulations, and extreme volatility, testing its resilience in the face of uncertainty. Little by little, it has strengthened, gaining the support of individuals, businesses, and even financial institutions. Its transformation reflects an exceptional capacity for adaptation, withstanding economic crises and asserting itself in a constantly evolving financial landscape. Today, like a majestic butterfly, it soars onto the global stage, recognized for its decentralization and potential for societal transformation. The resilience and flexibility of Bitcoin in the face of regulations enhance its role as a key player in the digital economy. Yet, like the butterfly sensitive to the wind, it remains vulnerable to fluctuations. The capacity for adaptation and resilience of Bitcoin promises a lasting influence in the future.

Bitcoin and the turtle: Resilience in the test of time

In this regard, nature and resilient systems reveal their true strength, through the test of time. The turtle, a symbol of perseverance and longevity, thus embodies antifragility by strengthening in the face of environmental challenges. Present for over 200 million years, it has survived mass extinctions through constant adaptation. Its shell thickens under pressure, and its metabolism adjusts to extreme conditions, allowing it to withstand crises. Like it, Bitcoin moves slowly but surely, overcoming attacks and volatility and resisting external shocks. Each challenge faced strengthens its decentralized network, proving that its solidity comes from its ability to evolve in the face of uncertainty.

Like the turtle, Bitcoin asserts its resilience, particularly its antifragility. It does not merely survive; it strengthens over time and through attacks. Its increasingly decentralized structure, similar to a living organism, ensures its resistance to crises and attempts at control. Its replicated ledger across thousands of computers prevents any centralized destruction, making the network unattackable. The more it faces pressure, the more robust it becomes, thereby consolidating its role in the digital economy. Its longevity is its greatest asset, just like the turtle, which traverses the ages by adapting its survival strategy. Bitcoin transforms every ordeal into an opportunity, asserting its place as a sustainable pillar of the global financial system.

Transforming and Evolving in the Face of Quantum

From this perspective, Bitcoin embodies resilience and evolution in the face of technological challenges, particularly the threat of quantum computing. Recent advances by Google, exemplified by their quantum computer Sycamore , highlight the future of computing systems. Although these machines may threaten certain encryptions, the Bitcoin protocol, thanks to its flexibility, remains adaptable. Developers are in the process of strengthening its encryption to anticipate quantum advances, thus ensuring the security of the network. This ability to evolve in the face of threats illustrates the intrinsic resilience of Bitcoin. Like the turtle, it rises by adapting over time, turning challenges into opportunities for growth.

If a hacker were to use quantum computing to corrupt the protocol and steal all the bitcoins, it would be in vain. By diverting all the bitcoins, they would destroy user trust, rendering the cryptocurrency immediately obsolete. Without trust, the value of Bitcoin would plummet to zero, turning its immense treasure into a mass without economic utility. Such an act would annihilate the decentralized network, the foundation of the value and utility of Bitcoin. It would be the empty realm of a devalued empire, unable to stimulate exchanges or investments. The corruption of the network would thus kill the very object of its ambition. The limited interest in such a maneuver highlights the resilience of the Bitcoin network.

Furthermore, innovations in cryptography, such as post-quantum signatures, are evidence of a constant preparedness for change. In the face of technological storms, Bitcoin continues to thrive, proving that even in the face of quantum power, it can remain inviolable and sustainably prosper. Thus, even in the face of an extreme threat, Bitcoin embodies a resilience and strength capable of protecting its central role in the digital economy. Like the turtle, adversity strengthens its evolution over time.

Survival of Bitcoin and the Wolf: Unity Creates Resilience

Bitcoin also embodies the resilience of the wolf, capable of surviving in organized groups in hostile environments. Like a united and tenacious pack, tens of thousands of miners work together to ensure the network’s security. Like the wolves, more and more miners operate in the inhospitable and remote areas of the planet. Alongside them, the validators , like tireless sentinels, verify the network’s integrity to ensure the system’s reliability. This decentralized cooperation resembles a pack where each individual plays a key role. It enables Bitcoin to withstand attacks and crises. Unlike centralized systems, it does not depend on any single authority, making its extinction almost impossible. Its strength comes from its global community, united by a common goal: to preserve and strengthen this revolutionary monetary network.

Just as the wolf can adapt to new territories, Bitcoin evolves in the face of challenges, consolidating its robustness. Its decentralized architecture relies on a ledger duplicated across all machines in the network, preventing any single points of failure. Each transaction since its inception is recorded, making the network transparent and indestructible. An attacker could never delete or falsify this data without dominating the entire network, which is practically impossible. Anyone can join the pack by becoming a miner or validator, continuously strengthening the system’s security. This openness, redundancy, and resilience make Bitcoin a living, evolving, and resistant organism.

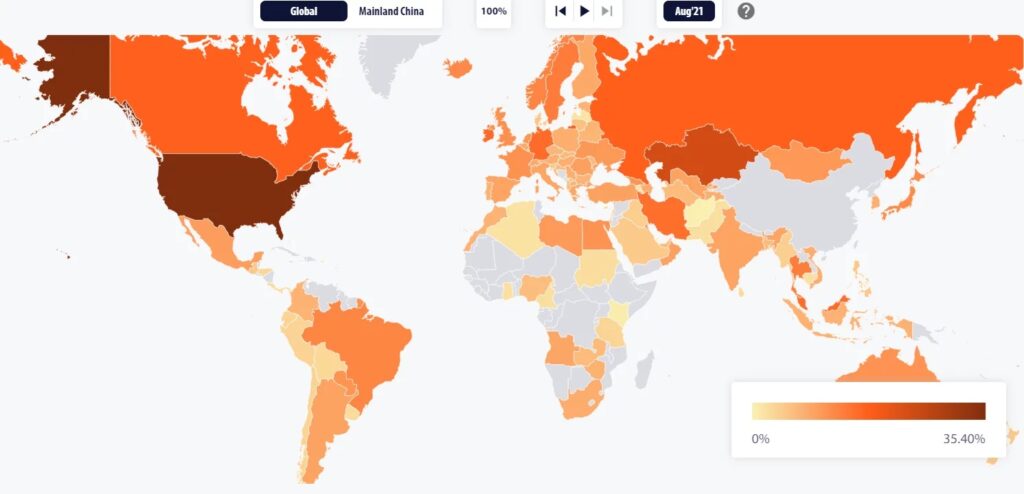

Map of Miners

Map of Miners

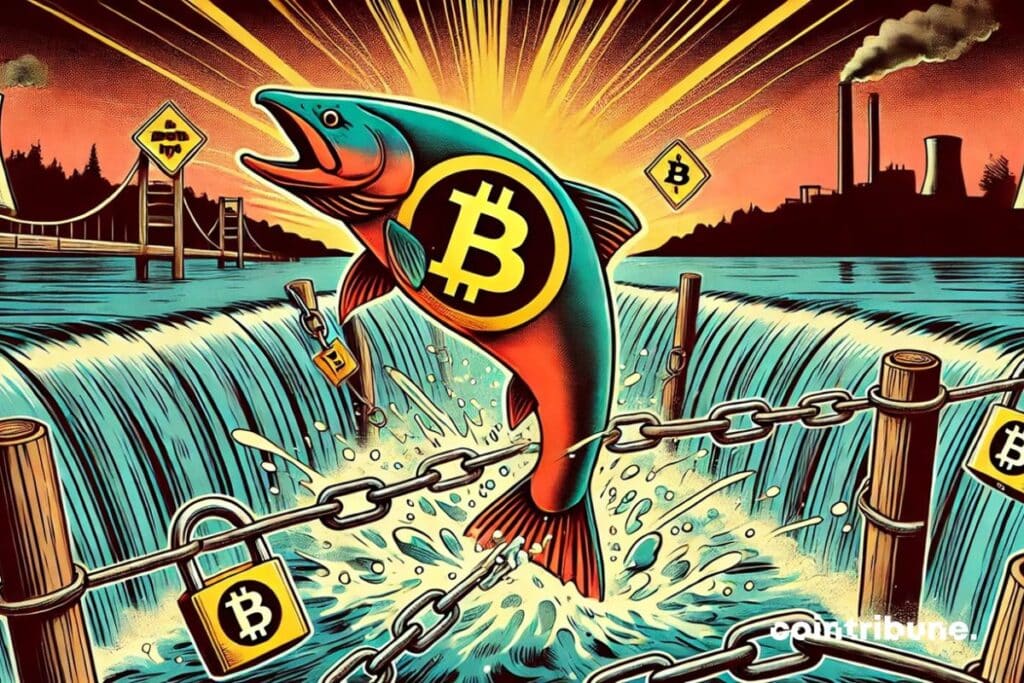

Bitcoin and the Salmon: Resilience in the Face of Currents

The salmon embodies resilience by swimming upstream against powerful currents, just as Bitcoin does against government bans. Despite its ban in nine countries , Bitcoin continues to thrive elsewhere, proving that it is a “headless dragon“. Without a leader, company, or headquarters, it is impossible to attack directly. Banning Bitcoin does not mean stopping it, as citizens always find ways to use it, and the network strengthens elsewhere. The ban becomes a double-edged sword. A country that bans Bitcoin shuts itself off from innovations and deprives itself of a major economic opportunity. Meanwhile, other nations welcome this technology and benefit from it. Bitcoin is above all a philosophy, impossible to destroy and stop, which continues to inspire and expand globally.

When China banned mining in 2021, companies relocated to Kazakhstan, demonstrating the network’s adaptability. If other countries strengthen their bans, Bitcoin adjusts naturally. There would certainly be fewer miners and a reduced hashrate, but increased profitability for those who remain. This flexibility enhances its attractiveness and encourages neighboring countries to adopt it to capture the relocated economic activity. Repression on one side creates a black market, while freedom on the other attracts capital and innovation. Each government must position itself between openness and respect for freedoms or total control and economic deprivation. Like the salmon that reaches its destination despite obstacles, Bitcoin continues its ascent, strengthening in the face of adversities.

Death and Resurrection of Bitcoin and the Phoenix

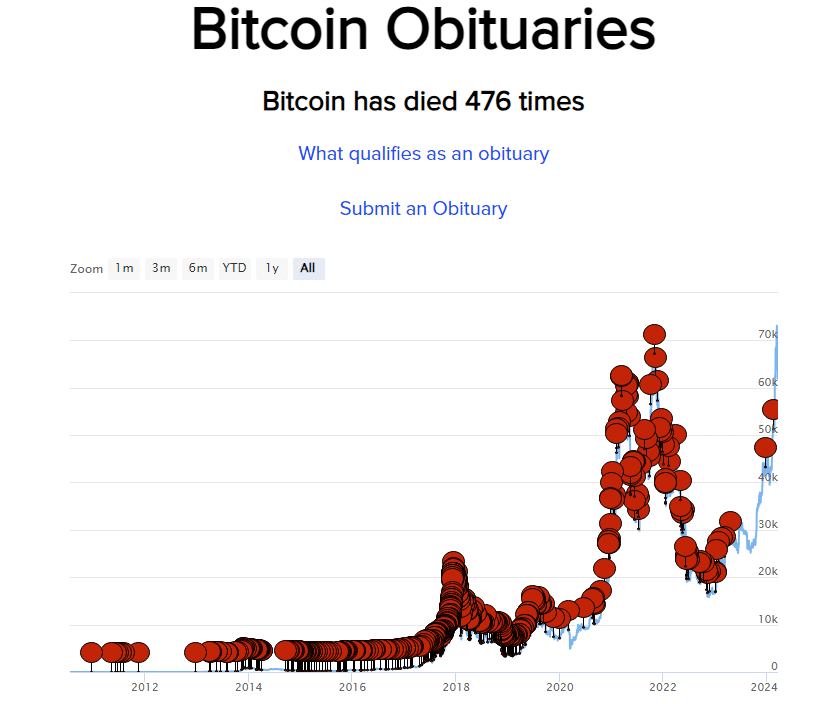

These futile bans against the flagship cryptocurrency often lead to multiple media executions. Bitcoin, often declared dead, embodies the resilience of the phoenix that always rises from its ashes after each destruction. Since its inception, it has been criticized, attacked from all sides, and regularly declared finished by many skeptics. Yet, with each crisis, it comes back stronger, demonstrating its ability to overcome trials. Like the phoenix, Bitcoin has transformed the many black swans that have marked its history into new beginnings. The fluctuations in its price and technological challenges have not diminished its relevance, reinforcing its position in the global economy. It continues to attract the interest of individuals and institutions and to push the boundaries of the traditional financial system. This cycle of symbolic death and rebirth testifies to its robustness in the face of adversity.

Death Notices of Bitcoin

Death Notices of Bitcoin

What Factors Could Alter the Resilience of Bitcoin?

The repeated government attacks represent a significant ongoing threat to the resilience of Bitcoin. For example, legislation and/or excessive taxation could make Bitcoin unprofitable, hindering its adoption. States can also demonize Bitcoin by wrongly linking it to issues such as money laundering or environmental pollution, influencing public opinion and justifying restrictions. Furthermore, strict regulations on bank transfers would complicate bitcoin buying and selling. If access to fiat currency became too difficult, many users would abandon it. These attacks would harm the adoption and sustainability of the network, questioning its ability to thrive in the face of governmental pressures. A coordinated global repression would place Bitcoin in a very fragile situation.

Targeting states, companies, and individuals

Furthermore, attacks against miners and Internet infrastructures are another often underestimated danger. The centralization of mining is strengthening, as operating large-scale farms is more profitable than mining individually. Publicly traded mining companies are exposed to government seizures and regulatory pressures. A coordinated attack on all miners and mining machine manufacturers could disrupt Bitcoin for years. On the other hand, Internet attacks can limit access to the network. It is easy to identify domestic Bitcoin nodes and block their connection. GitHub could be forced to remove the Bitcoin source code, complicating the distribution of software and wallets. Without a robust and decentralized infrastructure, Bitcoin risks losing its resilience against a well-organized offensive.

Finally, targeted attacks against key players in the Bitcoin ecosystem directly threaten the future of the protocol. Unlike Satoshi Nakamoto, most developers are not anonymous, as obtaining funding requires some visibility. Attending conferences and making themselves known allows them to access grants. However, this exposure makes them vulnerable to lawsuits. Some have abandoned Bitcoin, spending their money on legal defense rather than research and innovation. The multiplication of these attacks poses a genuine threat to surviving developers. Would the current associations be enough to ensure the continuity of this community project? The exodus of developers would slow down essential updates to Bitcoin, weakening the network. If the evolution of Bitcoin’s code were hindered, the resilience of the protocol as well as its ability to withstand attacks and adapt would become uncertain.

The quest for performance: A dead end in the face of the challenges of the current world?

The search for performance reaches its limits in the face of systemic crises and inevitable physical constraints. The obsession with immediate efficiency weakens our infrastructures and our environment, making our systems and ecosystem vulnerable to shocks. It is often believed that performance will rescue our societies from socio-ecological and economic crises, but it accentuates their fragility. Digital technology, AI , and quantum computing are designed to maximize efficiency, but forget the importance of adaptability. Yet, only resilience, which Bitcoin embodies, allows for survival through upheavals and sustainable evolution. Like nature, Bitcoin prioritizes redundancy and adaptation over speed and power. It illustrates an alternative model, based on robustness and diversity, unlike centralized systems. Survival in a changing world relies on the ability to absorb crises, not on an excessive desire for optimization. An obvious truth that nature continuously reveals.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Donald Trump’s Memecoin to Face $320 Million Token Unlock as Price Dips

33% of French looking to buy crypto in 2025 but Italians are even more bullish

Share link:In this post: A third of French people intend to purchase cryptocurrencies this year. New study shows Italians as most bullish among surveyed nations in Europe. The crypto sector’s growing legitimacy helps attract more investors, researchers say.

Spanish Police End Crypto Scam Ring That Used AI to Swipe $21 Million From Investors

Survey reveals 1 in 5 Americans own crypto, with 76% reporting personal benefits