Market Caution: Ethereum Shows Minor Improvement Amid Tariff Relief, But Bullish Momentum Remains Elusive

-

Ethereum (ETH) experienced a 5% surge following a temporary tariff relief by former President Trump, though bearish indicators suggest limited momentum for a sustained rally.

-

Despite the uptick, whale accumulation has plateaued at 5,376 wallets, indicating that large investors are cautious amid ongoing market volatility.

-

With a bearish EMA structure still in play, Ethereum’s price needs a robust influx of buying volume to challenge resistance levels above $1,700.

This article discusses Ethereum’s recent price movements amidst tariff relief news, whale activity, and technical indicators affecting its bullish outlook.

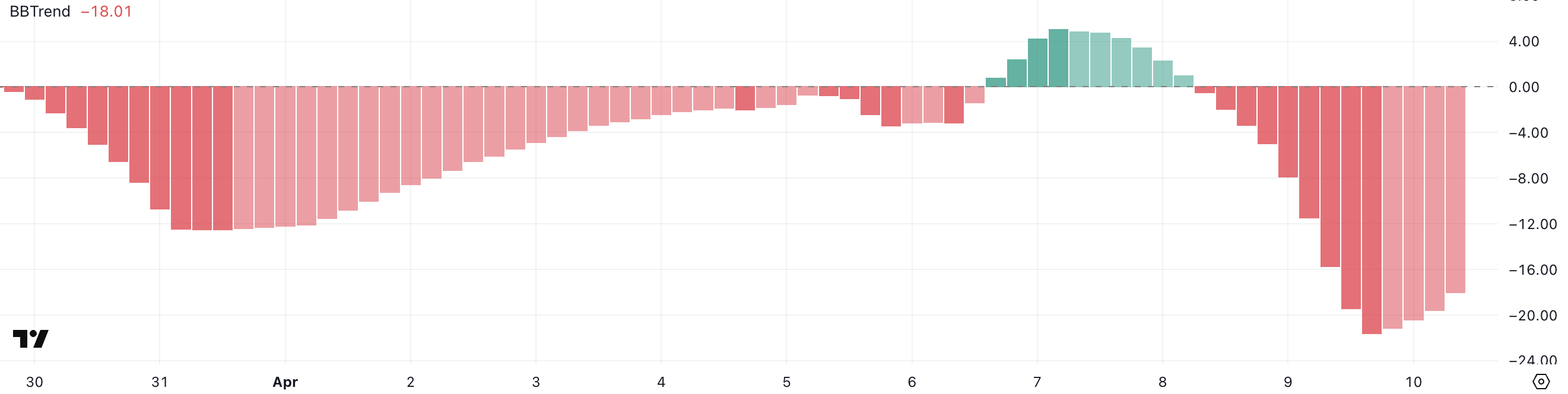

ETH BBTrend Shows Minor Improvement, Yet Still Bearish

Ethereum’s BBTrend indicator has seen a marginal improvement, rising to -18 from -21.59, indicating that although there are slight signs of bullish momentum, the overall trend remains predominantly negative.

The BBTrend (Band-Based Trend) is a crucial metric for traders, providing insights into market sentiment by analyzing the relationship between price movements and Bollinger Bands. In general, a reading below zero indicates prevailing bearish trends, while readings above reflect bullish conditions.

Specifically, Ethereum’s BBTrend has been firmly within negative boundaries since April 8, which underscores persistent selling pressure in the market. For ETH to reclaim bullish momentum, it needs to push the BBTrend back towards neutral or positive values supported by substantial trading volume and favorable price action.

Until this occurs, market participants should remain cautious, as current trends indicate a continuation of the correction phase.

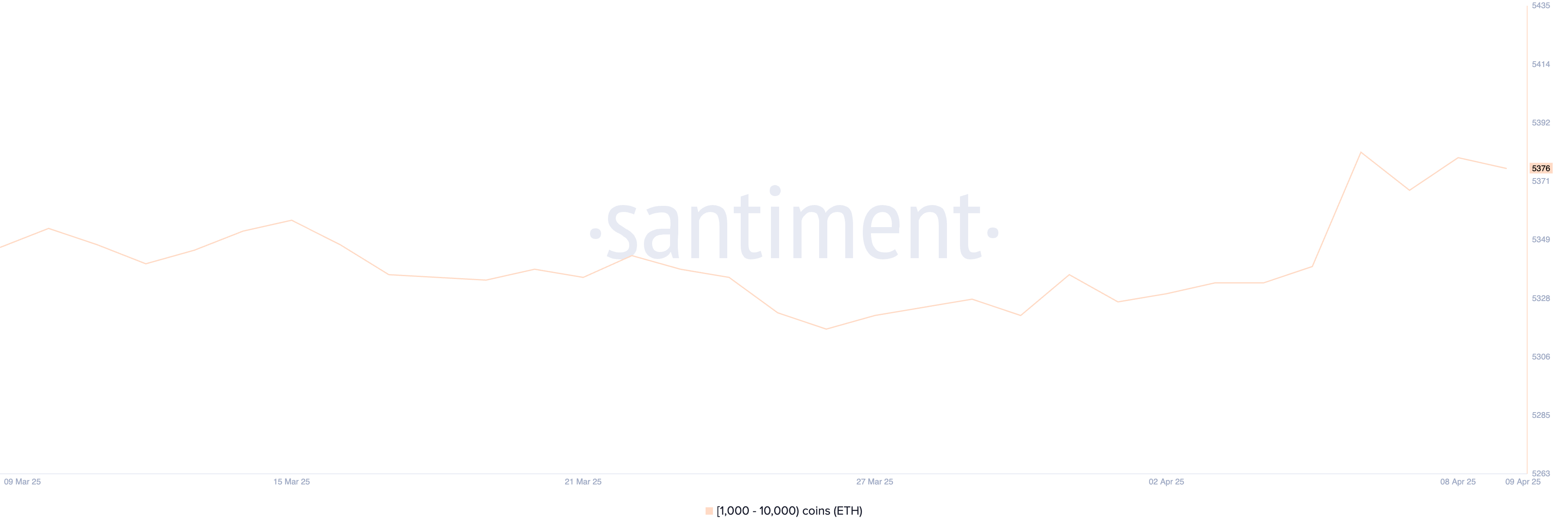

Stagnation in Whale Accumulation Signals Caution

Tracking Ethereum’s whale statistics reveals a concerning trend: the number of significant wallets holding between 1,000 and 10,000 ETH has stabilized at 5,376, following a slight increase earlier in the month.

This stabilization suggests that major investors are adopting a wait-and-see approach, refraining from aggressive buying or selling activities despite momentary market fluctuations.

The reluctance from whales to accumulate suggests a lack of confidence in a sustained rally, which could stall Ethereum’s price recovery. Increased accumulation from these influential investors would be a significant bullish signal, hinting at renewed conviction in the asset’s potential upside.

Temporary Price Movements Amidst Overall Bearish Structure

The recent 5% increase in Ethereum’s price, catalyzed by Trump’s tariff pause, highlights the asset’s volatility. However, despite this temporary relief, the bearish structure indicated by the EMA remains unchanged, with short-term averages still below long-term trends.

This positioning typically indicates ongoing selling pressure, which continues even during brief bullish movements. Coupled with a negative BBTrend and stagnant whale activity, Ethereum requires a substantial influx of buying pressure to change its trajectory towards a longer-term uptrend.

If bullish momentum can be established, Ethereum may test key resistance around $1,749, with potential further rises to $1,954 and even $2,104 appearing viable. Such upward movement could be driven by positive macroeconomic developments, such as the SEC’s latest action regarding the approval of options trading associated with BlackRock’s Ethereum ETF.

On the contrary, should current momentum wane, Ethereum risks slipping into another phase of correction. Key support sits at $1,412; if breached, it could plunge below $1,400, possibly revisiting levels beneath $1,300.

Conclusion

In summary, Ethereum’s recent movements reveal a mix of short-term optimism overshadowed by prevailing bearish indicators. A notable increase in whale activity and sustained buying pressure will be critical for reversing the current trend and establishing a new bullish phase in the market. Investors should monitor these key indicators closely as Ethereum navigates this precarious phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

GRASS Price Prediction 2025-35: Will It Hit $80 by 2035?

Tether Mints $1B on Tron Amid Soaring Stablecoin Demand

WLFI Invests $775K in Sei Blockchain, Denies ETH Sale Claims

Bitcoin Gains Power While US Confidence Hits Historic Low