Bitcoin Slips Below $77K as Traders Digest Trump-Fueled Market Jitters

Bitcoin Slides as Major Stock Indices Post Gains

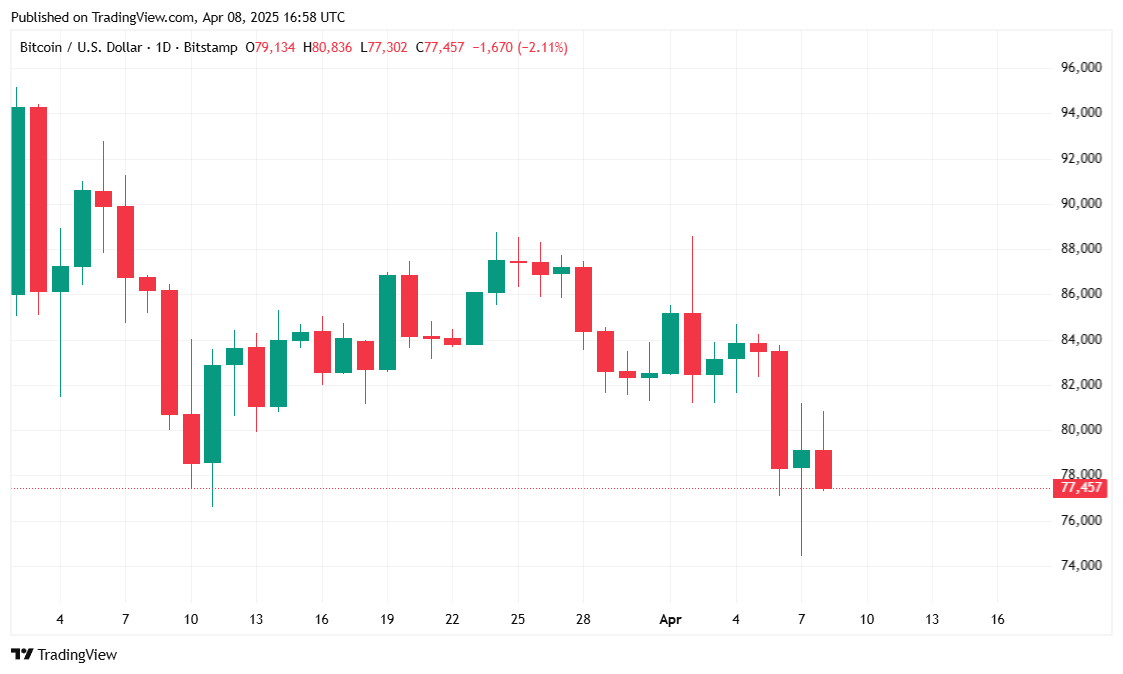

The three major stock indices all posted gains on Tuesday, causing bitcoin to reclaim $80K, during early trading, but the cryptocurrency had already slid under $77K at the time of reporting.

Overview of Market Metrics

Bitcoin is currently priced at $77,041, reflecting a 1.6% drop over the past 24 hours and an 9.4% decline over the last 7 days, according to data from Coinmarketcap.

( BTC price/ Tradingview)

( BTC price/ Tradingview)

The flagship cryptocurrency traded within a narrow 24-hour range of $76,814 to $80,823, a relatively tight band that suggests indecision among market participants. Volume tells a similar story, 24-hour trading volume plunged by 50.45% to $48.36 billion, signaling that fewer traders are actively positioning in this period of uncertainty.

Despite the pullback, the asset still commands a market capitalization of $1.55 trillion, which is down just 0.21% since yesterday, highlighting a degree of resilience amid broader market weakness.

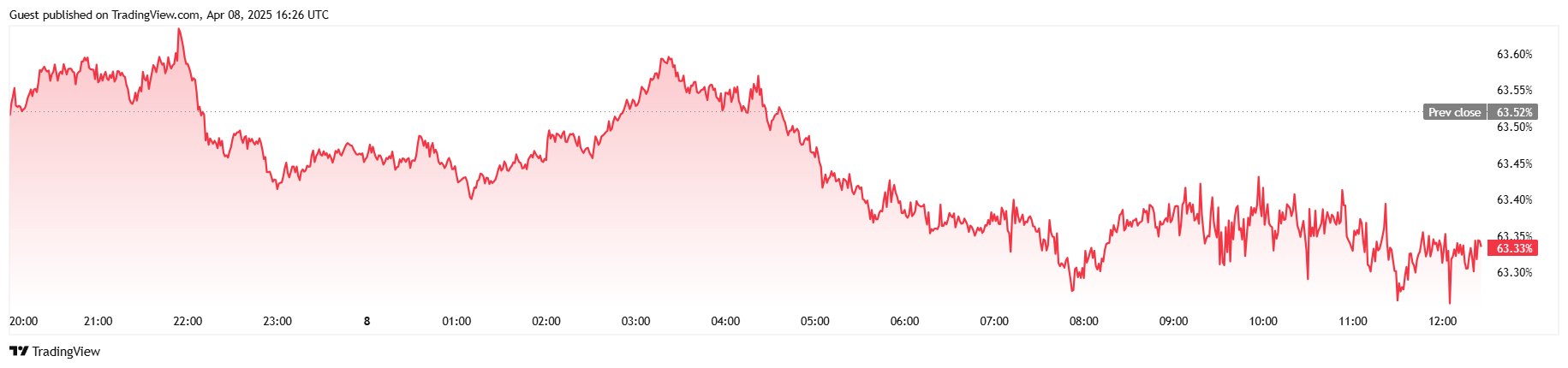

Bitcoin’s dominance over the crypto market slipped to 63.34%, down 0.26% over 24 hours, as some investors pivoted away from BTC , though altcoins continue to struggle even more in relative terms.

( BTCdominance / Trading View)

( BTCdominance / Trading View)

In the derivatives market, futures open interest dropped slightly by 0.23% to $50.51 billion, reflecting a minor de-risking by traders. However, liquidation data from Coinglass shows $5.93 million in total liquidations over 24 hours, with a lopsided $5.23 million in long positions getting wiped out, compared to just $701,120 in shorts. The imbalance suggests bullish traders betting on a near-term recovery have been caught off guard by continued downward pressure.

With bulls licking their wounds and trading activity cooling, the short-term outlook on bitcoin’s price remains cautious.

Markets Bounce Back, but for How Long?

Currently, the SP 500 is up 2.85%, the Dow Jones gained 1,023.55 points or 2.70% and the Nasdaq jumped 3.35%, all good news for both traditional markets and bitcoin.

However, tariffs are still at the top of everyone’s mind, especially with China’s retaliatory taxes on U.S. imports and an intentional weakening of the Chinese yuan to its lowest levels since September 2023 at roughly 7.2038 yuan per dollar.

“If the U.S. insists on its own way, China will fight to the end,” said China’s Commerce Ministry.

With the U.S. and China now in a full-blown trade war, it’s not clear what direction markets will take next, and it’s just as unclear where BTC ’s price will land in reaction to global macroeconomic conditions. Presently, BTC is struggling to hold and maintain the $77K range after its fall to $76,814 just an hour prior.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US spot Bitcoin ETFs saw a net inflow of $442.46 million yesterday

Anticipating ChatGPT 5’s Release: Potential Impact on Bitcoin Valuation

Anticipating ChatGPT 5: Its potential influence on Bitcoin and the role of Sam Altman's updates in shaping cryptocurrency fortunes

Unprecedented Inflow Skyrockets Bitcoin ETFs, Shattering 2025 Predictions – What’s Next?

U.S. Spot Bitcoin ETFs See Record Inflow of 11,898 BTC, Indicating a Resurgence in Institutional Confidence and Momentum