Research Report | In-Depth Analysis of the Babylon Project & BABY Token Valuation

I. Project Overview

Babylon Labs is an innovative protocol dedicated to enabling native Bitcoin staking. It leverages Taproot scripts to facilitate non-custodial, fully trustless BTC staking. This mechanism allows Bitcoin holders to contribute their BTC as security for Proof-of-Stake (PoS) blockchains without relinquishing ownership, introducing an unprecedented shared security model across multi-chain ecosystems. Babylon aims to elevate Bitcoin from "digital gold" to the foundational security layer of Web3.

The Babylon chain functions as a coordination layer built on the Cosmos SDK, bridging the Bitcoin network with multiple PoS blockchains—collectively referred to as Bitcoin Secured Networks (BSNs). By introducing finality providers and a checkpoint mechanism, Babylon not only enhances the security of PoS chains but also significantly reduces the unbonding period. Additionally, Babylon plans to launch a "multi-staking" feature, enabling a single BTC deposit to secure multiple chains simultaneously, thereby unlocking substantial liquidity.

Babylon’s native token, $BABY, is used for governance, transaction fees, and as incentives for BTC stakers, validators, and partner chains. As the first project to bring Bitcoin into the Security-as-a-Service (SaaS) model, Babylon is redefining security paradigms for DeFi and PoS networks and is poised to become a key infrastructure in the next phase of multi-chain interoperability.

II. Project Highlights

Trustless Native BTC Staking: Eliminating Custodial Risk

Babylon is the first protocol to truly enable native BTC staking. Users can lock BTC in self-custodial addresses via Taproot scripts—no cross-chain bridges, wrapping, or centralized intermediaries required. This ensures users retain full control of their BTC, eliminating custodial risks from intermediaries or smart contracts. It aligns with Bitcoin’s core trustless philosophy and offers a secure, yield-generating path for large BTC holders.

BTC as the Security Backbone for PoS Networks: Building a Decentralized Security Market

Built on the Cosmos SDK, the Babylon chain acts as a security intermediary between BTC and various PoS blockchains (BSNs). PoS chains can "rent security" from BTC stakers via Babylon, mitigating consensus risks caused by high inflation or inefficient validators. This model pioneers the concept of "Security-as-a-Service," transforming BTC from merely "digital gold" into a universal security foundation for multi-chain ecosystems.

Multi-Staking Mechanism: Unlocking BTC Liquidity and Yield Efficiency

Babylon’s upcoming Multi-Staking feature will allow users to use a single BTC deposit to secure multiple PoS networks simultaneously, earning multiple rewards. This significantly improves capital efficiency and bridges Bitcoin with the broader DeFi ecosystem. For BTC holders, this represents a low-risk compounding strategy with the potential for higher returns than traditional single-chain staking models.

Backed by Top-Tier Investors, Rapid Ecosystem Expansion

Babylon Labs is backed by leading institutions including Paradigm, Polychain, and YZi Labs, making it one of the most capital-favored security infrastructure projects. Its total BTC staked continues to grow, and integrations with major platforms such as Bitget Wallet, OKX Wallet, and Binance Earn have been completed. These integrations lower technical barriers and accelerate ecosystem adoption.

III. Market Valuation Outlook

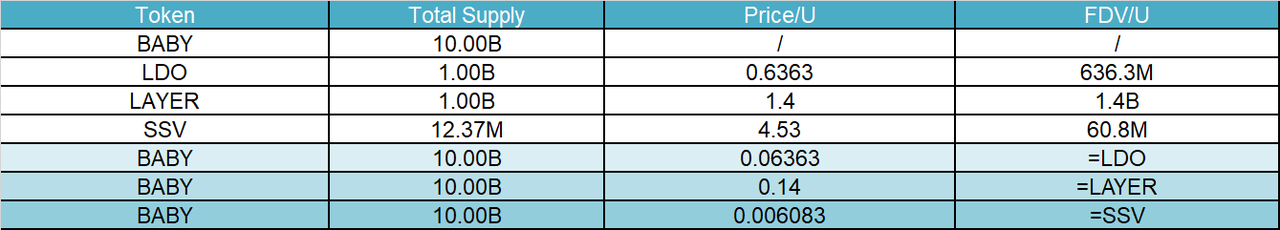

As a trustless BTC staking protocol emerging within the Bitcoin ecosystem, Babylon is positioned similarly to Ethereum-based staking infrastructures like Lido and SSV, focusing on unlocking BTC’s liquidity and security potential. Using valuation models from projects like Lido and Solayer as benchmarks, Babylon demonstrates strong growth potential and narrative appeal. With the rise of Bitcoin Layer 2s, restaking, and security intermediary markets, Babylon is poised to become a foundational asset in the BTC sector.

IV. Tokenomics

Total Supply of $BABY: 10 billion tokens

Token Allocation:

Community Incentives (15%): 1.5 billion tokens, fully unlocked, used for rewarding early users, airdrop participants, and stakers.

Ecosystem Development (18%): 1.8 billion tokens, linearly vested over 3 years, supporting cross-chain integrations, developer grants, and protocol growth.

R&D and Operations (18%): 1.8 billion tokens, linearly vested over 3 years, allocated to core protocol development, operations, and scaling.

Early Private Investors (30.5%): 3.05 billion tokens, linearly vested over 4 years, incentivizing strategic investors and institutional supporters.

Team (15%): 1.5 billion tokens, linearly vested over 4 years to ensure long-term alignment with the ecosystem.

Advisors (3.5%): 350 million tokens, linearly vested over 4 years, used to incentivize advisors and strategic partners.

Token Utility:

Governance: $BABY holders can participate in Babylon’s governance, including parameter adjustments, security mechanism upgrades, and BSN onboarding.

Fee Payments and Sharing: Transactions on Babylon will use $BABY for fee payments, with a portion of staking pair fees redistributed to $BABY holders.

Ecosystem Incentives: Future community campaigns, airdrops, and validator staking rewards will be settled in $BABY, reinforcing its role as the core asset in Babylon’s security market.

V. Team & Funding

Team:

Babylon Labs was co-founded by Stanford professor David Tse and cryptography expert Mingchao (Fisher) Yu. The core team comprises experts in Layer 1 protocol design, security research, and crypto economics. With deep experience in distributed systems, consensus mechanisms, and cross-chain architecture, the team aims to transform Bitcoin into the security layer for PoS networks and build a trustless, shared-security staking network.

Key team members include:

- David Tse (Co-founder)

- Mingchao Yu (Co-founder & CTO)

- Shalini Wood (Chief Marketing Officer)

- Adam Ettinger (Chief Legal Officer)

- Spyros Kekos (Head of Community)

The team brings expertise in Bitcoin-native protocols, Cosmos SDK architecture, decentralized governance, and strategic partnerships—positioning them to build next-generation security infrastructure.

Fundraising:

Babylon Labs has completed three major funding rounds totaling $97 million:

- May 30, 2024: Raised $70 million in the latest round at an $800 million valuation. Investors include Paradigm, Polychain, Binance Labs, Bullish, and others such as HashKey Capital, Amber Group, Galaxy Digital, P2P.org, InfStones, and StakeWith.Us.

- December 7, 2023: Raised $18 million in Series A funding from Polychain, Hack VC, Castle Island Ventures, Symbolic Capital, Finality Capital Partners, and others.

- January 2022: Raised $8 million in a seed round led by IDG Capital and Breyer Capital to support core staking mechanism development and testnet deployment.

Babylon is now in the early stages of mainnet launch and has achieved technical integrations with multiple wallets, exchanges, and PoS networks—laying the groundwork for rapid expansion of the BTC shared security market.

VI. Potential Risks

Token Unlock Pressure: With a total supply of 10 billion $BABY tokens, approximately 49% is allocated to early investors, the team, and advisors. Although these allocations are subject to 4-year linear vesting schedules, token unlocks could exert selling pressure on the secondary market.

Technical Risks in Cross-Chain Coordination: Babylon’s trustless staking mechanism relies on Taproot scripts and Cosmos SDK, involving data synchronization and validator coordination between BTC and PoS chains. Despite undergoing security audits, risks such as cross-chain data failures or synchronization delays remain in multi-chain environments.

VII. Official Links

Website: https://babylonlabs.io/

Twitter: https://x.com/babylonlabs_io

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto ETFs and staking, the next big thing?

El Salvador Keeps Stacking Sats: Will Trump Give Bukele Cover from IMF?

Bukele to meet Trump amid El Salvador’s $1.4B IMF deal tied to Bitcoin constraints. Trump’s potential pro-Bitcoin stance could shift global crypto politics. BTC nears $85K after breaking downtrend, showing strength amid macro volatility.

Metaplanet increases Bitcoin holdings with $26 million purchase

MANTRA's 88% crash sparks over $71 million in liquidations: Coinglass

Quick Take The OM token plunge has seen over $71.8 million in liquidations over the past 24 hours. The project’s co-founder disclosed that the price movements were caused by “reckless forced closures” initiated by centralized exchanges on OM account holders.