Ethereum’s DEX volume halves since December peak as traders shift to cost-efficient alternatives

Quick Take Despite the slowdown, decentralized exchanges still claim a growing share of spot trading, with newer platforms and Layer 2s helping offset Ethereum’s volume decline. The following is an excerpt from The Block’s Data and Insights newsletter.

Ethereum's decentralized exchange volume has slowed, with daily unique traders dropping to approximately 40,000 addresses, a 12-month low and a steep decline from the 95,000 peak observed in late 2024.

This sharp reduction in DEX participation coincides with broader market cooling and diminished speculative capital flows across the cryptocurrency landscape. Uniswap remains the dominant force in the Ethereum DEX ecosystem, dwarfing competitors like SushiSwap, which currently attracts only about 2,000 daily active addresses.

Trading volumes have contracted alongside user participation, with Ethereum DEX volume falling to $57 billion in March 2025, nearly half of the $112 billion recorded during the December 2024 market peak.

This volume reduction reflects both decreased user activity and potentially smaller average trade sizes as market participants adopt more cautious positioning. Despite this contraction, decentralized exchanges still maintain approximately 13% of the total spot trading volume compared to centralized exchanges, continuing a gradual upward trend observed over recent years.

The current landscape highlights persistent advantages and drawbacks between centralized and decentralized trading venues. Centralized exchanges continue to offer superior liquidity, lower transaction costs, and faster execution for most standard trading activities. However, innovations from DEX aggregators like Bebop and CoWSwap are progressively narrowing these gaps by optimizing routing, reducing slippage, and enhancing overall user experience.

Layer 2 solutions like Base have captured significant trading volume, while Solana continues to establish itself as a prominent alternative trading venue. This redistribution suggests that while Ethereum's native DEX activity has declined, traders are still interested in exploring cost-effective venues rather than exiting decentralized trading altogether.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

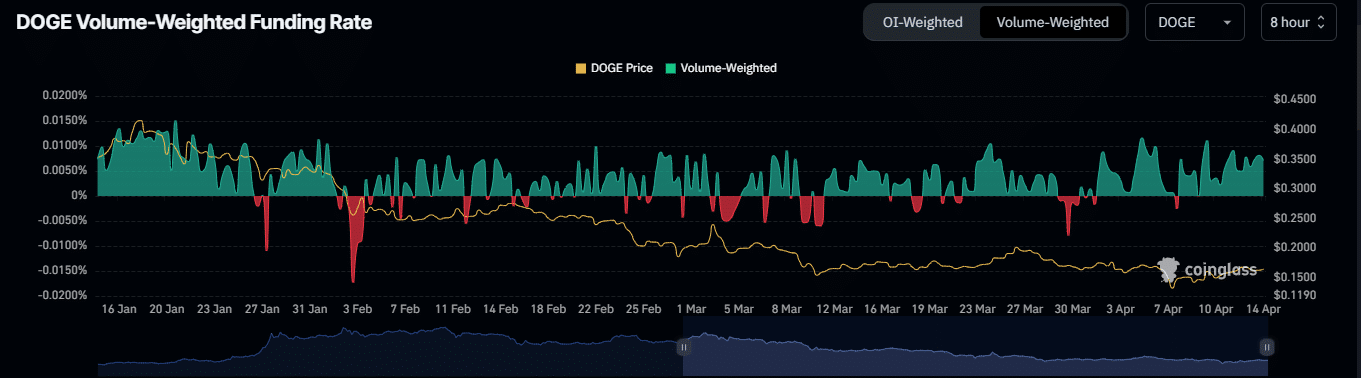

Potential Dogecoin Rally Ahead as Key Support Level and Increased Buying Interest Emerge

Market Insights: Short-Term Recovery Signals for BONK, ALCH, and Bitcoin

In Brief Analyst Pseudonym identifies recovery signals in BONK, ALCH, and Bitcoin. Short-term trading strategies recommended for cautious positions. Increasing interest in meme tokens amid market volatility.

Ethereum Price Fluctuations Ignite Technical Analysis and Strategic Forecasts

In Brief Ethereum's price fluctuations shift focus to technical indicators among market players. Analysts signal potential recovery and long-term growth opportunities for Ethereum. Competition from networks like Solana raises challenges for Ethereum's market position.

Market Turmoil: Investors React as OM Coin Crashes 90%

In Brief OM Coin experiences a dramatic 90% drop, alarming the crypto market. IP Coin's price decline raises investor concerns about potential panic sales. Support levels for IP Coin are being closely monitored following recent fluctuations.