Avalanche (AVAX) Mirrors a Past Bullish Setup – Is This Final Dip Before the Liftoff?

Date: Mon, April 07, 2025 | 10:20 AM GMT

The cryptocurrency market is experiencing its heaviest drop of the year, largely due to the escalating tariffs war triggered by Donald Trump. This geopolitical tension has rattled global financial markets, and crypto hasn’t been spared. Bitcoin (BTC) has fallen 6%, while Ethereum (ETH) is down a staggering 15% over the past 24 hours.

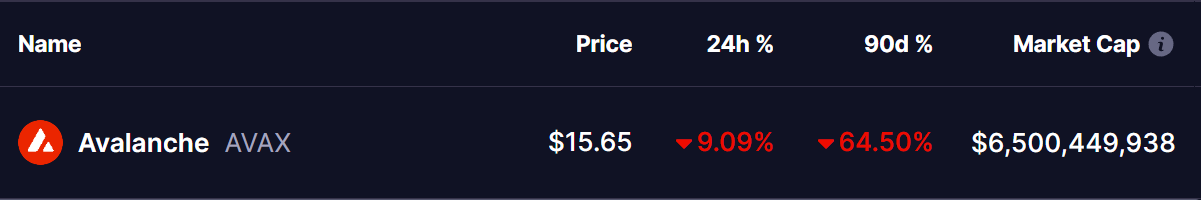

Among the altcoins , Avalanche (AVAX) has dropped over 9% today, deepening its 90-day correction to a harsh 64%. While the current sentiment might feel like doom and gloom, a closer look at AVAX’s chart paints a far more optimistic picture — one that could be hinting at a major comeback.

Source: Coinmarketcap

Source: Coinmarketcap

AVAX Chart Mirrors Its 2021 Breakout Pattern

A side-by-side comparison of AVAX’s current daily chart with its late-2021 setup reveals an almost uncanny similarity. In 2021, AVAX saw a prolonged decline that formed a falling wedge pattern — a structure often considered a bullish reversal signal. After bottoming out near the $9.50-$11.50 range and bouncing off the 50-day moving average, it surged over 560% in a matter of weeks.

Fast forward to today, and AVAX is once again forming a near-identical falling wedge. The price has pulled back into a key support zone around $14.50-$16.50, matching the structural behavior of its 2021 pattern. The curved base forming beneath price action could be the beginning of another parabolic run — just like last time.

The similarities go beyond just the wedge. AVAX is once again hovering below its 50-day moving average, consolidating near a prior breakout zone. If history does rhyme, then this could be the final shakeout before a major trend reversal.

Will History Repeat?

Technical setups like this don’t guarantee results, but they do offer strong signals. AVAX is currently sitting in what could be a generational accumulation zone, just as it did in mid-2021 before its explosive rally. The falling wedge, the curved base, and the behavior around the 50-day MA all hint at a potential liftoff.

While macroeconomic headwinds may delay or distort the timing, the chart suggests that once momentum returns to the market, AVAX could be one of the strongest performers in the next wave.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$106 Million In Ethereum Liquidated: Crypto Whale Erased By The Ongoing Storm

Conor McGregor's REAL Token: A Resounding Failure

The CAC 40 Below 6900 Points: Geopolitical Tensions Weigh Heavily On The Market

Bitcoin: Traders Face Record-Breaking Losses