Decentralized exchanges gain ground despite $6M Hyperliquid exploit

Decentralized cryptocurrency exchanges (DEXs) continue to challenge the dominance of centralized platforms, even as a recent $6.2 million exploit on Hyperliquid highlights risks in DEX infrastructure.

A cryptocurrency whale made at least $6.26 million profit on the Jelly my Jelly (JELLY) memecoin by exploiting the liquidation parameters on Hyperliquid, Cointelegraph reported on March 27.

The exploit was the second major incident on the platform in March, noted CoinGecko co-founder Bobby Ong.

“$JELLYJELLY was the more notable attack where we saw Binance and OKX listing perps, drawing accusations of coordinating an attack against Hyperliquid,” Ong said in an April 3 X post , adding:

“It’s clear that CEXes are feeling threatened by DEXes, and are not going to see their market share erode without putting on a fight.”

DEX growth reshapes derivatives market

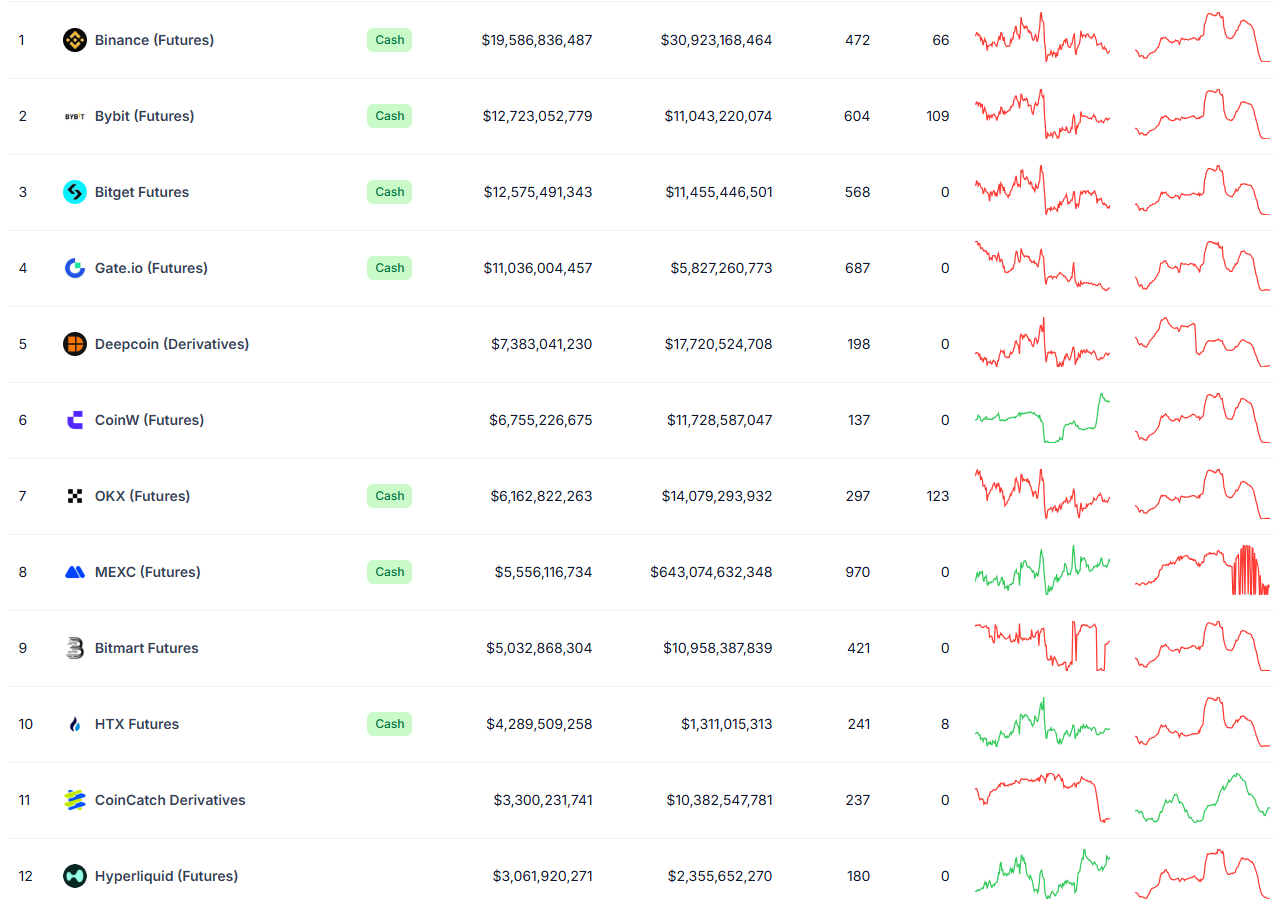

Hyperliquid is the eighth-largest perpetual futures exchange by volume across both centralized and decentralized exchanges. This puts it “ahead of some notable OGs such as HTX, Kraken and BitMEX,” Ong noted, citing an April 4 research report .

Hyperliquid’s growing trading volume is starting to cut into the market share of other centralized exchanges.

Top derivative exchanges by open interest. Source: CoinGecko

Top derivative exchanges by open interest. Source: CoinGecko

Hyperliquid is the 12th-largest derivatives exchange, with an over $3 billion 24-hour open interest — though it still trails Binance’s $19.5 billion by a wide margin, CoinGecko data shows.

According to Bitget Research analyst Ryan Lee, the incident may harm user confidence in emerging decentralized platforms, especially if actions taken post-exploit appear overly centralized.

“Hyperliquid’s intervention — criticized as centralized despite its decentralized ethos — may make investors wary of similar platforms,” Lee said.

Whale exploits Hyperliquid’s trading logic

The unknown Hyperliquid whale managed to exploit Hyperliquid’s liquidation parameters by deploying millions of dollars worth of trading positions.

The whale opened two long positions of $2.15 million and $1.9 million, and a $4.1 million short position that effectively offset the longs, according to a postmortem by blockchain analytics firm Arkham.

Hyperliquid exploiter, transactions. Source: Arkham

Hyperliquid exploiter, transactions. Source: Arkham

When the price of JELLY rose by 400%, the $4 million short position wasn’t immediately liquidated due to its size. Instead, it was absorbed into the Hyperliquidity Provider Vault (HLP), which is designed to liquidate large positions.

As of March 27, the unknown whale still held 10% of the memecoin’s total supply, worth nearly $2 million, despite Hyperliquid freezing and delisting the memecoin , citing “evidence of suspicious market activity” involving trading instruments.

The Hyperliquid exploit occurred two weeks after a Wolf of Wall Street-inspired memecoin — launched by the Official Melania Meme (MELANIA) and Libra (LIBRA) token co-creator Hayden Davis — crashed over 99% after launching with an 80% insider supply.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Policy Institute Appoints Rachel Green Horn as Chief Marketing Officer

SIGNUSDT now launched for futures trading and trading bots

Trump sees no red lines that would change tariff policy

MistTrack: Suspicious Bitcoin address has transferred most of the funds to multiple platforms