Is Ethena (ENA) in the Final Accumulation Zone Before a Reversal? This Fractal Says Yes!

Date: Sat, April 05, 2025 | 05:28 PM GMT

The cryptocurrency market has been under pressure throughout the first quarter of 2025, with Ethereum (ETH) logging its worst Q1 performance since 2018—down 45%. This steep decline has spilled over into the altcoin market, dragging many tokens into deep corrections.

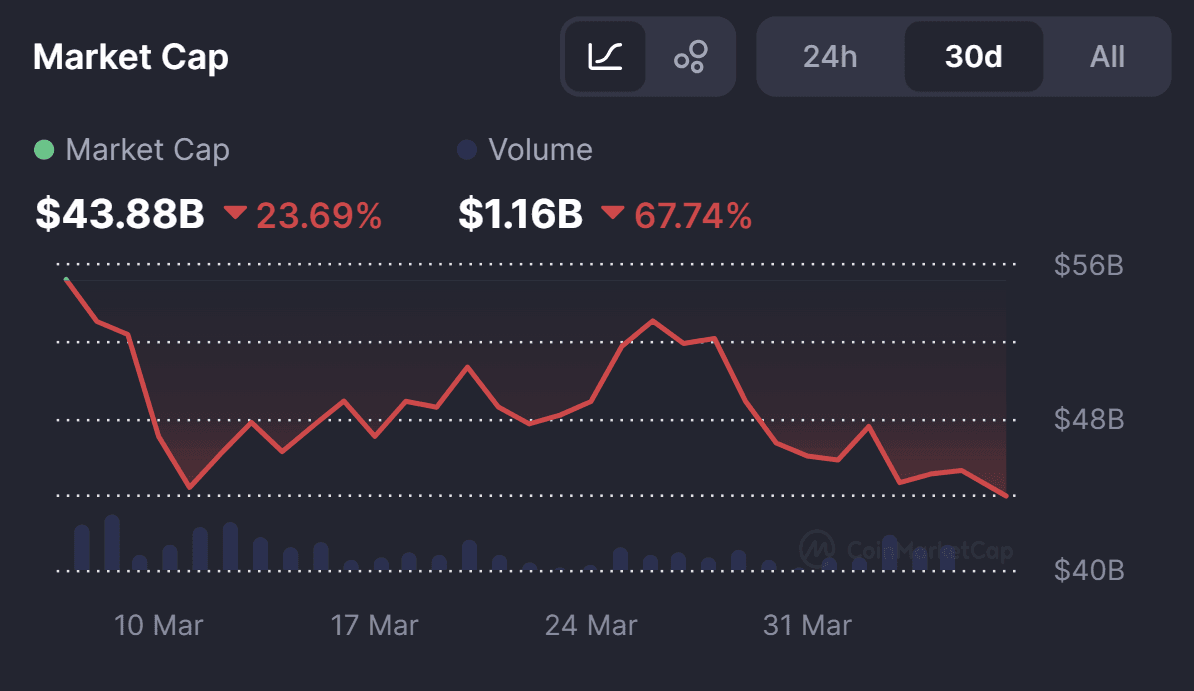

Among major altcoins , Ethena (ENA) has also suffered, dropping over 74% from its January peak of $1.30 to current price of $0.31. However, its current price structure is starting to flash early signs of a trend reversal, suggesting that ENA might be in its final accumulation zone before the next leg up.

Source: Coinmarketcap

Source: Coinmarketcap

Ethena (ENA) – Mirroring PENDLE’s Path?

Interestingly, the current setup on Ethena’s (ENA) chart bears a striking resemblance to PENDLE, which went through a similar 75% correction before bottoming out and reversing.

Much like PENDLE’s previous price action, ENA has now formed a clear double bottom pattern on the weekly chart—a classic signal of a potential bullish reversal. The two rounded lows are well-defined, with the second bottom aligning within the $0.20–$0.38 accumulation zone, which has emerged as a strong support area.

For some perspective, PENDLE also experienced a deep drop, losing nearly 75% of its value from the peak before consolidating in a similar curved structure. Once it bounced from the second low, PENDLE rallied more than 70%, wit a potential double bottom setup and marking the start of a trend reversal.

In ENA’s case, the MACD is beginning to tilt bullish, with a potential crossover forming that could validate the early stages of momentum building. At the same time, ENA is currently testing the second bottom around the $0.31 level.

A strong bounce from here—especially one backed by volume—could act as a launchpad for the next leg higher, just as it did for PENDLE.

If this fractal continues to play out, ENA could potentially revisit the $1.30–$1.50 zone, unlocking a major upside opportunity from current levels.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Black Monday 2.0? 5 things to know in Bitcoin this week

Bitcoin battles everything from a "death cross" to record low sentiment as US trade tariffs wreak havoc across global markets — will 2021 prices return?

Bitcoin crashes 10% as crypto market wipes out $1.3 trillion in value since January

Top 5 RWA Tokens to Buy in April 2025 Before They Skyrocket