Stellar (XLM) Faces Bearish Pressure with Potential Downturn Toward $0.22 Amid Weakening Momentum Signals

-

Stellar (XLM) has experienced a significant price drop of over 5%, raising concerns over the cryptocurrency’s stability amidst bearish momentum.

-

The current market landscape indicates a looming risk of XLM testing critical support levels around $0.22, potentially dropping below $0.20.

-

According to COINOTAG, analysts suggest that reclaiming the $0.27–$0.30 zone requires a formidable shift in market sentiment, yet indicators favor ongoing bearish trends.

Stellar (XLM) faces downward pressure as it drops over 5%, signaling potential tests of critical support levels while bearish indicators dominate the market.

Recent Price Drops Indicate Bearish Sentiment for XLM

On Thursday, Stellar (XLM) has witnessed a decline of more than 5%, leading to a market capitalization of approximately $8 billion. This recent shift in value is accompanied by strong bearish signals from XLM’s technical indicators, suggesting continued downward momentum that could lead to critical support testing around $0.22.

Although a potential reversal remains feasible, with resistance levels identified at $0.27, $0.29, and $0.30, any upward movement would necessitate a significant change in market sentiment, an unlikely scenario given current bearish pressures.

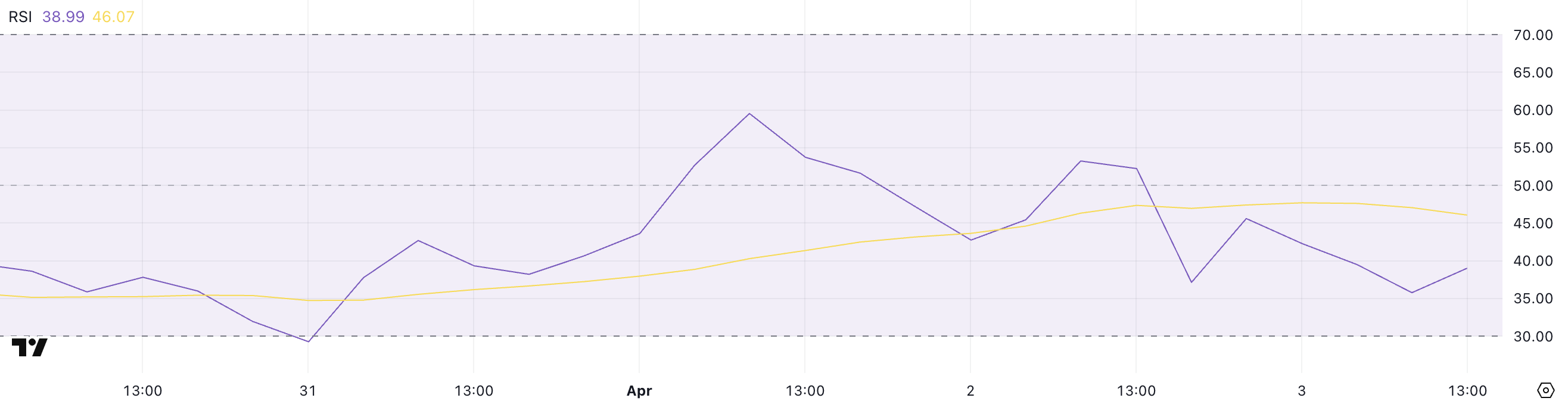

XLM RSI Indicates Downward Momentum

The Relative Strength Index (RSI) for XLM has sharply declined to 38.99, a significant drop from 59.54 just two days earlier, indicating a notable shift in momentum toward the bearish side.

The RSI serves as a momentum oscillator, providing insights into price changes within a range of 0 to 100. Readings exceeding 70 denote overbought conditions, whereas values below 30 indicate oversold levels. Presently, XLM’s RSI below the pivotal midpoint of 50 conveys that sellers are acquiring control.

As the RSI approaches the oversold threshold, this level suggests weakening buying pressure, leading to increased downside risks. If the RSI continues its downward trajectory, further price declines could be imminent unless buyer interventions stabilize the current trend.

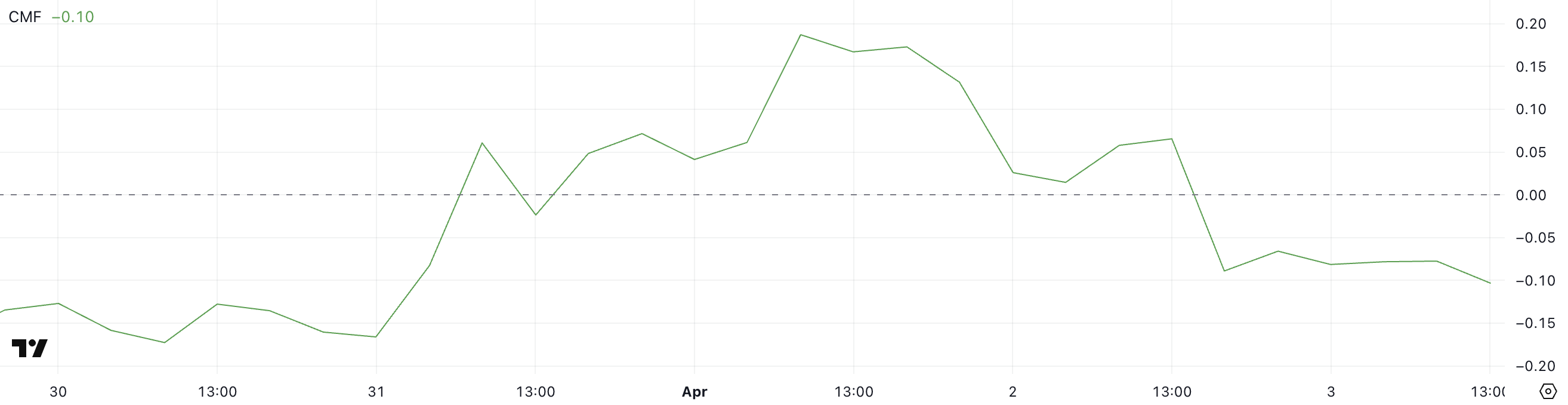

Significant Shift in Stellar CMF Signals Weakening Demand

Stellar’s Chaikin Money Flow (CMF) has plunged to -10, a stark drop from 0.19 just two days ago, indicating a serious reconfiguration in capital flow and investor sentiment.

The CMF is a vital indicator that gauges the volume-weighted average accumulation and distribution over time, effectively measuring entering and exiting capital from an asset. Positive readings typically indicate accumulation and buying pressure, while negative values reflect strong selling pressure and capital outflow.

With a CMF reading deep in negative territory, the assertion that sellers maintain control becomes clearer, exhibiting substantial capital exodus from the asset. This persistent outflow, combined with bearish indicators, signals a strong likelihood of downward pressure on the price unless notable buying activity emerges soon.

Downward Trajectory: Will Stellar Test Previous Lows?

The recent price actions for Stellar highlight concerning trends as EMA indicators suggest a robust bearish trajectory with the potential for significant declines.

Technical assessments indicate that XLM could test critical support around $0.22, with the risk of breaching this level, potentially falling below the psychologically significant threshold of $0.20—a price not seen since November 2024.

A scenario for trend reversal would hinge on a solid shift in market sentiment; for XLM to approach current resistance levels of $0.27, $0.29, and ideally, $0.30, considerable bullish momentum would be required. However, overcoming existing bearish trends remains challenging.

Until more definitive bullish signals arise, the existing technical structure continues to lean heavily toward bearish predictions, warranting caution among traders and investors in the current market landscape.

Conclusion

In summary, Stellar (XLM) is navigating a challenging environment characterized by declining prices and bearish technical indicators. With the RSI and CMF suggesting strong seller dominance, potential price tests around key supports may occur. Traders should remain vigilant for any signs of market sentiment shifts, as significant resistance recovery will be essential for positive price advancements.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

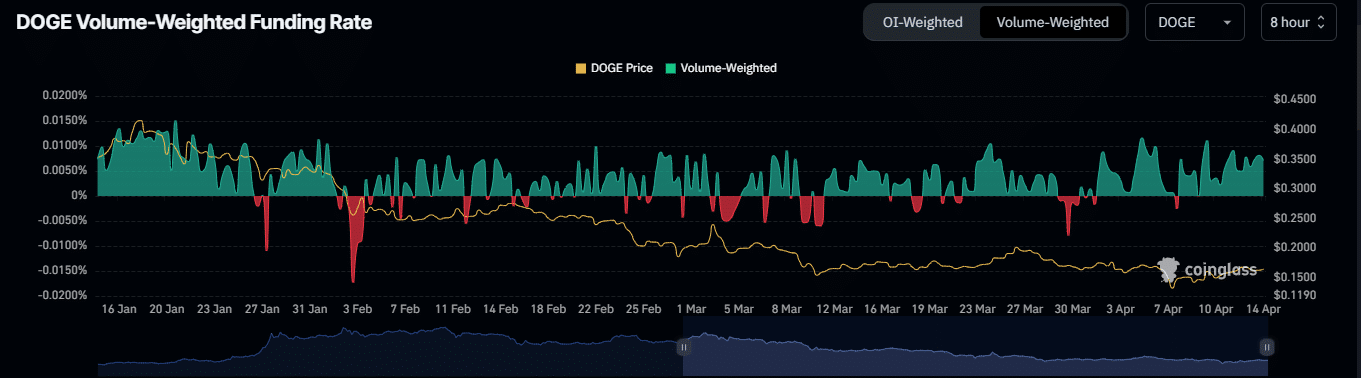

Potential Dogecoin Rally Ahead as Key Support Level and Increased Buying Interest Emerge

Market Insights: Short-Term Recovery Signals for BONK, ALCH, and Bitcoin

In Brief Analyst Pseudonym identifies recovery signals in BONK, ALCH, and Bitcoin. Short-term trading strategies recommended for cautious positions. Increasing interest in meme tokens amid market volatility.

Ethereum Price Fluctuations Ignite Technical Analysis and Strategic Forecasts

In Brief Ethereum's price fluctuations shift focus to technical indicators among market players. Analysts signal potential recovery and long-term growth opportunities for Ethereum. Competition from networks like Solana raises challenges for Ethereum's market position.

Market Turmoil: Investors React as OM Coin Crashes 90%

In Brief OM Coin experiences a dramatic 90% drop, alarming the crypto market. IP Coin's price decline raises investor concerns about potential panic sales. Support levels for IP Coin are being closely monitored following recent fluctuations.