Bitcoin Struggles Below $85,000 as Investors Show Caution and Long-Term Optimism

-

Bitcoin’s price grapples beneath $85,000 as investor caution surfaces, revealing a significant drop in circulation and market sentiment.

-

Despite turbulent market conditions, long-term holders remain optimistic, showcasing a strong commitment to Bitcoin amidst external shocks.

-

“The recovery hinges on reclaiming $85,000 as support,” analysts suggest, with $80,301 marking the next critical support threshold if bearish trends persist.

Bitcoin struggles below $85,000, but long-term holders remain steadfast. Will Bitcoin reclaim crucial support to reverse recent losses?

Investor Sentiment and Market Dynamics in Bitcoin

Bitcoin’s ongoing challenge to surpass the critical $85,000 resistance level has sparked discussions about the overall investor sentiment within the crypto market. Recent trends indicate that while price recovery has been sluggish, the behavior of long-term holders is telling a different story. Investors, who typically hold their assets for extended periods, are demonstrating remarkable resilience, indicating potential recovery signs.

The Role of Long-Term Holders in Stabilizing Bitcoin

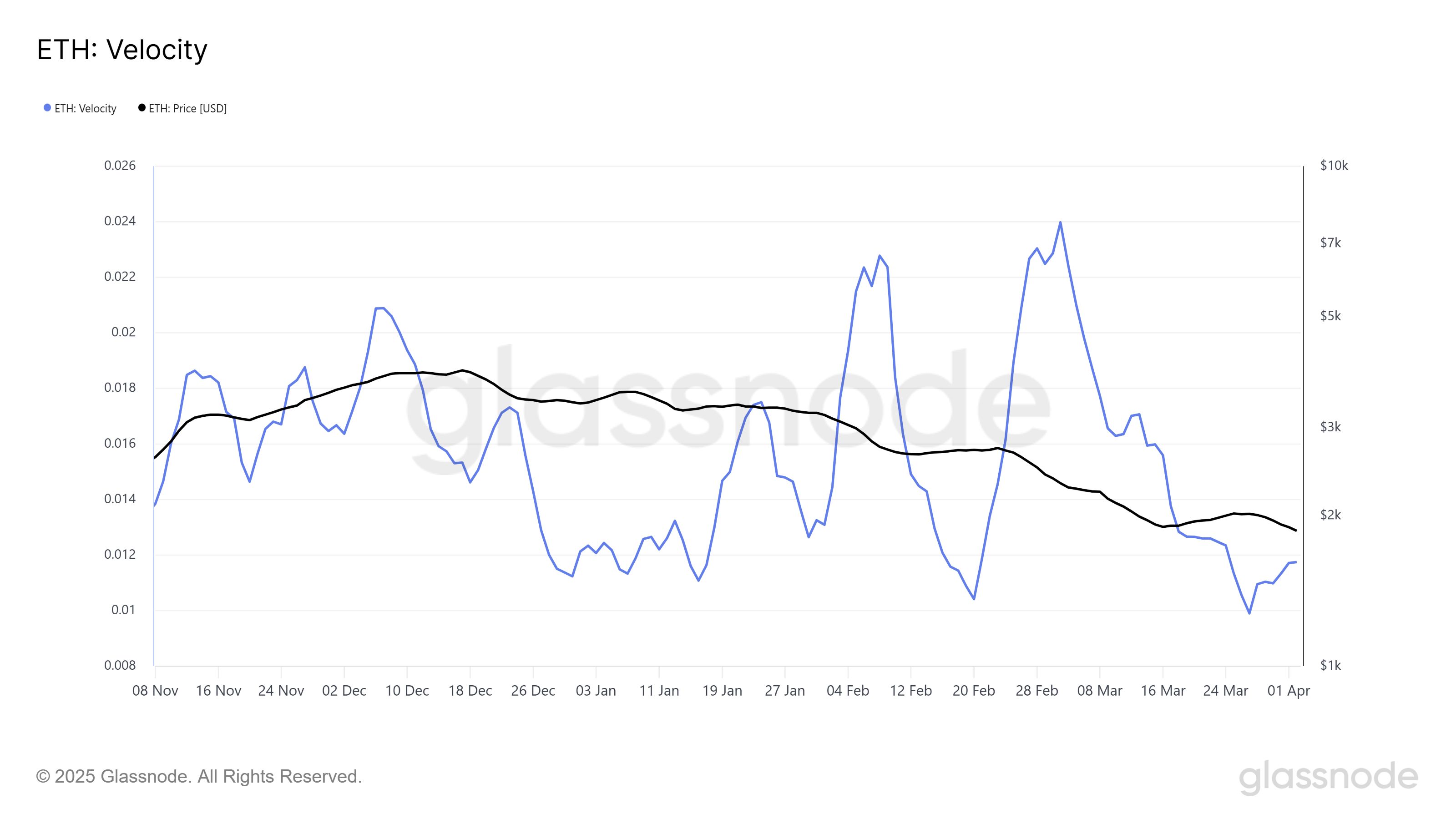

Many long-term holders of Bitcoin are choosing to retain their assets through these challenging market conditions. Data reveals that Bitcoin’s current velocity is at a five-month low, reflecting a substantial decrease in coins being transacted within the market. This trend indicates that investors are opting to hold rather than trade, which could be a strategic move in anticipation of a market rebound.

According to insights from Glassnode, a blockchain analytics company, this reluctance to sell among long-term holders ultimately stabilizes Bitcoin’s price amidst volatility. As many LTHs purchased Bitcoin during its all-time highs, their willingness to hold suggests a belief in the cryptocurrency’s long-term value and prospects.

Bitcoin Velocity. Source: Glassnode

Analyzing Key Support Levels for Bitcoin

As Bitcoin trades around $83,403, understanding key support levels becomes critical. Investors closely monitor the $85,000 resistance point and the subsequent support level at $80,301. If Bitcoin can reclaim the $85,000 mark, it would signal a potential upward reversal in market sentiment.

This analysis is critical considering the temporary dip following external events such as Trump’s tariff announcements, which can reshuffle market dynamics. A recovery above $85,000 could not only restore investor confidence but also encourage new inflows into the market.

Bitcoin Price Analysis. Source: TradingView

Future Outlook for Bitcoin’s Price Movement

Given the current market landscape, many analysts are cautiously optimistic. The sentiment among mid-term holders transitioning to long-term holders indicates a potential shift that could support price stabilization as they remain less inclined to sell during downturns.

However, should Bitcoin fail to maintain its momentum and drop below $80,301, a bearish scenario could play out, leading to further consolidation or decline. Hence, the vision of Bitcoin trading sustainably above $85,000 remains important not only for price recovery but for bolstering overall investor sentiment.

Conclusion

Bitcoin’s struggle beneath $85,000 signifies a cautious but determined investor landscape. With long-term holders displaying unwavering confidence and assuming a stabilizing role, the cryptocurrency prepares itself for potential recovery. Thus, reclaiming $85,000 becomes paramount as Bitcoin navigates through these essential market dynamics. Investors are keenly watching the trends as the path ahead unfolds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC breaks through $94,000

Nous Research Completes $50 Million Series A Financing, Led by Paradigm

Ripple President: No IPO Yet

Saylor Reacts to Fed's Bitcoin U-Turn