'BitBonds' pitched as solution to Trump’s budget-neutral bitcoin reserve strategy

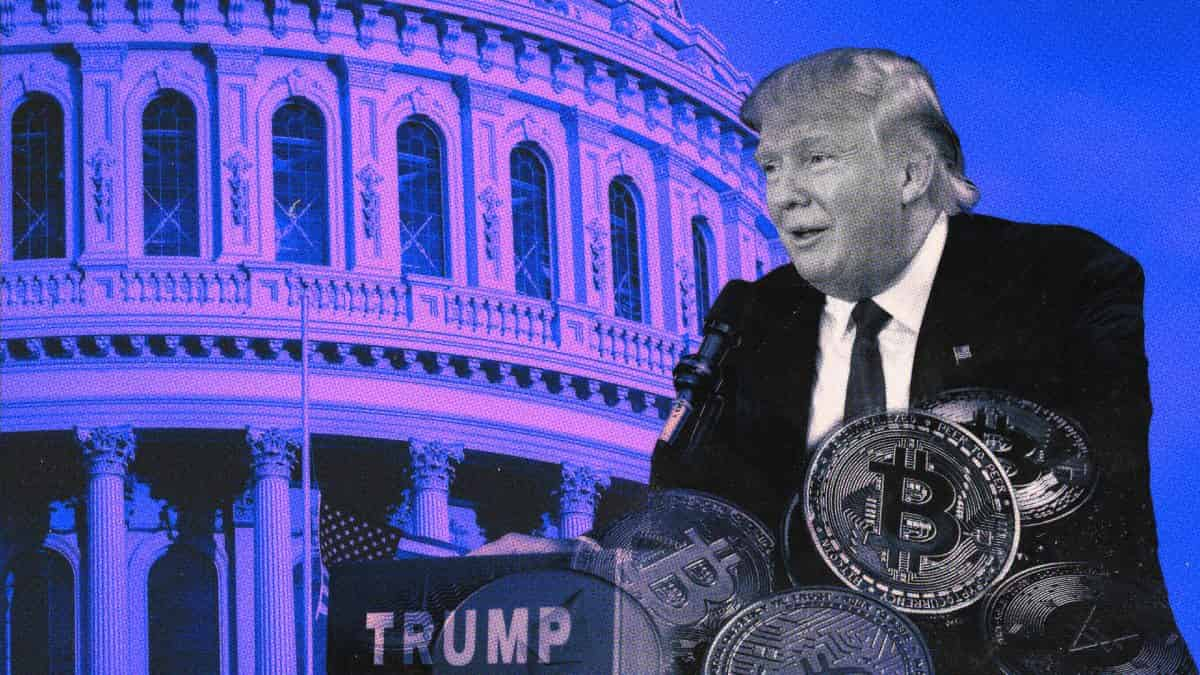

Quick Take The Bitcoin Policy Institute has put forward a policy brief on bitcoin-enhanced U.S. Treasury bonds, suggesting they can help implement President Trump’s Strategic Bitcoin Reserve, among other objectives. Trump’s March executive order to establish the reserve aligned closely with policy recommendations previously suggested by the think tank.

Bitcoin Policy Institute, a think tank dedicated to studying the future of money, on Monday proposed that the United States adopt bitcoin-enhanced Treasury Bonds, or "BitBonds," as an innovative fiscal tool to address multiple critical objectives, including the implementation of President Trump's Strategic Bitcoin Reserve.

The policy brief , co-authored by Newmarket Capital and Battery Finance founder and CEO Andrew Hohns and Bitcoin Policy Institute Executive Director Matthew Pines, suggests BitBonds are "an idea whose time has come," representing a direct implementation of Trump's directive by reducing the interest burden on U.S. Treasury bonds while simultaneously increasing the country's bitcoin holdings.

Trump signed an executive order on March 6 to create a U.S. Strategic Bitcoin Reserve, established from the approximate 200,000 BTC, worth about $17 billion at current prices, already in custody by the federal government that was forfeited as part of criminal or civil proceedings, minus those that still need to be returned to victims of crime. The bitcoin reserve is expected to hold approximately 103,500 BTC at its launch, with 94,636 BTC seized from the Bitfinex hackers likely to be returned to the crypto exchange, according to analysts at K33.

Trump also directed Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick to develop budget-neutral strategies for acquiring additional bitcoin, provided they do not incur incremental costs to American taxpayers.

BPI focuses on providing research and analysis to inform sound policy decisions regarding bitcoin and other monetary networks. Trump's executive order closely aligned with policy recommendations previously suggested by the think tank, proposing the designation of bitcoin as a reserve asset within the Treasury Department's Exchange Stabilization Fund, utilizing its approximate $40 billion surplus.

How would BitBonds work?

Under the plan, BitBonds would pay investors a fixed 1% annual interest in U.S. dollars, significantly lower than the current 4.5% rate on standard Treasury bonds. Ninety percent of the proceeds from BitBond sales would go to general government funding, while 10% would be used to purchase bitcoin for the reserve, which would be held in the Strategic Bitcoin Reserve, Hohns and Pines explained.

Investors would benefit from both the fixed interest and potential bitcoin appreciation at maturity, and the government would also retain a portion of any bitcoin gains.

"By leveraging America's position as a global financial and technology leader, BitBonds offer multiple mechanisms to reduce the overall debt burden while strengthening the nation's strategic position in the evolving monetary landscape," they said.

BPI also proposes BitBonds as a solution to address the U.S. government's broader fiscal challenges, particularly the need to refinance trillions of dollars in debt over the next few years.

"The United States faces an unprecedented fiscal challenge with approximately $9.3 trillion of federal debt maturing within the next 12 months," the authors warned. "This substantial refinancing requirement, combined with prevailing market interest rates approaching 4.5%, creates significant ongoing costs to service this debt. These costs place an extraordinary burden on taxpayers and substantially constrain the government's fiscal flexibility and economic growth potential."

BitBonds could generate "immediate fiscal relief," they said, arguing that by lowering the interest rates on U.S. Treasury bonds, the government could save billions annually, with estimates of up to $700 billion in savings over ten years.

"Detailed financial analysis indicates that implementation of the BitBonds program at the proposed scale of $2 trillion (approximately 20% of 2025 refinancing needs) could generate annual interest savings of $70 billion compared to conventional Treasury issuance," they said.

Additional benefits potentially include a significant reduction in the national debt under the assumption that bitcoin continues to appreciate over time, rapidly expanding the Strategic Bitcoin Reserve at no additional cost to taxpayers and offering tax-advantaged returns for American households, democratizing access to bitcoin's potential growth, Hohns and Pines argued.

Though the Trump administration has provided vague information on budget-neutral acquisition measures for the bitcoin reserve, Bessent is set to evaluate legal and investment considerations within 60 days of the executive order. Other potential budget-neutral strategies suggested by industry analysts include selling special drawing rights issued by the International Monetary Fund or revaluing gold certificates.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analyst Predicts Final Altcoin Rally, Utility Key to Gains

Altcoins may be on the cusp of one last major rally in the current market cycle, but only those with strong fundamentals and real-world utility are likely to see meaningful gains, according to Jamie Coutts, chief crypto analyst at Real Vision.

Kairos Research Report Reveals Jito’s Key Role in Solana’s 2024 Resurgence

A new report from Kairos Research highlights Jito’s pivotal role in Solana’s remarkable resurgence in 2024, transforming the blockchain’s infrastructure and economic landscape after the FTX collapse.

Rug Pulling, Market Maker Raking, What Can Save the Much-Maligned TGE?

DeFi-native TGE is a model that combines capital raising with the formation of public liquidity, overcoming traditional TGE shortcomings through on-chain liquidity and a transparent mechanism.

Grayscale Submits S-1 for Spot Solana ETF with SEC