Research Report | In-depth Analysis of the GUNZ Project & GUN Token Valuation

I. Project Overview

GUNZ is a high-performance Layer 1 blockchain purpose-built for large-scale gaming, developed by German AAA game studio Gunzilla Games. Built on an Avalanche subnet, it offers tens of thousands of TPS, ultra-low gas fees, and a highly modular architecture, aiming to help traditional game developers seamlessly transition to Web3. GUNZ supports mainstream game engines such as Unity and Unreal, provides comprehensive SDKs and toolchains, and enables true player ownership of in-game assets via NFTs. It introduces an optional “Play-to-Own” mechanism to lower the entry barrier for both users and developers.

The first application on GUNZ is Gunzilla’s self-developed cyberpunk-style battle royale game “Off The Grid (OTG),” which entered Early Access in October 2024 and is available on PC, PS5, and Xbox Series X|S. The game combines narrative-driven gameplay with PvP/PvE modes to attract a wide player base. Players can use GUN tokens to purchase NFT items such as weapons, cosmetics, and prosthetics, or earn GUN rewards by completing missions. According to official data, the GUNZ testnet has attracted over 12 million wallet addresses, ranking among the most active gaming blockchains.

The native token of GUNZ is GUN, with a total supply of 10 billion tokens and an initial circulating supply of approximately 6.05%. Of this, 4% (400 million tokens) will be distributed via CEX Launchpool to support early liquidity. The tokenomics integrates multiple utilities including in-game payments, NFT trading, ecosystem governance, and validator rewards. It also features enforced lockups and linear vesting to manage token release pressure. Gunzilla has committed to using 30% of game revenue to buy back GUN tokens, with a portion to be burned, creating a sustainable deflationary token-game feedback loop. The project has raised a total of $76 million, backed by Republic Capital, Animoca Brands, Jump Crypto, and Avalanche’s Blizzard Fund.

II. Project Highlights

AAA Studio Backing with Live Game Deployment

GUNZ is developed by Gunzilla Games, a renowned studio with team members from top-tier companies such as Ubisoft, EA, and Blizzard. Neill Blomkamp, director of “District 9,” serves as Chief Creative Officer. “Off The Grid,” the first live game on GUNZ, is officially launched on both console and PC platforms, offering a deeply integrated user experience with on-chain economic systems, ensuring real-world application and sustained user inflow.

High-Performance Blockchain Built for Gaming

Built on an Avalanche subnet, GUNZ delivers tens of thousands of TPS and near-zero gas fees. It is compatible with Unity and Unreal engines and offers SDKs to ease the transition from Web2 to Web3 for game developers. The platform supports on-chain asset minting, trading, and subscriptions, forming a complete “GameFi-as-a-Service” technical solution.

Robust Tokenomics and Long-Term Incentive Mechanism

GUNZ adopts a non-inflationary design, with only 6.05% of GUN tokens in initial circulation. Lockups and linear vesting control sell pressure, while 30% of game revenue is allocated to a buyback pool. Combined with a burn mechanism, this creates deflationary expectations. GUN tokens are widely used for in-game purchases, NFT marketplace transactions, subscription services, and ecosystem governance, forming a clear value loop.

Strong Fundraising and Top-Tier Backers

The project has completed two funding rounds totaling $76 million. Investors include Republic Capital, Animoca Brands, Jump Crypto, and Avalanche’s Blizzard Fund. In addition to capital support, the project benefits from industry resources and multi-chain ecosystem integration, providing a strong foundation for future development.

III. Market Valuation Outlook

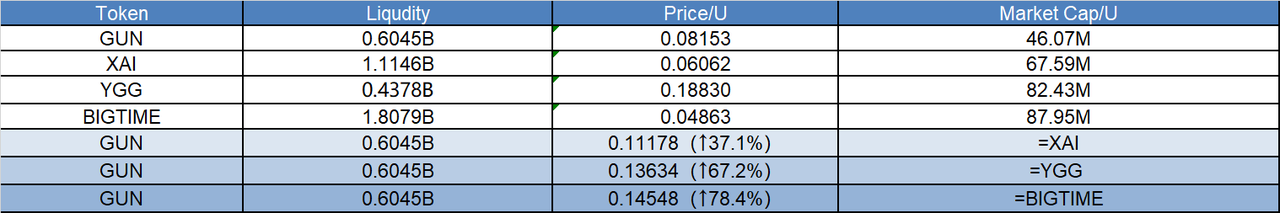

$GUN is the native token of GUNZ, a AAA gaming-focused blockchain developed by Gunzilla Games. It powers the “Play-to-Own” economic model in console-grade blockchain games like “Off The Grid” and is supported by a 30% revenue buyback mechanism to enhance intrinsic value. With only 6.05% of the total supply in initial circulation, GUN currently has a relatively small market cap. To assess its future growth potential, we compare it with three benchmark GameFi projects: XAI, YGG, and BIGTIME.

IV. Tokenomics

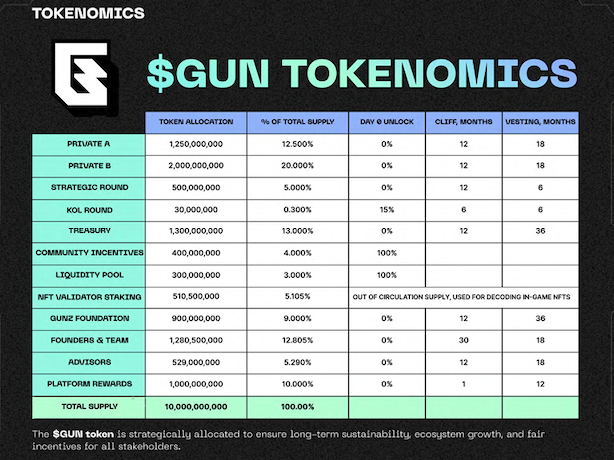

Total Supply: 10 billion GUN

Initial Circulating Supply: 604.5 million GUN (approx. 6% of total supply)

Token Allocation:

- Private Rounds (A + B) (32.5%): 3.25 billion tokens. Private A (12.5%) and Private B (20%) are fully locked at TGE, with a 12-month cliff followed by 18-month linear vesting.

- Strategic Round (5%): 500 million tokens, fully locked at TGE, 12-month cliff, then 6-month linear vesting.

- KOL Round (0.3%): 30 million tokens, 15% unlocked at TGE, remainder vested linearly over 6 months after a 6-month lock.

- Community Incentives (4%): 400 million tokens, fully unlocked at TGE, mainly distributed via Binance Launchpool.

- Liquidity Support (3%): 300 million tokens, fully unlocked at TGE for DEX/CEX market-making.

- NFT Validator Staking (5.105%): 510.5 million tokens, not in circulation, used for decoding in-game NFT data.

- Platform Rewards (10%): 1 billion tokens, locked at TGE, 1-month cliff, then 12-month linear vesting for rewarding gameplay, contributions, and platform tasks.

- GUNZ Foundation (9%): 900 million tokens, 12-month lock, then 36-month linear vesting for ecosystem expansion and strategic support.

- Treasury (13%): 1.3 billion tokens, 12-month lock, then 36-month linear vesting for long-term reserves and protocol support.

- Founding Team & Core Members (12.805%): 1.2805 billion tokens, 30-month lock, then 18-month linear vesting to ensure long-term incentives.

- Advisors (5.29%): 529 million tokens, 12-month lock, then 18-month linear vesting.

Token Utilities:

- In-Game Payments: Players can use $GUN to purchase virtual items such as weapons, skins, prosthetics, and story content in “Off The Grid,” and to pay for OTG Pro premium subscriptions.

- NFT Trading & Decoding: All in-game items on GUNZ are NFTs. $GUN is the primary medium for trading and decoding attributes and rarity, enhancing player-asset engagement.

- Network Validation & Staking: GUNZ introduces an NFT validator staking mechanism. Nodes must stake $GUN to earn network rewards and participate in NFT verification and decentralized data maintenance.

- Governance: Holders can participate in DAO governance of the GUNZ ecosystem, including proposals and voting on game economy models, NFT parameters, and fund allocations.

- Platform Incentives: Players can earn $GUN rewards from the incentive pool by completing tasks, creating content, and achieving social milestones, forming a “play-to-earn” feedback loop.

Additionally, Gunzilla has pledged to use 30% of revenue from “Off The Grid” to buy back $GUN. A portion will be used for player incentives and another portion may be burned, creating a deflationary mechanism that aligns token value with game growth.

V. Team & Fundraising

Team:

GUNZ is developed by Gunzilla Games, a German AAA game studio with a team composed of veterans from leading game companies:

- Co-founders Vlad Korolov (CEO) and Alexander Zoll (CSO) previously co-developed the online shooter “Warface.”

- CTO Timur Davidenko spent 18 years at Crytek, leading engine development for the “Crysis” and “Far Cry” series.

- Neill Blomkamp (director of “District 9”) serves as Chief Creative Officer, overseeing world-building.

- Richard K. Morgan, author of “Altered Carbon,” is the narrative architect.

- The team has over 330 members with backgrounds from Ubisoft, EA, Blizzard, THQ, HBO, and other top-tier content companies.

Fundraising:

Gunzilla Games, the company behind GUNZ, has completed two major funding rounds totaling $76 million:

- On August 9, 2022, it raised $46 million in a round led by Republic Capital, with participation from Animoca Brands, Griffin Gaming Partners, Jump Crypto, and angel investor Justin Kan (co-founder of Twitch).

- On March 26, 2024, Gunzilla announced a $30 million round co-led by Avalanche’s Blizzard Fund and CoinFund.

VI. Risk Factors

- GUNZ’s current ecosystem is primarily centered around “Off The Grid,” with limited diversification in DApps and open platform content. If future content development is slow or the core game fails to grow, ecosystem scalability may be constrained, affecting token value.

- The initial circulating supply of GUN is 6.05%, with 4% distributed via Launchpool and the remainder allocated for market and liquidity support. While early sell pressure is limited, the private rounds account for 32.5% and will begin unlocking one year after mainnet launch. If ecosystem growth does not keep pace, this could create mid-term supply pressure.

VII. Official Links

Website: https://gunbygunz.com/

Twitter: https://x.com/GUNbyGunz

Discord: https://discord.com/invite/gunbygunz

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VanEck Files for BNB ETF in Major Crypto Move

VanEck registers “VanEck BNB ETF” in Delaware, signaling a strong step toward launching a Binance Coin-backed ETF.What This Means for Binance Coin ($BNB)The Bigger Picture for Crypto ETFs

Tokens on Solana and BNB Chain Recorded Sharp Price Drops, as Wintermute Dumped Assets

GameStop raises $1.5 billion for Bitcoin investment

Metaplanet Acquires 160 BTC, Total Holdings Reach 4,206 BTC

Japan’s Metaplanet has reinforced its Bitcoin holdings with the recent acquisition of 160 BTC, bringing its total reserves to 4,206 BTC.