Bitcoin ETFs Post Second Straight Week of Inflows With $196 Million Inflow

Bitcoin ETFs Secure Another Week of Inflows as Ether ETFs Weekly Outflow Streak Reaches Fifth Week

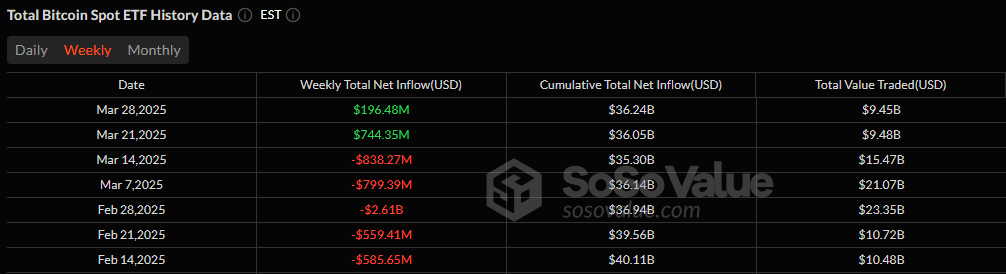

The tides have turned for bitcoin ETFs, which wrapped up their second consecutive week of net inflows, adding $196.48 million. The overall trend remained positive despite a sharp $93.16 million outflow on Friday, Mar. 28.

The highlight of the week came on Wednesday, Mar. 26, when bitcoin ETFs saw their biggest single-day inflow of $89.57 million, signaling continued institutional interest. Blackrock’s IBIT dominated the week with a $171.95 million inflow, followed by Fidelity’s FBTC, which added $86.84 million. Vaneck’s HODL contributed a modest $5 million.

Source: Sosovalue

However, not all funds shared in the gains. Ark 21shares’ ARKB saw the largest weekly outflow at $40.97 million, while Wisdomtree’s BTCW, Bitwise’s BITB, and Invesco’s BTCO lost $10.22 million, $9.15 million, and $6.95 million, respectively.

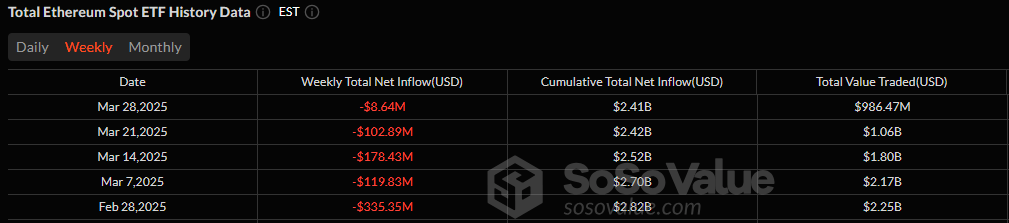

On the other hand, ether ETFs continued their struggle, marking their fifth consecutive week of outflows. Investors pulled $8.64 million over the week, with the most significant outflow occurring on Wednesday ($5.89 million).

Source: Sosovalue

Grayscale’s Mini ETH Trust led the losses with a $6.66 million exit, followed by Fidelity’s FETH ($3 million), Vaneck’s ETHV ($2.21 million), and Invesco’s QETH ($1.45 million). The lone bright spot was Grayscale’s ETHE, which bucked the trend with a $4.68 million inflow.

Bitcoin ETFs remain the focal point of institutional investment, solidifying their momentum despite the Friday setback. Meanwhile, ether ETFs have yet to attract sustained interest as investors continue to retreat.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

FDUSD released an audit report in February: Reserve assets exceeded 100%, supporting 1:1 exchange

White House press secretary: Musk will no longer hold public office after completing DOGE work

Maxine Waters Criticizes Trump's Crypto Ventures at House Financial Services Committee Hearing

FDUSD Stablecoin Depegged Amid Insolvency Claims