Bitcoin Hits Its Worst Quarter Since 2019, But Veteran Investors Are Shifting to Accumulation

Bitcoin faces its worst Q1 since 2019, but signs of veteran accumulation and a low sell-side risk ratio hint at a possible market recovery.

Bitcoin (BTC) is on track to end Q1 with its worst performance since 2019. Without an unexpected recovery, BTC could close the quarter with a 25% decline from its all-time high (ATH).

Some analysts have noted that experienced Bitcoin holders are shifting into an accumulation phase, signaling potential price growth in the medium term.

Signs That Veteran Investors Are Accumulating Again

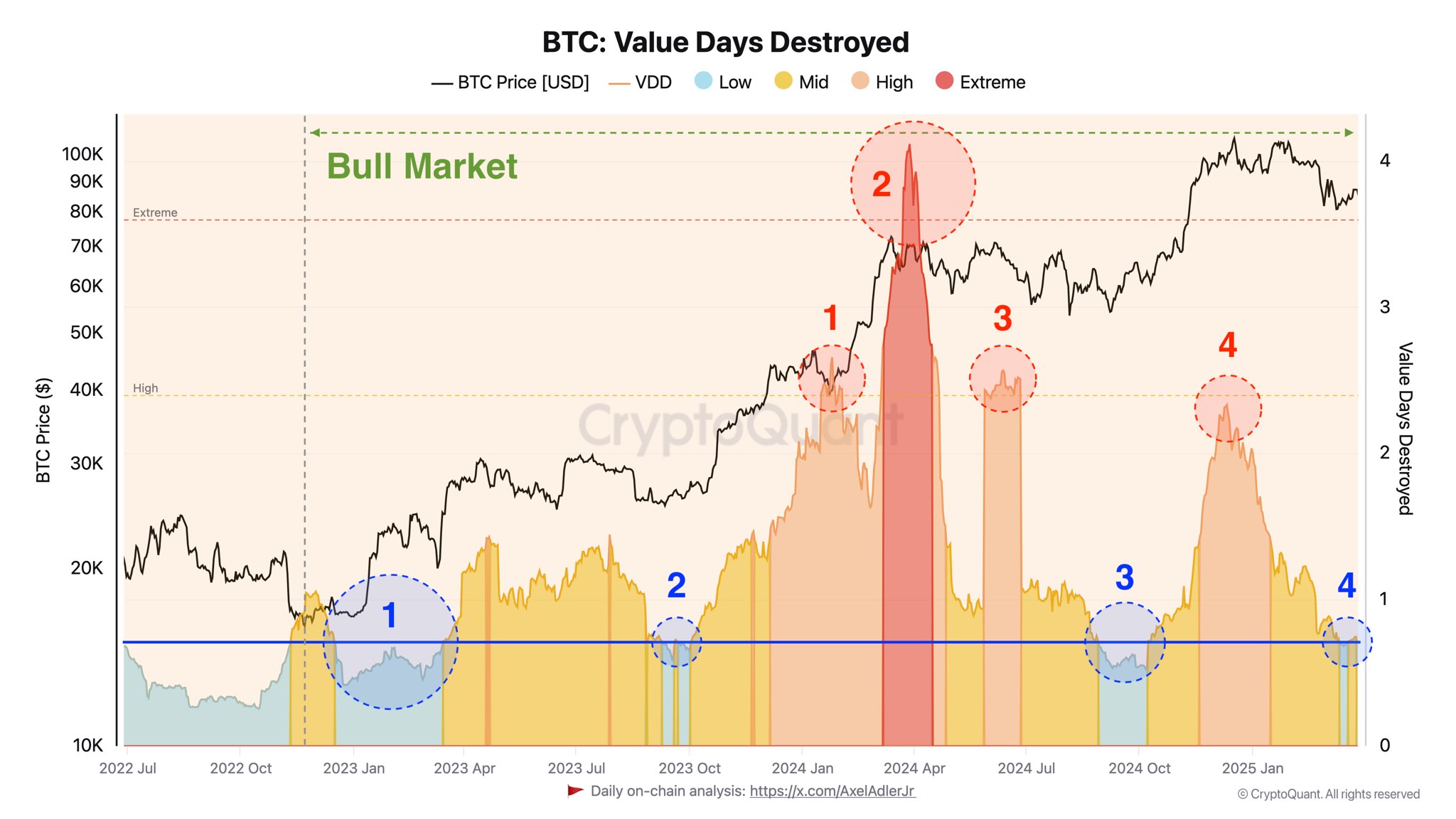

According to AxelAdlerJr, March 2025 marks a transition period where veteran investors move from selling to holding and accumulating. This shift is reflected in the Value Days Destroyed (VDD) metric, which remains low.

VDD is an on-chain indicator that tracks investor behavior by measuring the number of days Bitcoin remains unmoved before being transacted.

A high VDD suggests that older Bitcoin is being moved, which may indicate selling pressure from whales or long-term holders. A low VDD suggests that most transactions involve short-term holders, who have a smaller impact on the market.

BTC: Value Days Destroyed. Source:

CryptoQuant

BTC: Value Days Destroyed. Source:

CryptoQuant

Historically, low VDD periods often precede strong price rallies. These phases suggest that investors are accumulating Bitcoin with expectations of future price increases. AxelAdlerJr concludes that this shift signals Bitcoin’s potential for medium-term growth.

“The transition of experienced players into a holding (accumulation) phase signals the potential for further BTC growth in the medium term,” AxelAdlerJr predicted.

Bitcoin’s Sell-Side Risk Ratio Hits Low

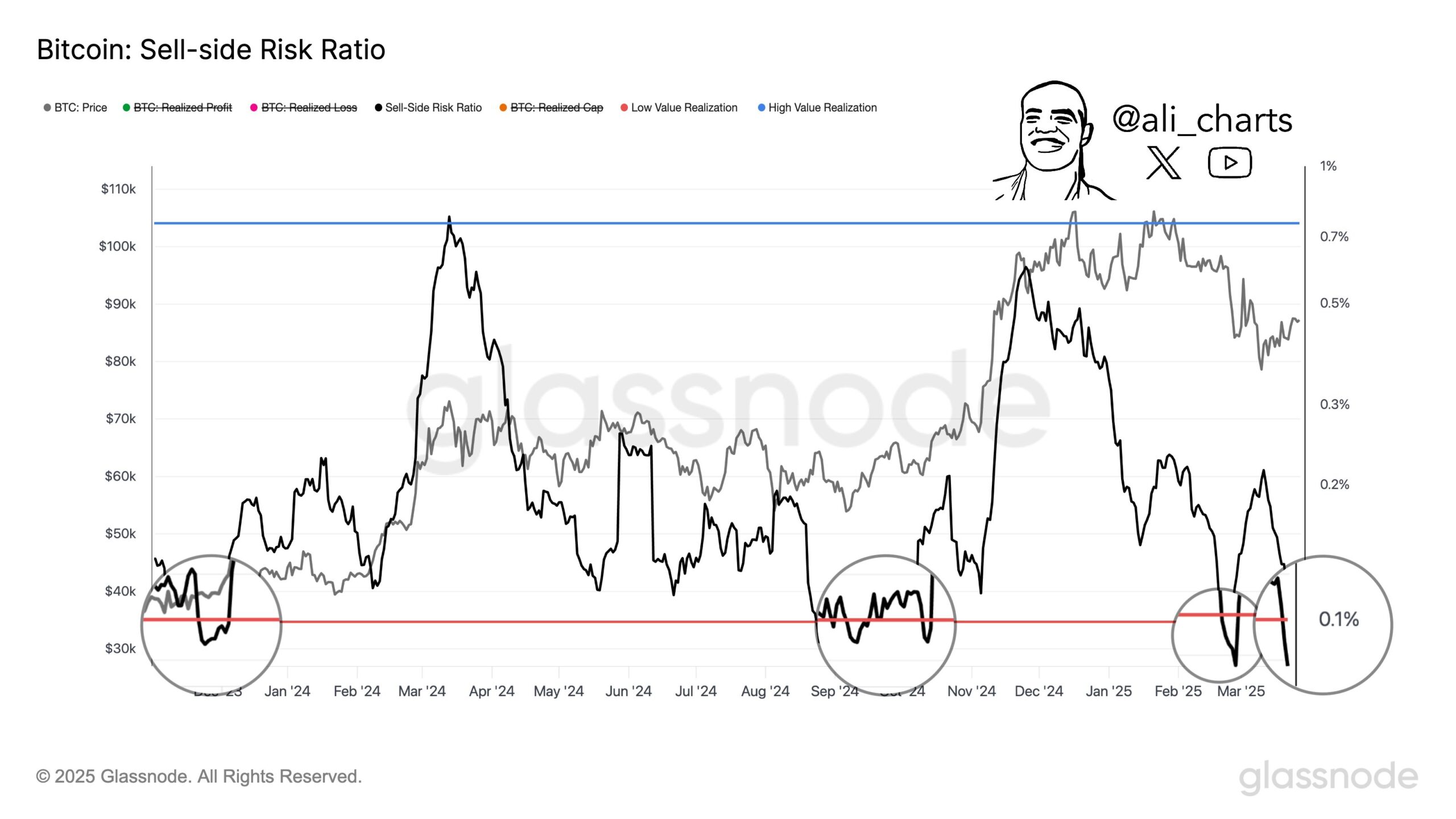

At the same time, analyst Ali highlighted another bullish indicator: Bitcoin’s sell-side risk ratio had dropped to 0.086%.

Bitcoin Sell-side Rish Ratio. Source:

Glassnode

Bitcoin Sell-side Rish Ratio. Source:

Glassnode

According to Ali, over the past two years, every time this ratio fell below 0.1%, Bitcoin experienced a strong price rebound. For example, in January 2024, Bitcoin surged to a then-all-time high of $73,800 after the sell-side risk ratio dipped below 0.1%.

Similarly, in September 2024, Bitcoin hit a new peak after this metric reached a low level.

The combination of veteran investors accumulating Bitcoin and a sharp decline in the sell-side risk ratio are positive signals for the market. However, a recent analysis from BeInCrypto warns of concerning technical patterns, with a death cross beginning to form.

Additionally, investors remain cautious about potential market volatility in early April. The uncertainty stems from President Trump’s upcoming announcement regarding a major retaliatory tariff.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Yesterday, the U.S. spot Ethereum ETF had a net outflow of $3.6 million

Scroll Co-founder: Taxing Layer2 is a major cancer for the future development of Ethereum

Crypto Industry-Backed Candidates Patronis and Fine Win Key Florida Seats