Crypto Rally Put On Ice For Now? (This week in crypto summary March 28)IntroductionIntro and Market OverviewWeekly Performance: BTC Up 1.7%, ETH Belo

Introduction

This week in crypto brings a mix of interesting market dynamics. Brian and Maksim analyze the recent pullback amid broader economic tensions. Their data-driven insights show Bitcoin staying resilient around $84K while altcoins face pressure. The duo examines on-chain metrics, social sentiment, and whale activity to determine if this is a temporary dip or a trend reversal. Their analysis shows important signals about investor behavior and what might predict the market's next move.

Intro and Market Overview

Crypto showed strength mid-week with Bitcoin climbing above $88K and Ethereum reaching nearly $2,100. The market then took a downward turn, creating what Brian calls "quite a blood bath" particularly for altcoins. This volatility comes amid global economic concerns, raising questions about whether crypto is following broader market trends or will chart its own recovery once conditions stabilize.

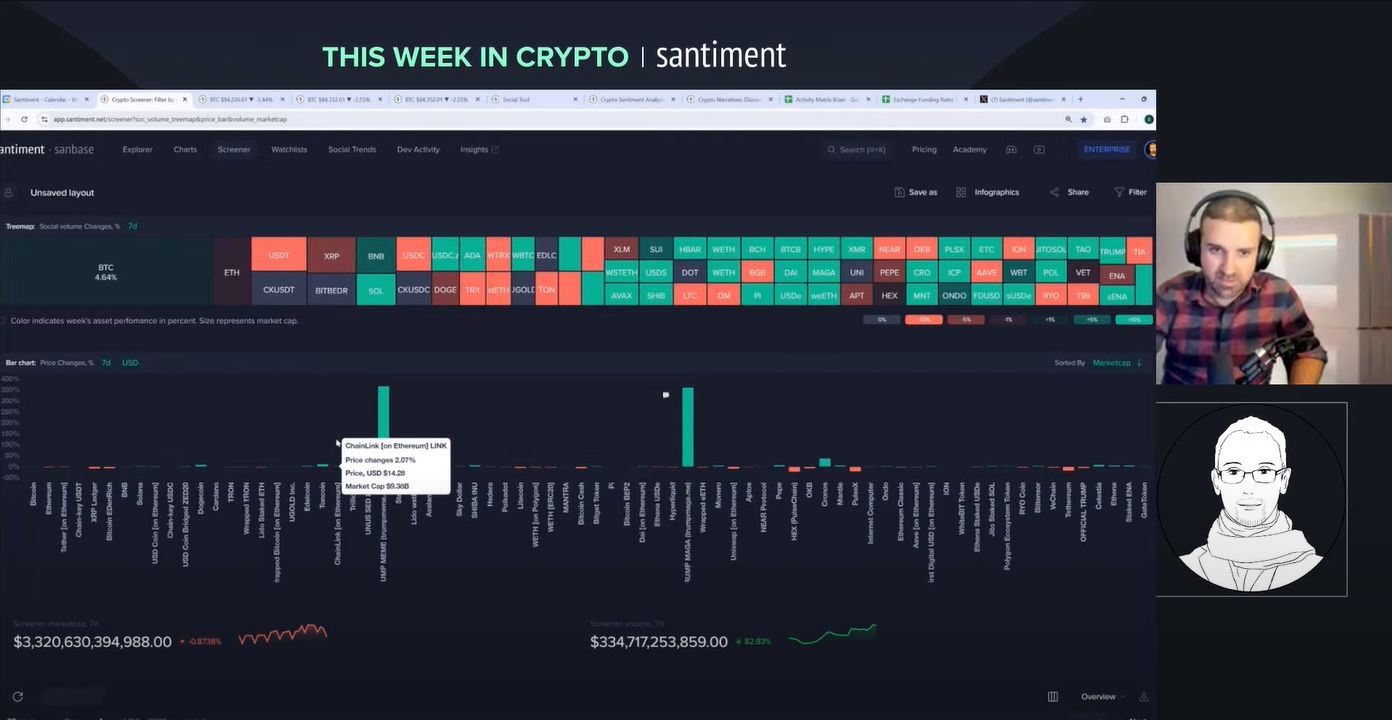

Weekly Performance: BTC Up 1.7%, ETH Below $1900, Altcoin Bloodbath

Bitcoin has maintained strength at $84.2K, up 1.7% over the week. This contrasts with Ethereum, now below $1900 and down about 3%. Most altcoins show larger drops, with XRP down 7.7% despite its SEC victory. Certain meme coins perform better, with Dogecoin up 8.7% and Toncoin rising 11.5%. This selective correction suggests investors are rebalancing portfolios rather than exiting crypto entirely.

Economic Tensions and Gold's Rise to All-Time Highs

Global economic concerns are affecting market sentiment. Maksim notes: "The economic war continues. Or actually intensifies." Inflation fears and US-Canada tensions have created uncertainty across markets. Gold has hit an all-time high of $3,111, showing how traditional safe-haven assets gain favor during uncertain periods. The hosts discuss whether Bitcoin might eventually benefit from similar safe-haven status, but currently crypto appears to move with broader risk assets.

Bitcoin vs Altcoins: BTC Showing More Resilience (-1% vs -5-8%)

A clear divergence has emerged between Bitcoin and altcoins. While Bitcoin shows only a 1% decline over 24 hours, most altcoins are experiencing steeper drops of 5-8%. Brian highlights: "This is not so much an impact on Bitcoin as it is on those altcoin bags." This pattern typically emerges during uncertain market conditions as investors reduce exposure to higher-risk assets while maintaining Bitcoin positions.

On-Chain Metrics: Investors at Break-Even, No Capitulation Yet

Most investors are currently sitting at near break-even positions. Short-term Bitcoin investors are down about 1% on average, with long-term holders down only 0.25%. "Panic is now easy to induce," Maksim comments. However, the market lacks the significant realized losses that typically signal a true bottom. Transaction volume, daily active addresses, and circulation all show downward trends that need to reverse for sustainable price increases.

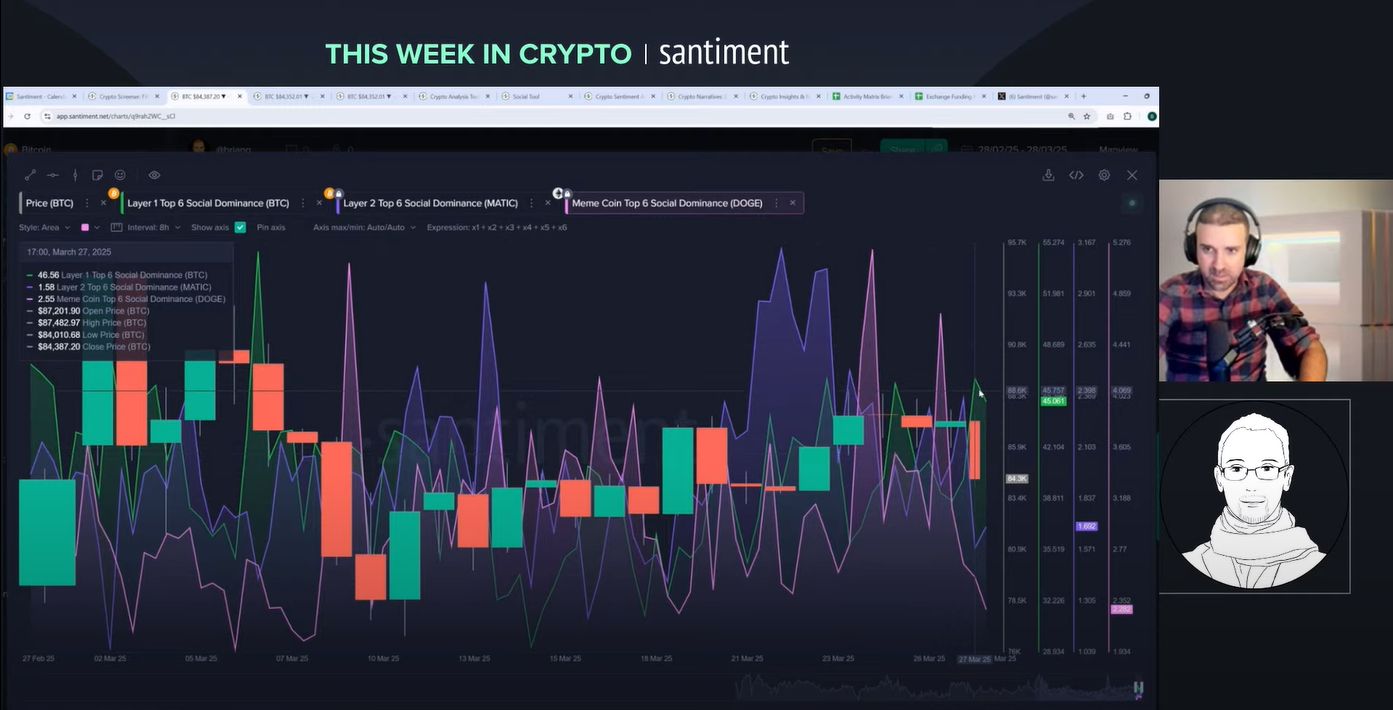

Social Sentiment Analysis: "Buy the Dip" Indicators

Social media shows slight increases in "buy the dip" mentions, suggesting recognition of the current price action as a legitimate dip. Brian explains the optimal scenario: "We want to see the crowd getting complacent to the dip and believing that there's just no point in buying the dip." Maksim adds that at true bottoms, "they don't talk much about buying the dip" because fear dominates. This sentiment metric provides valuable context for market psychology at potential turning points.

Market Predictions Still Bullish - Potential Warning Sign

Despite recent price drops, most market participants remain optimistic. The ratio of "higher" to "lower" price predictions still heavily favors positive outcomes. Brian observes: "Most traders are still talking more about Bitcoin going higher than going lower," with Maksim confirming this isn't the signal they'd want to see for a market bottom. This persistent optimism could indicate further downside is needed before a sustainable recovery can begin.

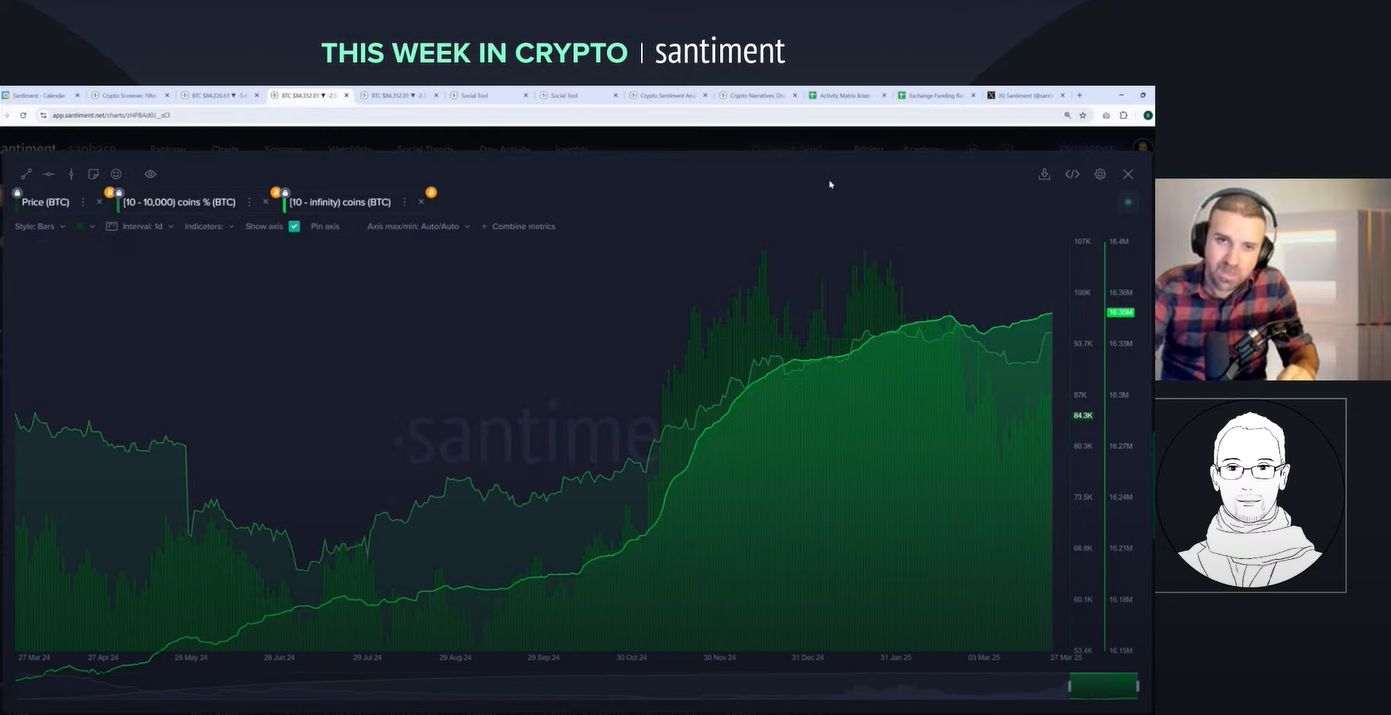

Whale Behavior: Large Wallets Accumulating While Retail Exits

Wallets holding 10+ BTC have accumulated nearly 13,000 BTC since March 3rd, showing confidence despite market uncertainty. Meanwhile, retail traders holding less than 0.1 BTC have reduced their positions by about 840 BTC over the past 15 days. "Key stakeholders are scooping up a lot of the coins that the retail traders are dropping," Brian notes. This pattern often emerges during market bottoming processes, though the current retail exodus remains modest compared to previous capitulation events.

Exchange Supply at 8-Year Lows; Funding Rates Turning Negative

Bitcoin's exchange supply has reached an eight-year low, reducing potential sell pressure. Simultaneously, funding rates are beginning to turn negative, indicating an increase in short positions. Brian explains: "We want to continue to see plenty of shorting going on" because high short interest can fuel later recoveries through short squeezes. These conditions may be setting up for a potential trend reversal, though more significant shifts would strengthen the case.

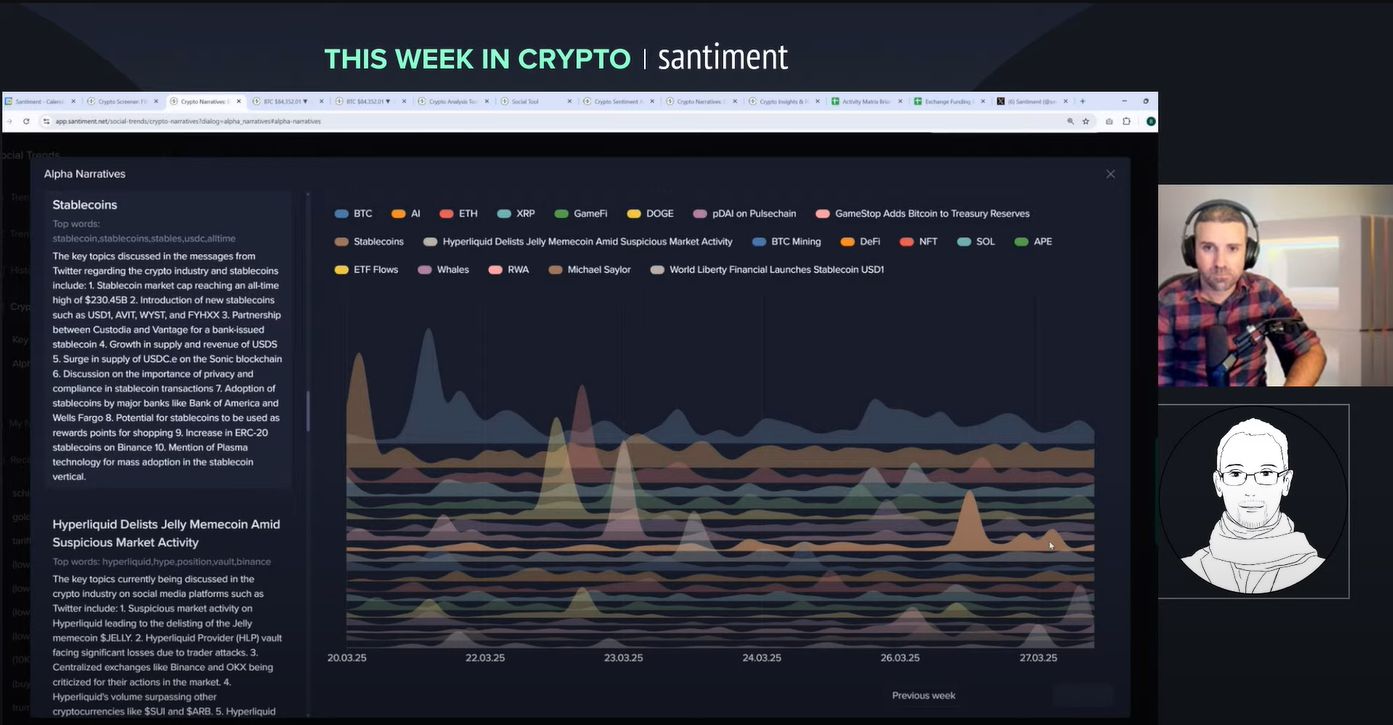

Key Narratives: USD1 Stablecoin Launch and Growing Stablecoin Interest

Stablecoin discussion has spiked recently. World Liberty Financial has launched USD1, a stablecoin tied to President Trump, while other major financial institutions are expanding crypto offerings. Brian identifies the increased stablecoin interest as "a bit of a fear signal," with Maksim suggesting it could be a "top signal." The growing focus on stable assets rather than growth-oriented cryptocurrencies often indicates market participants becoming more risk-averse.

Meme Coin Activity: Dogecoin Whales Accumulating 120M DOGE

Certain meme coins show surprising strength. Dogecoin whales have accumulated over 120 million DOGE in a week, explaining its 8-9% gain during general market decline. Trump-related meme coins have also seen significant gains, though Brian cautions about their speculative nature: "Do so at your own risk." The fluctuating interest in meme coins often serves as a sentiment indicator for overall market risk appetite.

Bottom Indicators: Market Lacks True Fear Signals Despite Downturn

The data suggests we haven't yet seen the extreme fear typically associated with market bottoms. Social media shows only mild concern rather than panic, and on-chain metrics don't display the capitulation signals that usually mark significant lows. "Not yet. Well, we need to break lows. Then it will be," Maksim comments, suggesting the $78K support level could trigger more substantial reactions if tested. The market currently shows "some worries, but not real fear."

What to Watch: Funding Rates, Realized Profit/Loss, Support Levels

Key metrics to monitor for potential bottom signals include:

- Funding rates turning more consistently negative

- Realized profit/loss showing significant negative spikes

- The critical $78K support level being tested

- Social sentiment shifting from optimistic to fearful

- Discussion moving from "buy the dip" to economic concerns

"Looking for a bottom to form," Maksim concludes. These indicators together provide a framework for monitoring market conditions and identifying potential turning points.

Conclusion

The crypto market shows mixed signals with Bitcoin demonstrating resilience while altcoins face pressure. This dip lacks the extreme fear and capitulation typically associated with market bottoms. We may need to see further price drops, increased negative sentiment, and clearer capitulation signals before a definitive bottom forms.

For traders and investors, watching key metrics like funding rates, realized profit/loss, whale behavior, and social sentiment will provide valuable clues about market direction. The $78K support level for Bitcoin remains particularly important as a potential trigger point for clearer directional signals.

Stay informed with these data-driven insights as the market evolves in response to broader economic conditions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hut 8 and Eric Trump Launch American Bitcoin Mining Firm

Donald Trump Jr. states that buying Bitcoin is just half the story; mining Bitcoin on favourable economics is huge.

Australia’s Financial Crime Regulatory Issues Notice To Crypto ATM Providers

Forbes: Trump doubled his fortune with crypto & Truth Social

His crypto ventures have pumped nearly $800 million in liquid cash into his pockets, keeping asset seizures off the table.

Strategy Buys 22,048 Bitcoin for $1.9B, Now Holds 528,185 BTC