ETH Leads in 24 Hour Liquidation, Leaves BTC Behind

While dropping below the $1,900 range today, Ethereum (ETH) has taken the lead in total liquidations across the crypto market, surpassing the largest crypto asset Bitcoin (BTC).

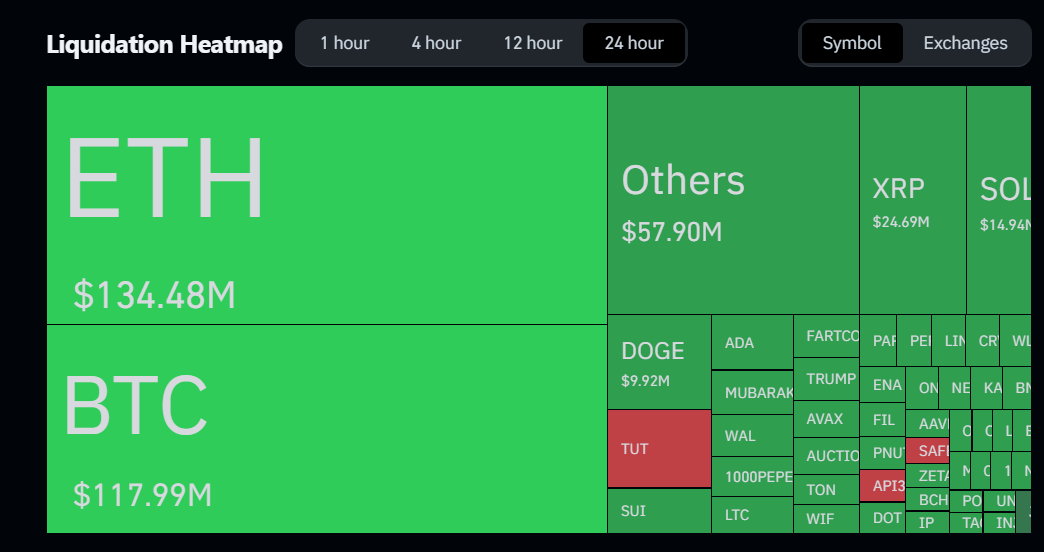

As per Coinglass data, ETH witnessed a staggering $135 million in liquidations while BTC nearing $118 million in total liquidations in the past 24 hours. The overall liquidation amount for past 24 hours reaches to $443 million, of which $398 million is in long positions and nearly $45 million in short positions.

ETH Leads Total Liquidation – Source: Coinglass

ETH Leads Total Liquidation – Source: Coinglass

This massive liquidation wave for ETH has come amid heightened market volatility as its price loses key support at $2,000 and falling below $1900 today. This price action has triggered forced closures of leveraged positions across major exchanges. The liquidation of over $135 million in ETH suggests that traders may have been overly leveraged, leading to forced liquidations when price movements went against their positions.

The surge in liquidations signals increased turbulence in the crypto market, as investors react to recently increased sell-side pressure and a sudden shifting in market sentiment.

Bitcoin, which usually leads liquidation volumes on a daily basis, has today followed closely with $118 million in liquidations. This shift highlights Ethereum’s growing dominance in derivative trading and its increased volatility compared to BTC.

Although this is not the first time ETH has led the market in liquidation volumes as in May and August 2023, ETH witnessed massive volatility and increased liquidation figures than Bitcoin. With ETH’s liquidation surpassing BTC’s, analysts are now predicting further price swings in the crypto markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hut 8 and Eric Trump Launch American Bitcoin Mining Firm

Donald Trump Jr. states that buying Bitcoin is just half the story; mining Bitcoin on favourable economics is huge.

Australia’s Financial Crime Regulatory Issues Notice To Crypto ATM Providers

Forbes: Trump doubled his fortune with crypto & Truth Social

His crypto ventures have pumped nearly $800 million in liquid cash into his pockets, keeping asset seizures off the table.

Strategy Buys 22,048 Bitcoin for $1.9B, Now Holds 528,185 BTC