As March 2025 nears its end, Bitcoin (BTC) traders and investors closely watch whether the market’s leading cryptocurrency can maintain support above the psychologically significant $87,000 level. Recent political developments and market dynamics have added optimism and uncertainty to the mix, creating a complex backdrop for Bitcoin’s next move.

Crypto-specific fundamentals remain constructive. Bitcoin ETFs launched in 2024 have accumulated over $100 million in assets , and recent weeks have seen a renewed uptick in institutional interest. Stablecoin circulation has grown by $4 billion in the past week alone, historically a signal of increased capital ready to flow into crypto markets. Global liquidity indicators are at elevated levels, and even speculative chatter surrounding the possibility of the U.S. holding a Bitcoin reserve has added to market enthusiasm. However, technical analysis tells a more cautious story.

BTC at a Crossroads: Key Levels, Crypto Market Sentiment, and What’s Next

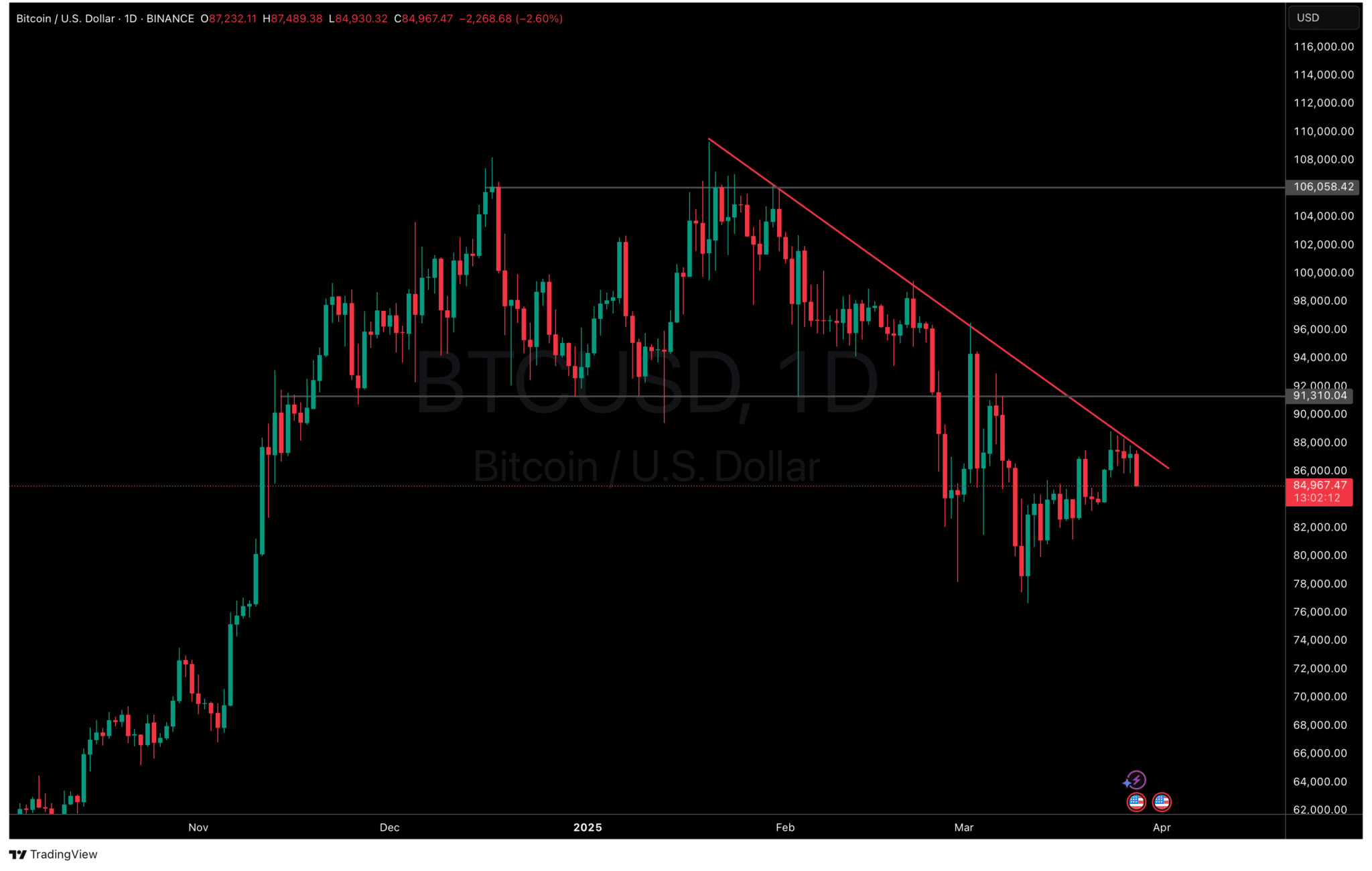

In lower timeframes, Bitcoin showed signs of weakness in March. Price has been rejected several times from the $87,000–$88,000 range, with a clear descending trendline pressing down the market. Recent breakdowns point toward potential liquidity sweeps around the $85,000 and even $84,300 levels, where traders may look for short-term entries. A deeper retracement toward $82,500 or lower cannot be ruled out if these supports fail.

On the daily chart, Bitcoin remains under a long-term downtrend structure that has held since February. Bitcoin will need to reclaim the $87,000–$88,000 area daily to invalidate the current bearish setup and open the door toward higher targets like $91,000 and beyond.

( BTCUSDT )

While the short-term technicals lean bearish, the macro context and historical patterns suggest that Bitcoin could find a strong base in the current range. April has often been a month of renewed momentum following corrective phases. BTC could target $90,000–$100,000 in the coming weeks.

BTC Bull Token Hits $4 Million in Presale as Bitcoin Market Eyes Key Levels

Ultimately, Bitcoin’s price action navigates between solid fundamentals and technical resistance. While no outcome is guaranteed, both bulls and bears will have crucial moments ahead.

This volatility may present a window of opportunity for participants in the BTC Bull presale , an emerging meme coin project with a unique reward system distributing real Bitcoin. Whether Bitcoin sees another dip or begins a breakout, accumulation zones in the $84,000–$87,000 range could offer a strategic entry point for long-term believers.

BTC Bull Token ($BTCBULL) has surpassed $4 million in its presale phase, drawing strong interest from the crypto community. Unlike typical meme coins, BTCBULL connects its value proposition directly to Bitcoin’s price action, offering holders real rewards beyond speculation.

The project’s appeal centers around a three-tier reward system designed to benefit investors as Bitcoin’s price climbs. First, BTCBULL holders will receive Bitcoin airdrops when BTC reaches major milestones—such as $150,000 and $200,000. Second, the token incorporates a deflationary burn mechanism at key price levels, like $125,000, systematically reducing token supply over time. Third, the team has launched a staking platform, currently offering 101% APY during the presale, with over one billion tokens already locked by early participants.

With a current presale price of $0.002435 per token, $BTCBULL has prioritized accessibility, allowing purchases via credit card, crypto payments, and direct acquisition through the Best Wallet app.

The project has also focused on transparency and security, having undergone two independent smart contract audits by Coinsult and SolidProof , both of which confirmed no vulnerabilities or risks of team-controlled minting.

This presale momentum comes as Bitcoin itself is testing critical price levels around $87,000, a zone closely watched by traders. While short-term price action remains volatile, improving macroeconomic conditions and renewed institutional interest suggest that Bitcoin, and by extension, BTCBULL, could benefit from a broader market recovery.

Visit BTCBULL Here

EXPLORE: BlackRock Bitcoin ETP Lands in Europe: Time to Buy Crypto Now?

Key Takeaways

- Bitcoin fights to reclaim the crucial $87,000 level as March 2025 ends, with traders watching if it can hold this psychological support.

- BTC remains below a long-term descending trendline, with recent rejections suggesting short-term downside risk toward $85,000 or lower.

- Despite bearish technicals, institutional interest, growing ETF inflows, and rising stablecoin circulation point to improving long-term market conditions.

- Potential for April Recovery: Historically, April has been a favorable month for Bitcoin. If BTC reclaims $87,000–$88,000 resistance, a move toward $90,000–$100,000 is possible.