Fear Of The Markets Reaches A Peak… And Gold Benefits Like Never Before

The stock market endures a new shock. Wall Street wobbles, Asia slips, Europe hesitates. The reason? The return of a certain Donald Trump, armed with his favorite weapon: tariffs. At the announcement of “reciprocal” measures, investors fled riskier assets. And as always in such cases, it is gold that has reaped the fruits of panic. A reaction as classic as it is concerning.

Global stock market crash, surge in gold: the cocktail is bitter

Stock markets red like a Soviet banknote. In Tokyo, the Nikkei gives up ground. Shanghai drops, Seoul sways. And in the meantime, Wall Street incurs losses on industrial and technological stocks. Investors play hide and seek with volatility, preferring gold over stocks.

The numbers don’t lie: gold reached $3,056 per ounce this Wednesday, marking its 16th annual increase, according to Reuters . This is a direct translation of a flight to safe-haven assets in the face of trade uncertainties.

And this is not just an Asian phenomenon. In Europe too, the DAX has declined. In Paris, the CAC 40 has lost its breath. The tensions generated by Trump over automobile import tariffs weigh on the mood of major financial markets.

- The MSCI Asia-Pacific declines by 1.3 %;

- Automotive stocks drop on European exchanges.

In this dissonant ballet, gold leads the dance while the stock market drags its feet.

When the slogan “America First” rhymes with “the world of tomorrow”

Donald Trump plays an old tune again: that of provocative protectionism. His idea? To apply reciprocal tariffs to all countries that tax the United States. In other words, if you tax my cars, I tax your products. A classic from the “Make America Great Again” doctrine, version 2025.

“ Trump’s remarks on tariffs have fueled uncertainty, reviving memories of 2019. “

But in the quest to make America great, one ends up putting everyone down. China is immediately targeted. And the chain reactions do not take long. The yuan wobbles, Chinese export stocks plummet, regional indices falter.

Europe, on the other hand, hesitates between diplomatic outrage and commercial opportunism. The tensions are such that even central banks are tightening up. Behind the scenes, some suggest a return to the logic of blocs. The markets themselves do not like these stories.

- The VIX fear index jumps by 7 % in two sessions;

- Stocks related to semiconductors lose up to 4 % on Nasdaq.

In this climate, every phrase from Trump weighs heavier than a benchmark rate. He plays with fire… and the stock market smells burnt.

The Fed, inflation, and gold: a triangle of explosive tension

While the stock market trembles and Trump rants, the Federal Reserve remains frozen like a rabbit in the headlights. Investors await the core PCE inflation figures, scheduled for Friday. According to Reuters’ projections , the increase is expected to reach +0.3 %, like the previous month.

” The core PCE remains the Fed’s preferred indicator. “

But the context changes everything. Gold, thermometer of silent fears, rises to historic levels. The ounce is not rising by chance: it reflects the anxiety of a weakening dollar and a loss of credibility for the Fed.

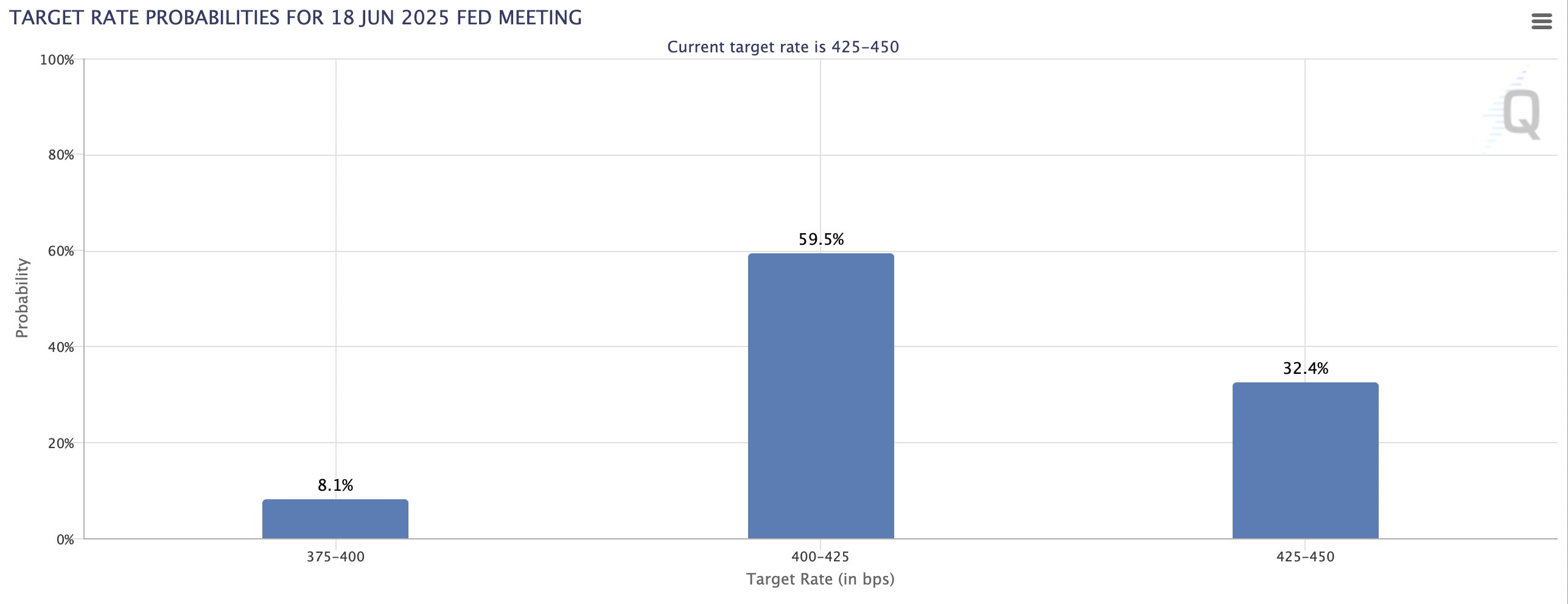

On the bond markets, yields adjust slowly. But traders adjust their hopes even faster: the probability of a rate cut in June is revised downwards.

- The dollar index loses 0.4 %, favoring the rise of gold;

- Rate cut expectations drop from 60 % to 43 %.

Probabilities of FED rate cuts in June – Source: CME Group

Probabilities of FED rate cuts in June – Source: CME Group

As an old banker from Chicago would say: “When gold rises without a ceiling, it means the house has no walls. ” And it’s not Trump who will rebuild the monetary foundations.

The American stock market, shaken by politics and speculation, loses credibility. Meanwhile, Europe waits and collects the crumbs. Yes, when Wall Street is in turmoil, Europe collects the winnings : what if this time the old continent knew how to play the stability card in the face of chaos?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hut 8 and Eric Trump Launch American Bitcoin Mining Firm

Donald Trump Jr. states that buying Bitcoin is just half the story; mining Bitcoin on favourable economics is huge.

Australia’s Financial Crime Regulatory Issues Notice To Crypto ATM Providers

Forbes: Trump doubled his fortune with crypto & Truth Social

His crypto ventures have pumped nearly $800 million in liquid cash into his pockets, keeping asset seizures off the table.

Strategy Buys 22,048 Bitcoin for $1.9B, Now Holds 528,185 BTC