3 Key Ways Retail Investors Can Capitalize on Stablecoin Growth

- The stablecoin market has surged 90% since late 2023, with Ethereum and Tron hitting record circulation highs.

- Emerging stablecoin issuers now offer utility tokens, letting retail investors share in platform growth and governance.

The stablecoin market, after slowly building up for a while, has suddenly taken off significantly. Since the end of 2023, its total value has shot up by around 90%, crossing the $230 billion line. Everyday investors are now looking for ways to get a piece of the action as this space gains serious financial weight.

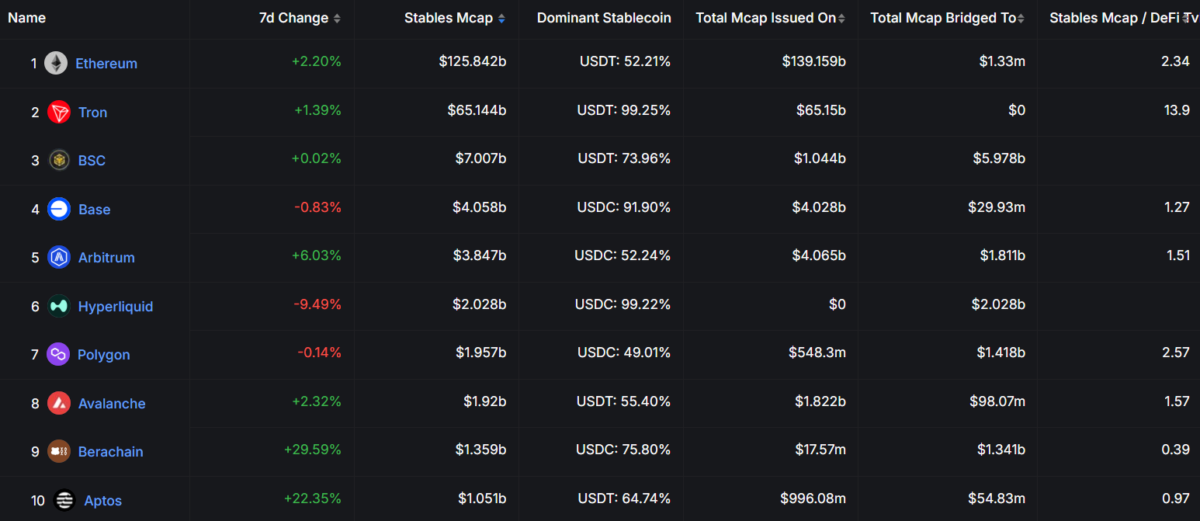

Ethereum and Tron—two of the biggest blockchain networks in the game—have hit all-time highs in stablecoin circulation. Ethereum, the more dominant of the two, hosts roughly $126 billion in stablecoins. Tron follows with a solid $65 billion, driven largely by peer-to-peer transaction growth across developing nations.

That kind of expansion isn’t just about numbers—it’s also about position. Patrick Scott, a leading voice in decentralized finance, said :

There are 3 ways to play the stablecoin boom: 1) Chains stablecoins are issued on 2) Stablecoin issuers 3) DeFi protocols stablecoins are used in.

1: ETH and TRX Poised to Benefit as Stablecoin Surges

Retail investors are beginning to notice that investing in the native tokens of these networks—ETH for Ethereum and TRX for Tron—could be a smart long-term move. Analyst DCinvestor made a bold claim :

…within a few years it will be obvious in hindsight that the best way to invest in the coming stablecoin boom was simply just to buy ETH where the most stablecoins are and will be settled and ultimately a key beneficiary of the economic activity which emerges around them.

Both ETH and TRX act as the fuel that drives stablecoin usage on their platforms. As more digital dollars move across these rails, demand for these native tokens could increase. Ethereum already serves as the home for more than half the total stablecoin supply, while Tron is quickly narrowing the gap.

Outside of Ethereum and Tron, other blockchains are trying to get a piece of the action, but these two remain the most battle-tested when it comes to stablecoin scalability and adoption.

2: New Stablecoin Issuers Offer More Than Just Stability

While the biggest stablecoin issuers—Tether and Circle—remain private and unavailable for direct investment, new kids on the block have arrived with something different to offer. Emerging issuers like Ethena ( USDe ), Ondo’s USDY, HONEY on Berachain, and Curve’s crvUSD have introduced governance or utility tokens that give retail investors a chance to tap into the revenue and growth of their platforms.

These aren’t just decorative tokens—they often come with voting power, governance control, or even a slice of the revenue pie. That means as the stablecoin economy swells, these tokens could see real upside potential.

Issuers are innovating fast, and investors are paying attention. It’s not just about holding a stablecoin anymore—it’s about becoming a stakeholder in the system that runs it.

3: DeFi Platforms Thrive on Stablecoins

DeFi is where stablecoins are put into use in the fullest possible manner. Aave, Morpho, Pendle, Curve, and Fluid have incorporated stablecoins into the very core of their offerings—lending and borrowing to yield farming and liquidity pools.

Retail investors can access such platforms through providing capital or taking part in smart lending strategies. Such operations generally make money on the basis of interest fees or trading commissions. Small players would be able to earn consistent returns with the proper steps if market conditions are favorable.

Stablecoins are the lifeblood of DeFi, and the protocols that use them best are seeing a steady uptick in user activity. As long as adoption keeps growing, the incentives to participate will likely grow with it.

Recommended for you:

- Buy Ethereum Guide

- Ethereum Wallet Tutorial

- Check 24-hour Ethereum Price

- More Ethereum News

- What is Ethereum?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hut 8 and Eric Trump Launch American Bitcoin Mining Firm

Donald Trump Jr. states that buying Bitcoin is just half the story; mining Bitcoin on favourable economics is huge.

Australia’s Financial Crime Regulatory Issues Notice To Crypto ATM Providers

Forbes: Trump doubled his fortune with crypto & Truth Social

His crypto ventures have pumped nearly $800 million in liquid cash into his pockets, keeping asset seizures off the table.

Strategy Buys 22,048 Bitcoin for $1.9B, Now Holds 528,185 BTC