Key Notes

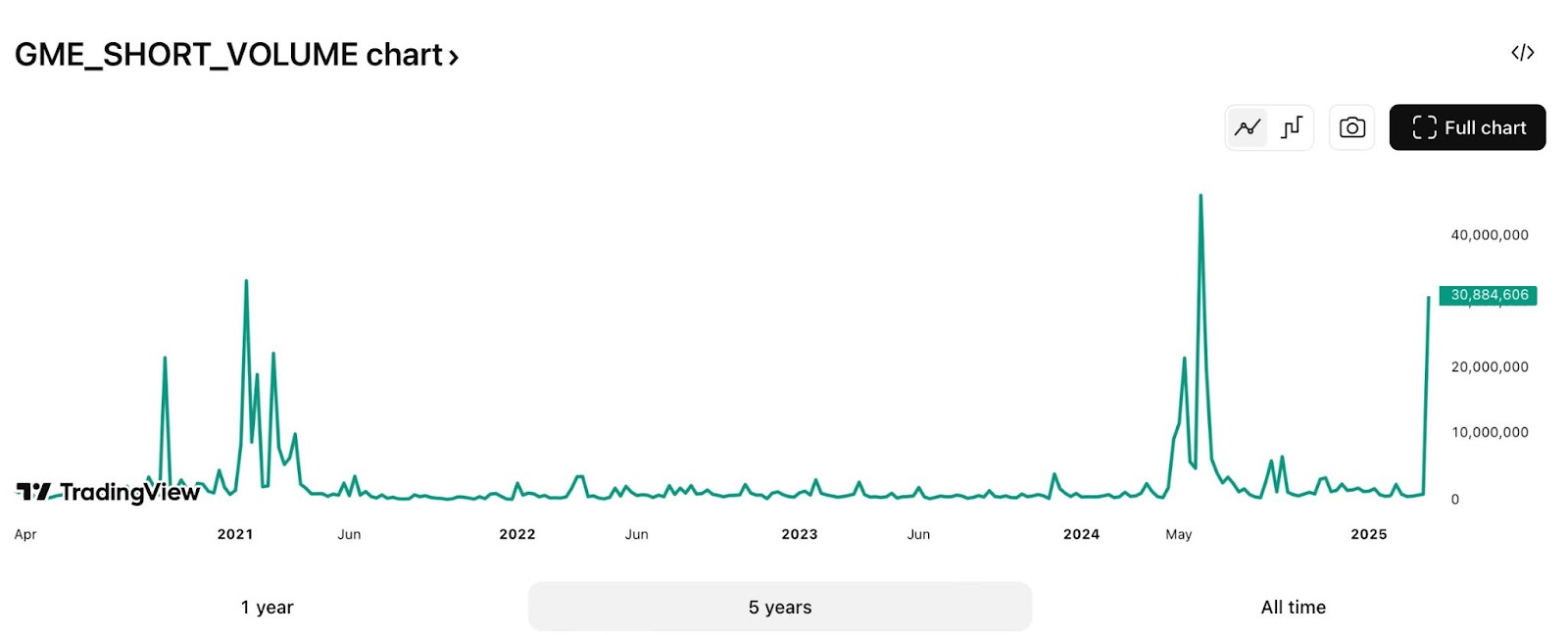

- GameStop's short sales volume skyrocketed by 234% within 24 hours of announcing its Bitcoin buying plans, reaching 30.85 million shares.

- The decline followed a spike in trading volume reminiscent of the 2021 short squeeze, prompting NYSE to impose a Short Sale Restriction (SSR).

- Some analysts, like Han Akamatsu, compare GameStop’s current trajectory to MicroStrategy's 2021 issuance of convertible notes for Bitcoin purchases .

GameStop Corp (NYSE: GME) stock crashed by more than 22% on March 27, two days after the firm announced a plan to build its own Bitcoin reserves. Following the BTC plan announcement, GME trading volumes spiked to levels similar to GameStop’s 2021 short squeeze, forcing the New York Stock Exchange (NYSE) to impose a Short Sale Restriction (SSR).

The SSR comes into effect whenever the stock price drops over 10% from the previous day’s closing. With its latest crash, GameStop stock lost its 12% gains accumulated after the announcement of the Bitcoin reserve plans. During yesterday’s closing session, the GME stock was trading at $22.09.

As per the data from TradingView, GameStop (GME) short sales volume surged by 234% within 24 hours, climbing to 30.85 million shares sold as of March 27.

This number is very much closer to levels seen in January 2021, when the stock skyrocketed due to a “short squeeze” thereby resulting in substantial losses for other short sellers and hedge funds. The peak during that period was 33.26 million shares on January 19.

In an X post, Malone Wealth president and CEO Kevin Malone commented on GME stock moves.

GameStop’s Bitcoin Plans

A day after the firm announced its Bitcoin reserve plans, it also disclosed that it would be deploying $1.3 billion, out of its $4.7 billion cash reserve, to purchasing Bitcoins. GameStop revealed that the convertible senior notes will be used for general corporate purposes, including the acquisition of Bitcoin.

Some analysts attribute the stock’s decline to the announcement of the convertible notes offering. In a post on March 27, Han Akamatsu stated that the GameStop stock is dropping for the same reason that Strategy declines after issuing convertible notes.

Along with the GameStop stock, BTC price is also seeing some selling pressure, dropping 1.7% today and slipping under $86,000.

nextDisclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.