GameStop Bets on Bitcoin Despite Financial Woes

GameStop (GME) stock rallied after the video game retailer announced plans to invest in Bitcoin ($BTC), signaling a shift toward cryptocurrency as part of its financial strategy.

Announces Bitcoin Investment Plans

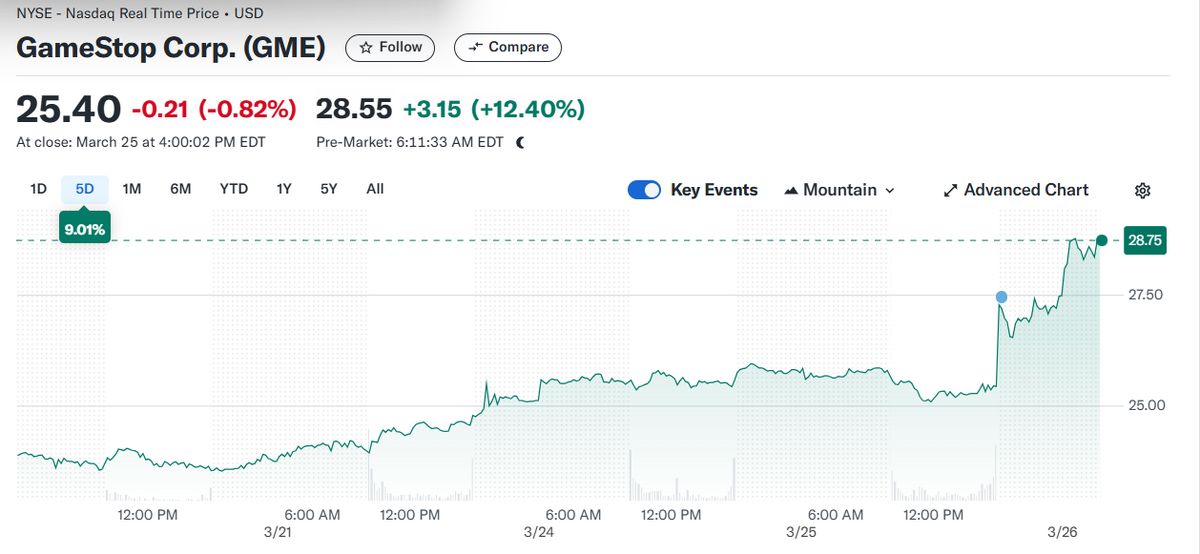

GameStop’s stock (GME) surged over 12.4% to $28.75 on Tuesday after the video game retailer announced a major shift in its investment strategy: adding Bitcoin ($BTC) to its treasury reserves.

Gamestop (GME) stock price surged after the company announced its investment policy update. Source: Yahoo Finance

Gamestop (GME) stock price surged after the company announced its investment policy update. Source: Yahoo Finance

In a brief statement , GameStop confirmed that its board unanimously approved an update to its investment policy, allowing the company to invest in Bitcoin.

Sponsored

However, no specifics were provided regarding the timeline, the proportion of reserves to be allocated, or how GameStop plans to raise funds for the investment.

Inspired by Saylor’s Bitcoin Play?

The announcement follows speculation ignited by GameStop CEO Ryan Cohen about a month ago when he tweeted a picture with MicroStrategy’s CEO Michael Saylor , a well-known Bitcoin advocate.

MicroStrategy has aggressively accumulated Bitcoin through convertible debt offerings and senior secured notes.

The company has issued convertible bonds, allowing investors to exchange them for shares, and leveraged low-interest senior secured debt to buy more BTC.

The company now holds over 447,000 Bitcoin. The strategy has paid off, with MicroStrategy’s stock soaring over 84% in the past year, fueled by Bitcoin’s price surge.

Will GameStop’s Move Impact Bitcoin’s Price?

Michael Saylor quickly expressed support for GameStop’s decision, posting on X: “They are adopting the winning strategy. The Golden Bull Run is happening.”

However, it remains unclear how much impact GameStop’s Bitcoin investment will have on the cryptocurrency market, especially given the company’s latest financial struggles.

GameStop reported $1.28 billion in net sales for the Q4, marking a 28% decline from the same period the previous year, signaling weakening revenue.

Additionally, its adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) dropped from $64.7 million to $36.1 million year-over-year, suggesting declining profitability amid falling sales or rising operating costs.

Why GameStop Still Matters in Crypto?

GameStop became the epicenter of the 2021 memestock mania due to a combination of retail investor enthusiasm, short squeezing, and social media hype.

Users on Reddit’s r/WallStreetBets noticed that hedge funds had heavily shorted GameStop (GME), betting its price would fall.

In response, retail traders coordinated a massive buying spree, driving up GME’s price from under $20 to over $400 at its peak.

This short squeeze forced hedge funds like Melvin Capital to cover their positions at huge losses.

The frenzy was fueled by commission-free trading platforms like Robinhood, viral social media posts, and a populist backlash against Wall Street . Robinhood later restricted GME trading, sparking controversy and congressional hearings.

Why This Matters

GameStop’s Bitcoin investment could signal growing corporate adoption of $BTC beyond traditional finance and tech firms.

Discover DailyCoin’s top crypto news:

Ripple (XRP) vs. HBAR: Which SWIFT Is More Likely To Choose?

Bitcoin Reclaims $87K: Will the Bull Run Continue?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysis: Luna 2.0 and low-liquidity assets may not be eligible for Terraform Labs claims

Viewpoint: "Tariff Day" is here, risk assets may see a short-term rebound

Musk says US government has no plans to use Dogecoin