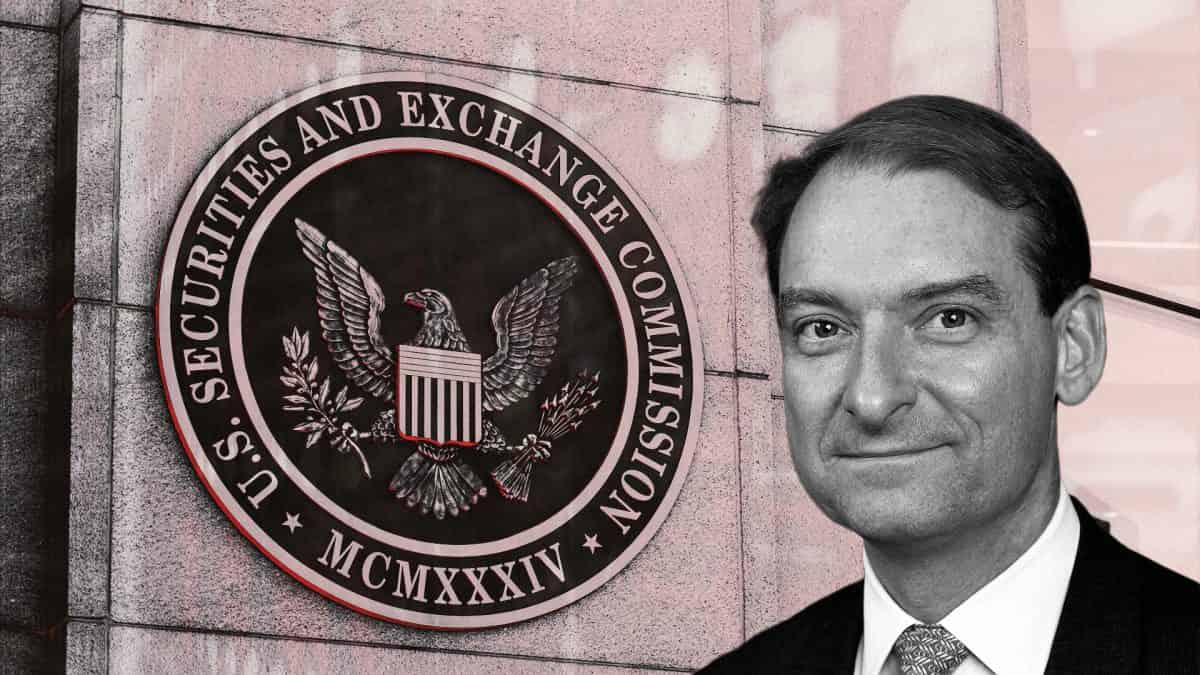

Senators grill SEC nominee Paul Atkins over FTX ties, agency missteps under Gensler

Quick Take Senate Banking Committee Chair Tim Scott, R-S.C., asked Paul Atkins about how the agency could recuperate from losses the senator described as involving court cases such as Debt Box. Sen. John Kennedy, R-La., quickly lodged questions toward Atkins about what the SEC plans to do in terms of Sam Bankman-Fried’s parents. The hearing also included other nominees, and there were not many questions from lawmakers on crypto.

U.S. lawmakers peppered potential incoming Securities and Exchange Commission Chair Paul Atkins about his ties to bankrupt crypto exchange FTX while also criticizing the agency's former chair, Gary Gensler.

Senate Banking Committee Chair Tim Scott, R-S.C., asked Atkins about how the agency could recuperate from losses the senator described as involving court cases such as Debt Box — a case brought by the SEC in 2023 against the crypto startup. The judge in that case criticized the agency for making misleading statements and resulted in the SEC paying $1.8 million in fines .

"I commit to get to work, if I'm confirmed, to try to make sure that we increase the morale of the agency, that we cure some of the dysfunction that's there, the demoralization of it, and get back to work and get back to basics," Atkins said on Thursday at his nomination hearing in the Senate Banking Committee.

In prepared testimony, Atkins said he would make creating a regulatory framework for digital assets a "top priority." Lawmakers were also considering nominations on Thursday for the Comptroller of the Currency Jonathan Gould, Assistant Secretary of the Treasury Luke Pettit and Federal Transit Administrator Marcus Molinaro, so topics varied and were not focused on crypto.

President Donald Trump tapped Atkins in December to lead the SEC. Atkins founded the consulting firm Patomak Global Partners in 2009 and the firm has clients including banks, crypto exchanges and DeFi platforms, according to its website. Atkins was also appointed by former President George W. Bush as an SEC commissioner from 2002 to 2008, and was asked questions on Thursday about his role during the financial crisis.

The SEC is, and has already, turned a new leaf in its approach to regulating crypto after former Chair Gary Gensler took a more wary viewpoint of the digital asset industry. Since Gensler's exit in January, the SEC has rescinded controversial crypto accounting guidance, dropped enforcement actions against major crypto industry players and created a crypto task force.

Earlier this week, Atkins disclosed that he owns shares in three crypto-related companies, according to Fortune .

Ties to FTX

Top Democrat of the Senate Banking Committee Elizabeth Warren has pressed Atkins over his ties to collapsed crypto exchange FTX and President Donald Trump's possible conflicts of interests with the rise of his memecoin.

According to multiple news reports, including The Wall Street Journal , FTX was a client of Patomak Global Partners and signed on as an adviser to FTX in early 2022. FTX filed for bankruptcy in late 2022 and the exchange's CEO, Sam Bankman-Fried, was found guilty in November 2023 of seven criminal counts.

During Thursday's hearing, Warren said Atkins would be "in a prime spot" given his firm's clients.

"If you're confirmed, you will be in a prime spot to deliver for all those clients who have been paying you millions of dollars," she said.

Sen. John Kennedy, R-La., quickly lodged questions toward Atkins about what the SEC plans to do in terms of Sam Bankman-Fried's parents. The SEC sued Bankman-Fried in 2022, but charges were not brought against his parents Barbara Fried and Joseph Bankman. His parents are also looking to get a pardon for their son from President Donald Trump.

Kennedy said he would continue to ask Atkins about what the SEC's plans to do.

"They're crooks, and I expect the SEC to do something about it," the senator said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mark Zuckerberg thinks he can make Trump go to war with Europe for him

Share link:In this post: Mark Zuckerberg wants Trump to use tariffs to pressure the EU over a coming fine against Meta. The EU plans to force Meta to offer Facebook and Instagram without personalized ads. Meta says this would kill its main revenue source in Europe, which brings in 25% of its income.

Ethereum Eyes a Comeback After Brutal Q1 Slide

White House: Trump will speak in the Rose Garden at 4 p.m. Wednesday