Polymarket faces scrutiny over Trump Ukraine mineral deal bet manipulation

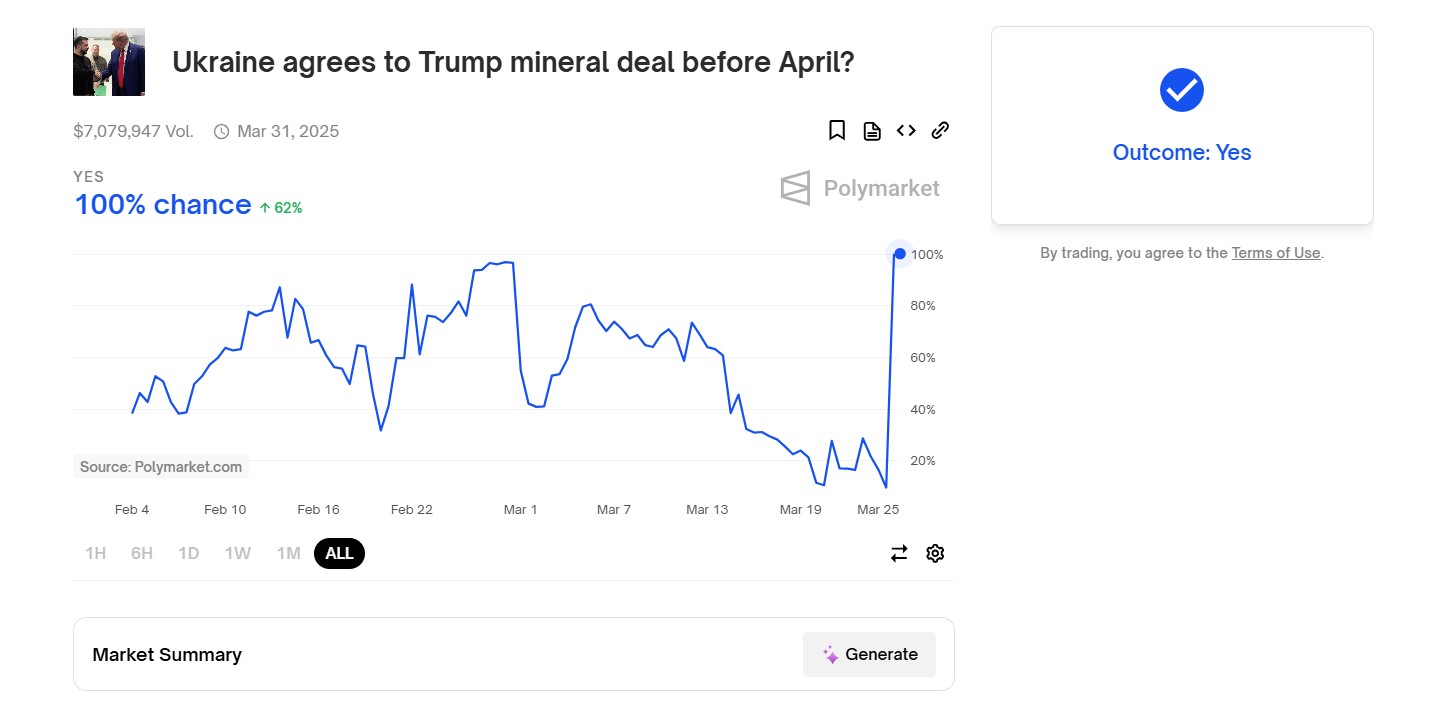

- Polymarket criticized for incorrect ‘Yes’ outcome on $7M Trump/Ukraine deal bet.

- There are allegations of governance manipulation by a UMA Whale.

- Polymarket moderators have said there will be no refunds.

Polymarket, the world’s leading decentralized prediction market, is grappling with a wave of criticism following a controversial resolution of a high-profile bet.

The market in question wagered on whether US President Donald Trump would accept a rare earth mineral deal with Ukraine before April.

Despite no evidence of such an event occurring, the market settled as “Yes” on March 25, 2025 , sparking outrage among users and raising questions about the platform’s integrity.

With over $7 million in trading volume, the outcome has fueled concerns over potential manipulation and governance vulnerabilities.

Polymarket “governance attack” tied to UMA Protocol oracles

The backlash centers on allegations of a “governance attack” tied to Polymarket’s use of UMA Protocol’s blockchain oracles, which verify real-world events to settle bets.

Crypto threat researcher Vladimir S. pointed to a single “whale” from UMA who allegedly wielded 5 million tokens across three accounts, representing 25% of the total votes, to force the incorrect settlement. This move, he argued on March 26, allowed the tycoon to profit at the expense of other traders.

A governance attack occurred on @Polymarket , where a @UMAprotocol tycoon used his voting power to manipulate the oracle, allowing the market to settle false results and successfully profit.

The tycoon cast 5 million tokens through three accounts, accounting for 25% of the… pic.twitter.com/FYZmmFK2Fq

— Vladimir S. | Officer's Notes (@officer_cia) March 26, 2025

Polymarket has since pledged to prevent such incidents, but the damage to its reputation has already taken root.

Not everyone agrees on the manipulation narrative, however. Pseudonymous Polymarket user Tenadome offered a different take, suggesting negligence rather than malice was to blame.

In a March 26 X post, Tenadome claimed the decision came from UMA’s usual voting whales—many affiliated with the protocol’s team—who don’t trade on Polymarket. Ignoring the market’s clarification, they opted for a quick resolution to secure rewards and avoid penalties, he argued.

There was no governance attack. This was just extreme negligence from both @Polymarket and @UMAprotocol .

What actually happened was:

1. A user submitted a Yes proposal for "Ukraine agrees to Trump mineral deal before April?" ( https://t.co/HeHC6775K2 ) and this proposal was… https://t.co/49bGhEAwrZ

— tenadome (@tenad0me) March 26, 2025

This competing perspective has only deepened the debate over accountability.

Polymarket rules out refunds

Adding to user frustration, Polymarket moderators have ruled out refunds. Moderator Tanner acknowledged the resolution defied expectations and the platform’s own guidance, but maintained it wasn’t a “market failure” warranting compensation.

This decision has left many traders feeling betrayed by a platform that prides itself on transparency.

In response, Polymarket vowed to implement new monitoring systems to address what it called an “unprecedented situation,” though specifics remain unclear.

Notably, the controversy comes amid a broader boom for prediction markets, fueled by the 2024 US presidential election. Data from CoinGecko shows betting volumes across the top three platforms soared 565% in Q3 2024, reaching $3.1 billion—up from $463.3 million the prior quarter.

Polymarket, commanding over 99% of the market share as of September, has been a key driver of this growth. However, as this incident reveals, its rapid rise may be exposing cracks in its decentralized framework, leaving observers to wonder if tighter oversight is needed to sustain trust in the platform’s future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wasabi Adds Berachain Vaults With Up To 300% Yields

Terraform Labs Creditors Alert—Claim Your Crypto Losses Before the Deadline!

How Jack Du Rose Went From Jewels To Building DAOs

Market Chop: Altcoins Follow 2020-2021 Pattern, Says Analyst

Analysts suggest the current market chop is temporary, likening it to 2020/2021 patterns. Could altcoins be set for significant gains?Altcoin Market Chop: Just a Pause Before the Surge?Why the Chop Isn’t a Cause for ConcernLooking Ahead: What’s Next for Altcoins?