Will Bitcoin and Ethereum Experience a Shift in Q2 Amid Declining Retail Adoption?

The cryptocurrency landscape faces pivotal challenges as Bitcoin and Ethereum navigate a phase of declining retail adoption, leaving investors questioning the outlook for Q2.

-

Despite expectations for a traditional Q1 bull run, both Bitcoin and Ethereum have reported significant drops in retail participation, evident from reduced network activity.

-

Analysts are contemplating whether Q2 will signal the beginning of a more profound corrective cycle amidst shifting dynamics in institutional holdings.

As Bitcoin and Ethereum confront declining retail interest, will institutional trends dictate the cryptocurrency market’s fate in Q2? Find out in our analysis.

Understanding the Dynamics: Bitcoin and Ethereum’s Adoption Trends

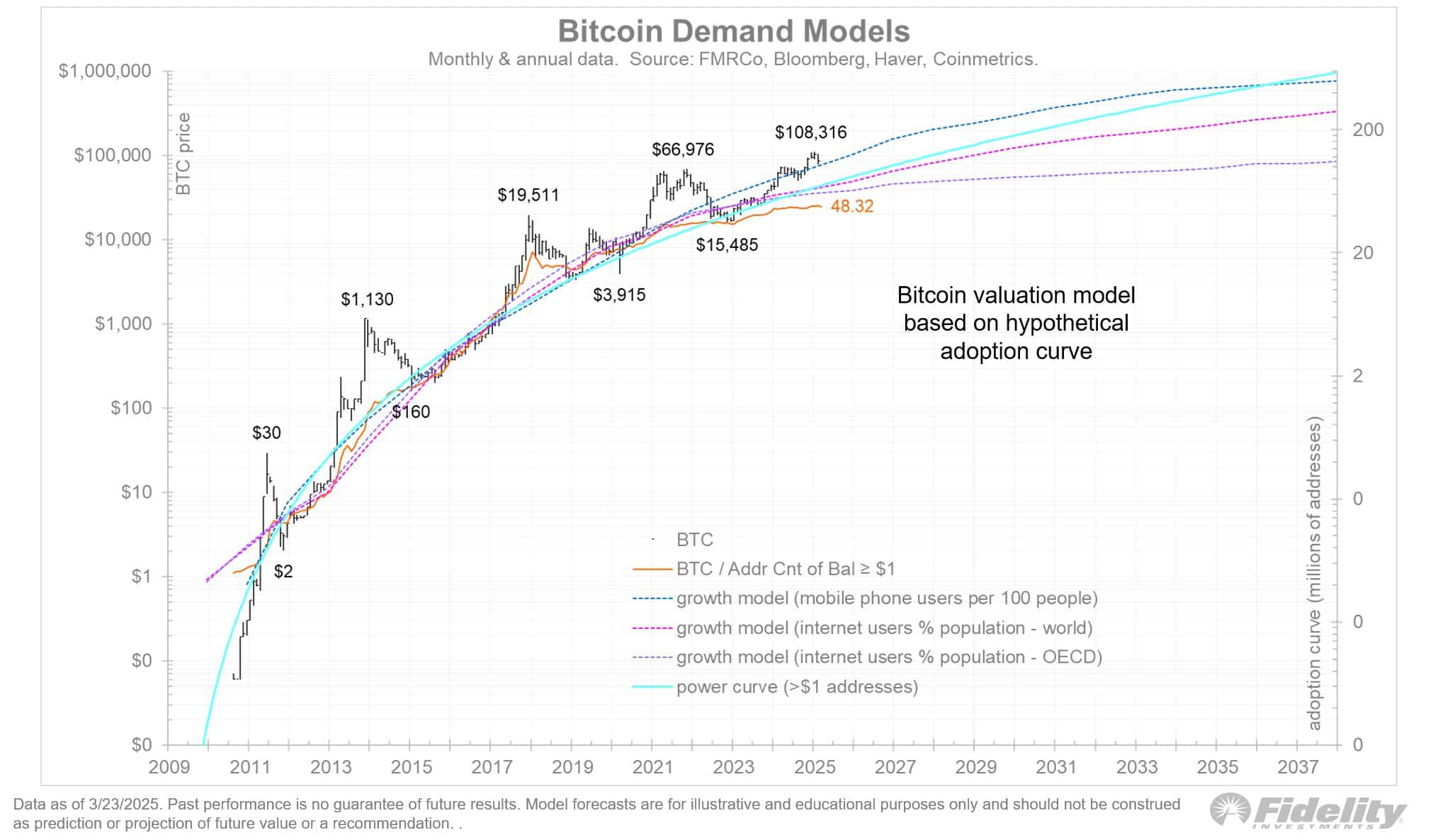

The recent statistics reveal a concerning trend: both Bitcoin and Ethereum are experiencing a stagnation in network adoption. This drop is characterized by a decrease in unique wallets and active addresses, particularly among those holding more than $1. This phenomenon reflects a consolidating grip of institutional players over retail investors.

Institutional Influence: The Rise of High-Value Wallets

In essence, large-scale entities such as MicroStrategy (MSTR) have significantly concentrated their holdings. With major assets pooled into fewer wallets, there is a diminishing need for broader participation from retail investors. This fundamental shift suggests a recalibration of market dynamics, reinforcing the notion that the crypto market may be increasingly influenced by institutional rather than retail sentiment.

Source: Fidelity Investments

Market Reactions: The Impact of Institutional Outflows

The market’s reaction to institutional dynamics has been notable, particularly evidenced by Bitcoin’s significant price movements. For instance, the recent decline in Bitcoin’s price, attributed to ETF outflows, has raised concerns among investors about the sustainability of the current cycle. On February 25th, a net outflow of $1.4 billion from Bitcoin ETFs catalyzed a rapid price drop of over 5% within just a day.

Similarly concerning, Ethereum’s ETFs have struggled to gain traction, leading to a pattern of persistent selling pressure. The effects of such institutional movements underscore the importance of understanding the broader economic factors influencing the market.

Source: TradingView (ETH/USDT)

Evaluating Future Trends: Will Q2 Deliver a Bullish Turnaround?

As the second quarter progresses, the question remains: can Bitcoin and Ethereum overcome the obstacles presented by declining retail adoption and institutional outflows? Recently, Bitcoin’s price briefly reclaimed $88k, buoyed by a surge in ETF inflows, while MicroStrategy notably acquired an additional 6,911 BTC for $584 million.

Ethereum’s recent attempts to approach $2,000 also signal potential recovery, yet underlying issues related to network adoption persist. The prolonged stabilization phase, combined with dwindling institutional inflows, indicates a period of caution.

Conclusion

In summary, while Bitcoin and Ethereum have shown moments of resilience, the road ahead appears fraught with uncertainty. The lack of widespread retail participation alongside the shifting influence of institutional entities may create headwinds for a robust Q2 rally. With macroeconomic factors continuing to play a significant role, stakeholders should proceed carefully.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why PepeX could be a good pick as Stellar (XLM) price consolidates

If you wanna mining Bitcoin at home, Canaan’s new Avalon Q Brings the noise (or lack of it)

Ethereum Drops to $1,874: Are Bears Pushing for a Breakdown Below Key Support?

SUI Surges 6% This Week: A Sign of Bullish Momentum or Just the Beginning?