Bitget Daily Digest (March 27) | U.S. Senate votes to repeal DeFi broker rule, Hyperliquid faces on-chain short position crisis

Bitget Research2025/03/27 10:49

By:远山洞见

Today's preview

1. U.S. initial jobless claims (March 22): The report for the week ending March 22 will be released today. Previous value: 223,000.

2. U.S. Real GDP annualized QoQ Final (Q4): The final figure for Q4 Real GDP will be released today. Previous value: 2.3%

3. Yield Guild Games (YGG): Approximately 14.08 million tokens will be unlocked, representing 3.28% of the circulating supply, valued at around $3 million.

4. GRASS Airdrop One claim period has ended.

Key market highlights

1. St. Louis Fed President James Bullard commented on Wednesday that the ongoing tariff hikes under the Trump administration could result in a "secondary effect,"

raising potential price levels and compelling the Federal Reserve to maintain higher interest rates for a longer period. He forecasts that the inflation target will likely be delayed until 2027 and emphasized that if inflation expectations spiral out of control, the Fed may prioritize price stabilization, even at the expense of employment. This view contrasts with Chairman Powell's earlier stance on inflation being "temporary", further raising market speculation that rate cuts may be delayed.

2.

Hyperliquid faces on-chain short position crisis. Its protocol encountered significant issues after a whale opened a massive short position on JELLY, causing its price to skyrocket and trigger liquidation. As a result, Hyperliquid's protocol treasury was forced to take on short positions, incurring significant unrealized losses. The community interpreted the listing of JELLY perpetual contracts on centralized exchanges as a "sniping" attempt. In response, Hyperliquid urgently delisted JELLY and pulled the plug by liquidating all open positions that night, settling at a price well below the market value. Hyperliquid later announced full compensation for affected users, which sparked widespread skepticism about the platform's decentralization.

3. Grayscale Research has released its top 20 cryptocurrency asset rankings for Q2 2025, introducing three new token categories: $

SYRUP, $

GEOD, and $

IP, representing the tokenization of RWA, DePIN, and intellectual property, respectively. Grayscale noted its focus for the quarter would be on non-speculative blockchain applications in the real world.

4. The controversy over market maker practices continues to grow, with several projects initiating token buybacks. Monitoring data reveals that the $

GPS repurchase progress is approximately 0%, with the token price increasing by 4.19% since March 23; the $

SHELL repurchase progress is 81.12%, with an 8.07% increase since March 13; and the $

MOVE repurchase progress is 14.31%, with the token price surging by 31.62% since March 25. MOVE's leading gain may be attributed to its large buyback amount and concentrated operations.

5.

The U.S. Senate passed a resolution by a 70-28 vote to repeal the crypto tax regulations introduced during the Biden administration. The bill will now be sent to President Trump for signature. These rules required certain DeFi industry participants to operate like traditional securities brokers, including collecting and reporting user transaction data. They also required the issuance of 1099 tax returns to customers, reporting non-employment income such as gambling profits, rent, and royalties. White House crypto advisor David Sacks has stated that senior advisors will recommend the President sign the bill, marking Trump's first crypto-related legislation.

Market overview

1. $BTC has experienced short-term fluctuations, with the broader market showing a downward trend. Smaller tokens, such as $JELLY, surged and then rapidly declined following the Hyperliquid issue. Tokens being voted on for listing, like $MUBARAK and $SIREN, also saw short-term declines.

2. The Nasdaq fell 2%, with Nvidia dropping nearly 6% and Tesla losing over 5%. Chinese tech stocks rebounded, while copper prices reached new highs. Trump announced a 25% tariff on cars not made in the U.S., causing a drop in U.S. auto stocks after hours.

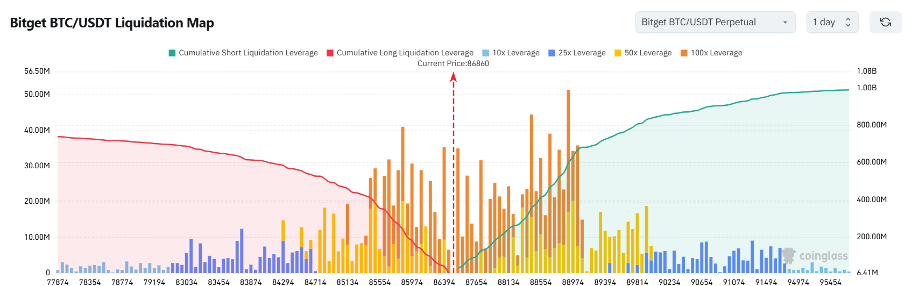

3. Currently standing at 86,860 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 85,860 USDT could trigger

over $241 million in cumulative long-position liquidations. Conversely, a rise to 87,860 USDT could lead to

more than $155 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

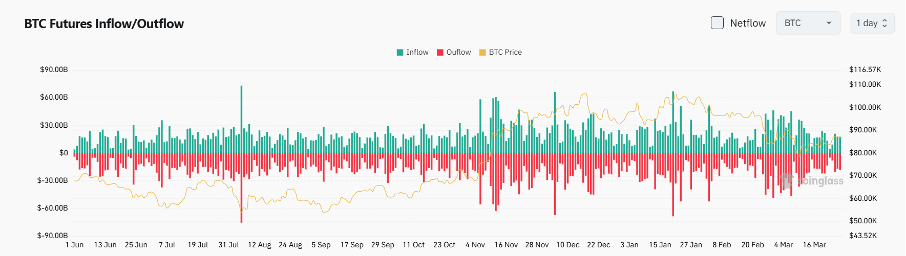

4. Over the past 24 hours, the BTC spot market recorded $17.7 billion in inflows and $18.4 billion in outflows, resulting in a

net inflow of $700 million.

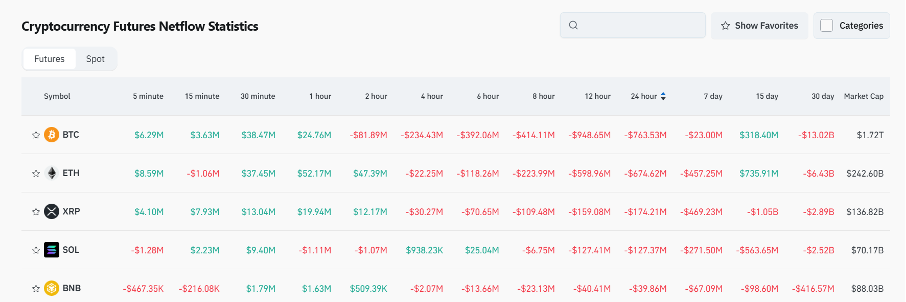

5. In the last 24 hours, $BTC, $ETH, $XRP, $SOL, and $BNB led in

net outflows in futures trading, signaling potential trading opportunities.

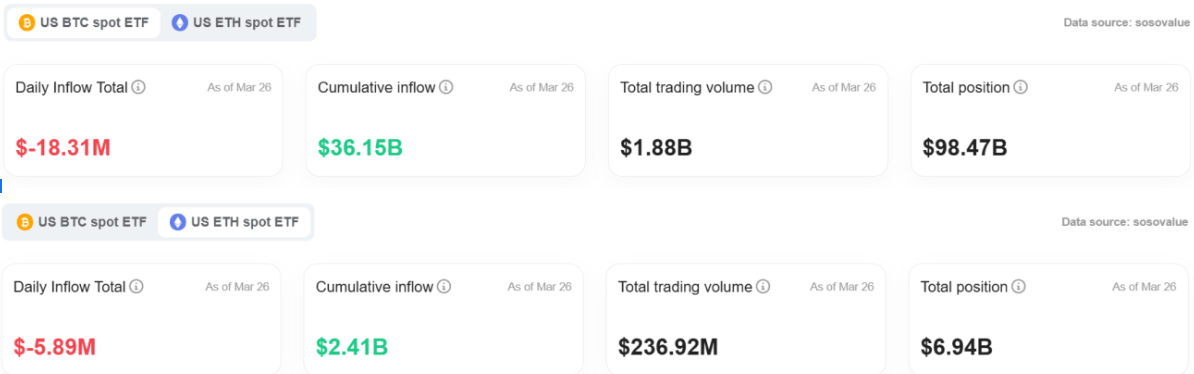

6. According to the latest data from SoSoValue, U.S. spot Bitcoin ETFs recorded a single-day outflow of $18.3157 million, while the cumulative inflows amount to $36.144 billion, with total holdings at $98.47 billion. U.S. spot Ethereum ETFs saw a single-day outflow of $5.8939 million, with cumulative inflows of $2.409 billion and total holdings of $6.935 billion.

Institutional insights

K33 Research: The recent "

Liberation Day"

tariff news could increase crypto market volatility. Traders remain cautious, adopting a risk-averse stance.

Read the full article here:

https://www.theblock.co

Bernstein: Strategy is expected to double its BTC holdings in the future, with a stock price target of $600.

Article:

https://www.theblock.co

Matrixport: Bitcoin tests key downtrend line as bullish flag pattern takes shape

News updates

1. Trump says there will be "flexibility" on his reciprocal tariff plan.

2. The U.S. House of Representatives to release a revised version of crypto market structure legislation.

3. Google Play blocks access to 17 unregistered crypto exchanges in South Korea

Project updates

1. GameStop offers $1.3 billion in convertible notes, with net proceeds expected to be used for acquiring Bitcoin.

2. The WalletConnect community votes to approve the WCT Transferability proposal.

3. ZKsync to carry out the v26 upgrade, during which deposits and withdrawals to the Elastic Network will be temporarily unavailable.

4. Pump.Fun's total revenue exceeds $600 million, with the number of participating addresses surpassing 15 million.

5. Monad announces that early X account followers will receive a commemorative soulbound NFT.

6. Movement repurchases 10 million MOVE tokens, valued at $5.44 million.

7. Wyoming stablecoin WYST enters a critical testing phase, with the governor anticipating a potential launch in July 2025.

8. Kaito AI plans to start a KAITO rewards program in April, distributing $sKAITO to the top 50 Yappers and top 50 emerging Yappers.

9. Custodia Bank and Vantage Bank launch the first U.S. bank-issued stablecoin Avit on Ethereum.

10. Hyperliquid states that the committee has voted to delist JELLY, and promises to compensate affected users fully.

Highlights on X

1. @CyberPhilos: JellyJelly's siege on HLP: A crypto version of Soros' shorting strategy

The market manipulators behind $JellyJelly flooded HLP with a wave of short positions, creating the illusion that they were about to force HLP shorts into liquidation. This triggered panic withdrawals, ultimately causing a self-fulfilling liquidation spiral — a move straight out of Soros' legendary playbook when he shorted the British pound. Once futures for the token went live on exchanges, the manipulators shifted their strategy, using volatility to drive the price up and down repeatedly, capturing profits from both retail and whale traders alike. As for me, I positioned myself by holding Hyperliquid's liquidated assets and executing a Long Gamma strategy — betting purely on volatility itself. That's how I profited from this reflexive game of market expectations.

2. @CycleStudies: Bitcoin rebounds, with some altcoins showing oversold opportunities

With Bitcoin rebounding and Ethereum stabilizing, several altcoins are beginning to break out of oversold patterns, presenting short-term rebound opportunities. By analyzing the weekly charts, two types of tokens are currently worth watching: those that have fallen back to their previous lows and those showing clear oversold signals, such as #MEW, #JUP, #AXL, #SUI, #AAVE, #TAO, #SUPER, and #ENJ. These opportunities fall under a left-side trading strategy and do not indicate a confirmed trend reversal. Traders are advised to take smaller positions with wider stop-loss ranges. A maximum position size of 10,000 USDT is recommended, with a target rebound of 50%. If you're not confident in selecting tokens or setting stop-losses, it's safer to focus on BTC and ETH, which offer a more stable trading experience for most participants.

3. @Chris_Defi: This year is about breaking even, not chasing new narratives

There's no real "new narrative" or major bull cycle in the market this year — the main theme is breaking even, especially for those still holding heavy bags of altcoins. While a rebound might occur in April or May, most projects are unlikely to return to previous highs. Even major coins outside of Bitcoin are struggling to escape their fleeting moments of hype. This cycle feels more like punishment for the so-called "diamond hands." Those who made real profits were the ones who got the timing right, not necessarily the ones who held the longest. What hurts the most isn't missing out on profits — it's making gains only to give them all back. That kind of self-doubt is the most damaging. Many people underestimate the role of luck in this game. Sometimes luck outweighs effort, and sometimes timing outweighs luck. It's not just about having the right strategy — it's about doing the right thing at the right time.

4. @kiki520_eth: The ultimate battle for on-chain access and the immense potential of UniversalX and Particle Network

UniversalX is the front-end application built on Particle Network's chain abstraction technology, offering users a CEX-like trading experience on the blockchain. It is one of the most promising products in the ongoing battle for control over on-chain access. As on-chain ecosystems become the primary source of both assets and liquidity, controlling the transaction access point means controlling future value distribution. Whether it's cross-chain trading, derivatives, token launches, wealth management, or IDOs, UniversalX is positioned to provide a seamless, all-in-one solution. Through continuous user experience optimization, it's shaping up to become the most powerful combination of on-chain portal and infrastructure distribution network. PARTI is the core governance token of this ecosystem, with long-term potential that some believe could rival BNB.

8

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Why PepeX could be a good pick as Stellar (XLM) price consolidates

Coinjournal•2025/03/30 22:33

If you wanna mining Bitcoin at home, Canaan’s new Avalon Q Brings the noise (or lack of it)

Kriptoworld•2025/03/30 22:33

Ethereum Drops to $1,874: Are Bears Pushing for a Breakdown Below Key Support?

CryptoNews•2025/03/30 22:22

SUI Surges 6% This Week: A Sign of Bullish Momentum or Just the Beginning?

CryptoNews•2025/03/30 22:22

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$81,464.91

-1.95%

Ethereum

ETH

$1,796.59

-2.18%

Tether USDt

USDT

$1.0000

+0.03%

XRP

XRP

$2.08

-4.83%

BNB

BNB

$600.34

-1.61%

Solana

SOL

$124.51

-1.33%

USDC

USDC

$1

+0.02%

Dogecoin

DOGE

$0.1643

-3.87%

Cardano

ADA

$0.6497

-4.68%

TRON

TRX

$0.2331

+1.37%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now