Research Report | Particle Network Project Analysis & PARTI Market Valuation

I. Project Introduction

Particle Network is a Web3 chain abstraction infrastructure provider focused on addressing the fragmentation of multi-chain assets and accounts. Through Universal Accounts, it enables a seamless user experience with "one account, any chain, unified balance." The launch of its mainnet marks the transition of chain abstraction from theory to real-world application.

Particle Network’s architecture is built around three core modules: Universal Accounts, Universal Liquidity, and Universal Gas, all running on a high-performance, EVM-compatible modular chain built with the Cosmos SDK. This framework allows users to interact, make payments, and trade across multiple blockchains using any token—without the need to create multiple wallets or hold native tokens. Cross-chain transactions are executed via a distributed relay and bundler node network, while the platform supports Account Abstraction (AA) features, including gas-free transactions and auto-authorization.

Currently, Particle Network is integrated with major ecosystems such as Arbitrum, zkSync, Berachain, and Avalanche. Its native token, PARTI, functions as both the settlement and governance asset on the network. The team, consisting of over 30 members, has secured over $25 million in funding from top-tier investors, including Binance Labs, Spartan Group, HashKey, and Animoca. As chain abstraction gains real-world adoption, Particle Network is positioning itself as the leading standard for the "unified account layer" in this emerging sector.

II. Project Highlights

1. Universal Accounts: A Unified Entry Point for Users and Assets

The Universal Accounts system is Particle Network’s flagship innovation. Built on ERC-4337 and Particle’s proprietary cross-chain architecture, it enables users to manage balances and execute transactions across multiple chains in a unified manner. With just one login, users can access all their assets across various dApps without needing to create multiple wallets or transfer funds manually.

2. Pay Gas with Any Token, Removing Native Token Barriers

The Universal Gas module allows users to pay gas fees on any blockchain using any token, eliminating the need to acquire native assets like ETH, SOL, or MATIC just for transaction fees. The system automatically processes these payments through Particle’s native Paymaster contract, enhancing accessibility and convenience.

3. Modular Architecture for Scalability and Security

Particle L1 is built with the Cosmos SDK, featuring a modular execution framework and aggregated data availability (DA) architecture. It integrates with Celestia, Avail, Near DA, and other DA solutions to eliminate single points of failure, bolster network stability, and improve scalability. Additionally, it employs a dual-staking model incorporating BTC and PARTI to further enhance network security.

4. Strong Backing from Top Investors & Rapid Ecosystem Growth

Particle Network has raised over $25 million from leading venture firms, including Binance Labs, Spartan Group, HashKey, and Animoca. It has also formed partnerships with key blockchain ecosystems such as Arbitrum, zkSync, Avalanche, and Berachain, driving strong network effects and adoption in the chain abstraction sector.

III. Market Valuation

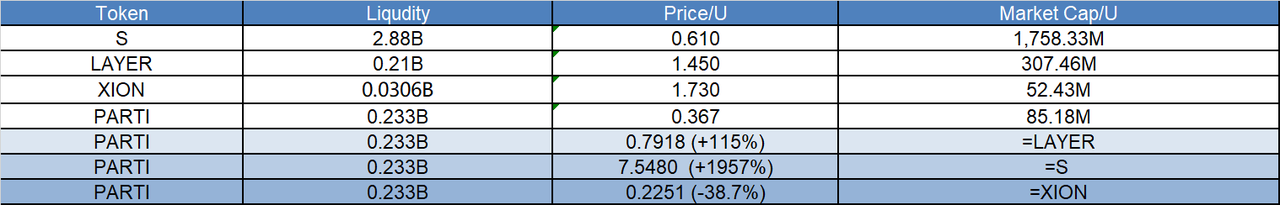

PARTI is the native token of the Particle Network mainnet. As the settlement asset for Web3 chain abstraction, it plays a vital role in unifying accounts, liquidity, and gas payments, reducing barriers to multi-chain interactions. The project is currently in an early-stage expansion phase, with increasing developer integrations and cross-chain collaborations. As the chain abstraction narrative gains momentum, PARTI’s valuation could align with similar Layer-1 blockchain projects.

- Current PARTI price: $0.3670

- Circulating supply: 0.233 billion tokens

- Circulating market cap: ~$85.18M

If the ecosystem continues expanding and attracts more developers and blockchain integrations, PARTI’s market valuation has significant growth potential.

IV. Tokenomics

PARTI Total Supply: 1 billion tokens

Initial Circulating Supply:

- 233 million PARTI (23.3% of total supply)

Token Allocation:

- Community Growth (40%) – 400,000,000 tokens, with 9% distributed via an initial airdrop, and the remainder released gradually.

- Private Sale (24.39%) – 243,900,000 tokens, initially locked and released over multiple years.

- Team & Advisors (12.11%) – 121,100,000 tokens, subject to long-term linear vesting to align with project incentives.

- IDO (5%) – 50,000,000 tokens, launched via Binance Wallet.

- Liquidity (5%) – 50,000,000 tokens, allocated at TGE for market-making and stability.

- Binance HODLer Airdrop (6%) – 60,000,000 tokens, distributed in two rounds to long-term BNB holders.

- Binance Wallet Airdrop (1%) – 10,000,000 tokens, distributed at TGE to attract wallet users.

- KOL Round (1.5%) – 15,000,000 tokens, partially unlocked at TGE, with the remainder vesting over time.

- Reserve (5%) – 50,000,000 tokens, allocated for future ecosystem expansion and strategic use.

Token Utility:

- Gas Settlement: Transactions through Universal Accounts are settled in PARTI, ensuring ongoing demand regardless of which token is used for gas payments.

- Universal Gas Payments: Users can pay gas fees on any chain with any token, which is then automatically converted to PARTI for settlement, eliminating gas token fragmentation and improving user experience.

- Cross-Chain Functionality: As the settlement layer for chain abstraction, PARTI enables Universal Accounts to maintain unified balances across multiple chains.

- Auto-Conversion Mechanism: A portion of transaction gas fees is automatically converted into PARTI, allowing users to interact with the network without needing to hold PARTI directly.

- Ecosystem Incentives & Governance: As the network’s native asset, PARTI will be used for governance, staking, and incentive mechanisms, with potential future utilities including governance rights, priority access to ecosystem programs, and premium features.

V. Team & Fundraising

Team Information:

Particle Network’s core team consists of four key members:

- Pengyu Wang – Founder & CEO

- Tao Pan – Co-Founder & CTO

- Ethan Francis – Head of Developer Relations

- Lydia Wu – Researcher

The team is dedicated to building Web3 chain abstraction infrastructure, accelerating the adoption of a multi-chain environment.

Fundraising History:

Particle Network has successfully raised over $25 million in multiple funding rounds:

- Series A: $15 million, expected to conclude on June 20, 2024. Investors include Spartan Group, gumi Cryptos Capital, SevenX Ventures, Morningstar Ventures, HashKey Capital, UOB Venture, MH Ventures, SNZ Holding, Flow Traders, Alibaba, FOMO Ventures, and notable individuals such as dingaling, Alex Krüger, Zeneca, OxSun, Altcoin Sherpa, SalsaTekila, and SpiderCrypto.

- Strategic Round (April 14, 2023): Led by Cobo Ventures.

- Pre-Seed Round (May 5, 2022): Raised $30 million, backed by LongHash Ventures, Mask Network, Cyber, Insignia Ventures Partners, and Monad.

VI. Potential Risks

- High Airdrop Allocation – With 23.3% of tokens initially circulating, inadequate user retention and conversion could trigger early sell-offs, leading to significant price volatility. The community airdrop (9% of total supply) may exert downward pressure if recipients engage in speculative selling rather than long-term participation.

- Limited Direct Token Utility for Users – Since PARTI primarily functions as a backend settlement asset (e.g., gas conversion, Paymaster transactions), most end users don’t directly interact with it. Unlike tokens with strong user incentives (e.g., fee discounts or staking rewards), PARTI may face challenges in maintaining long-term demand beyond speculation.

VII. Official Links

- Website: https://particle.network/

- Twitter: https://x.com/ParticleNtwrk

- Discord: https://discord.com/invite/particlenetwork

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ARK Invest Raises 2030 Bitcoin Price Target to as High as $2.4M in Bullish Scenario

XRP News: What's on May 19 for XRP?

ADA Explodes Past $0.70 — What Now?

PEPE Dips Slightly – But Whales Are Still Accumulating. Should You Follow?

Pepe's funding rate has risen strongly in the past couple of days, one of several signals that more gains are coming.