Meme Coin Comeback? TRUMP Bounces 11% – What This Could Mean for the Entire Market

Donald Trump’s meme coin, TRUMP, rallied over the weekend after the former President posted a now-viral endorsement on Truth Social.

Declaring “I LOVE $TRUMP — SO COOL!!!,” Trump’s enthusiastic support drove a 11% price jump, taking the coin from $10.93 to a peak of $12.24.

While prices later stabilized around $11.85, the trading frenzy was unmistakable. Daily volume exploded 288% to $1.22 billion, temporarily positioning the coin as the most traded meme coin on the market.

This isn’t the first time a celebrity-backed crypto asset has seen explosive gains. Yet, the sharp uptick in trading activity has reignited debate over the longevity of such tokens.

Since peaking at $73.40 in January, $TRUMP has remained in a prolonged downtrend, with this latest rally offering only a temporary reprieve.

Meanwhile, broader market sentiment improved on reports that the coin may ease planned tariff policies ahead of the April 2 announcement.

Bloomberg and WSJ sources indicated potential sector-specific exemptions, triggering a mild risk-on reaction in both equities and digital assets.

Centralization and Token Unlock Concerns; TRUMP Update

Despite the short-term surge, long-term structural concerns persist around $TRUMP. On-chain data reveals that 94% of the total token supply is held in just 40 wallets, raising red flags about price manipulation and the potential for coordinated sell-offs.

Adding to investor unease is the scheduled unlocking of 40 million tokens on April 18. Should large holders begin liquidating, it could trigger significant downward pressure on the coin’s price.

Political scrutiny is also intensifying. Democratic Congressman Sam Liccardo has proposed the MEME Act, a bill aimed at preventing federal officials and their families from profiting off meme coins. While the bill does not name Trump directly, it reflects growing concern over the use of personal influence in financial markets.

Key Risks to Monitor:

- 94% of supply held by top 40 wallets

- April 18 unlock of 40 million tokens

- Regulatory pressure via proposed MEME Act

- Token still down over 80% from January peak

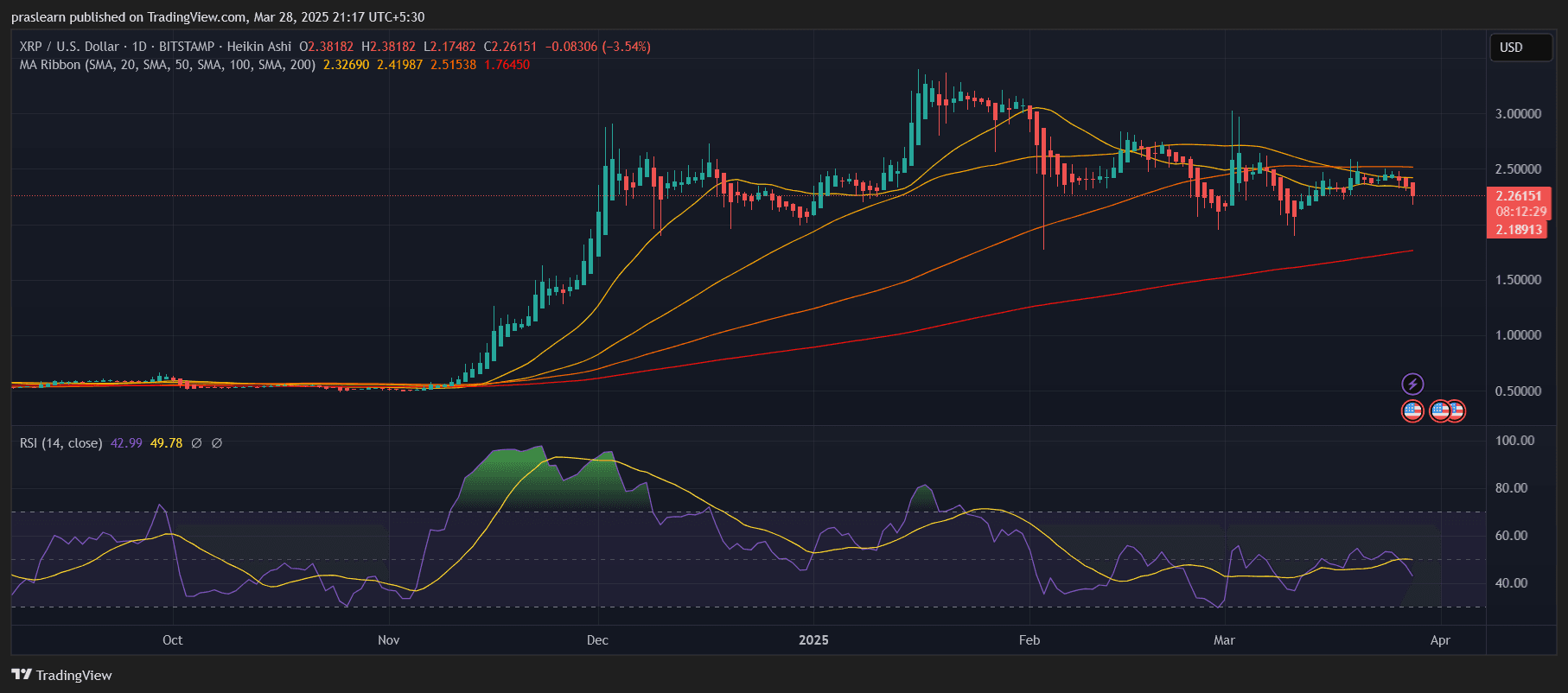

TRUMP/USDT Price Tests Key Resistance at $12.54

Technically, TRUMP/USDT is consolidating just below a key resistance level of $12.54, where a descending trendline and horizontal resistance intersect. The token is currently trading at $11.58, hovering above its 50-period EMA at $11.39 on the 4-hour chart.

Price momentum appears neutral for now, but the tightening range within a descending wedge pattern could indicate a breakout is nearing.

- Upside Levels to Watch: Breakout above $12.54 could target $13.90 and $15.22

- Downside Risk Zones: Support at $10.71 and further breakdown could test $9.57

Until a decisive breakout occurs, traders should remain cautious, especially with broader macro and token-specific risks on the horizon.

Conclusion; TRUMP Remains Highly Speculative

Trump’s viral endorsement offered $TRUMP a short-term jolt, sparking a wave of speculative buying. However, the coin’s long-term trajectory remains clouded by centralization risks, an imminent token unlock, and emerging political scrutiny.

While additional rallies may occur on the back of sentiment or political developments, the underlying fundamentals suggest that $TRUMP remains a highly speculative asset—better suited for short-term traders than long-term holders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Rivals Poised for Massive Gains—Turn $100 Into $10K Before Q2 Ends

Movement (MOVE) Price Gains 27% as Accumulation Builds and Bullish Momentum Takes Over

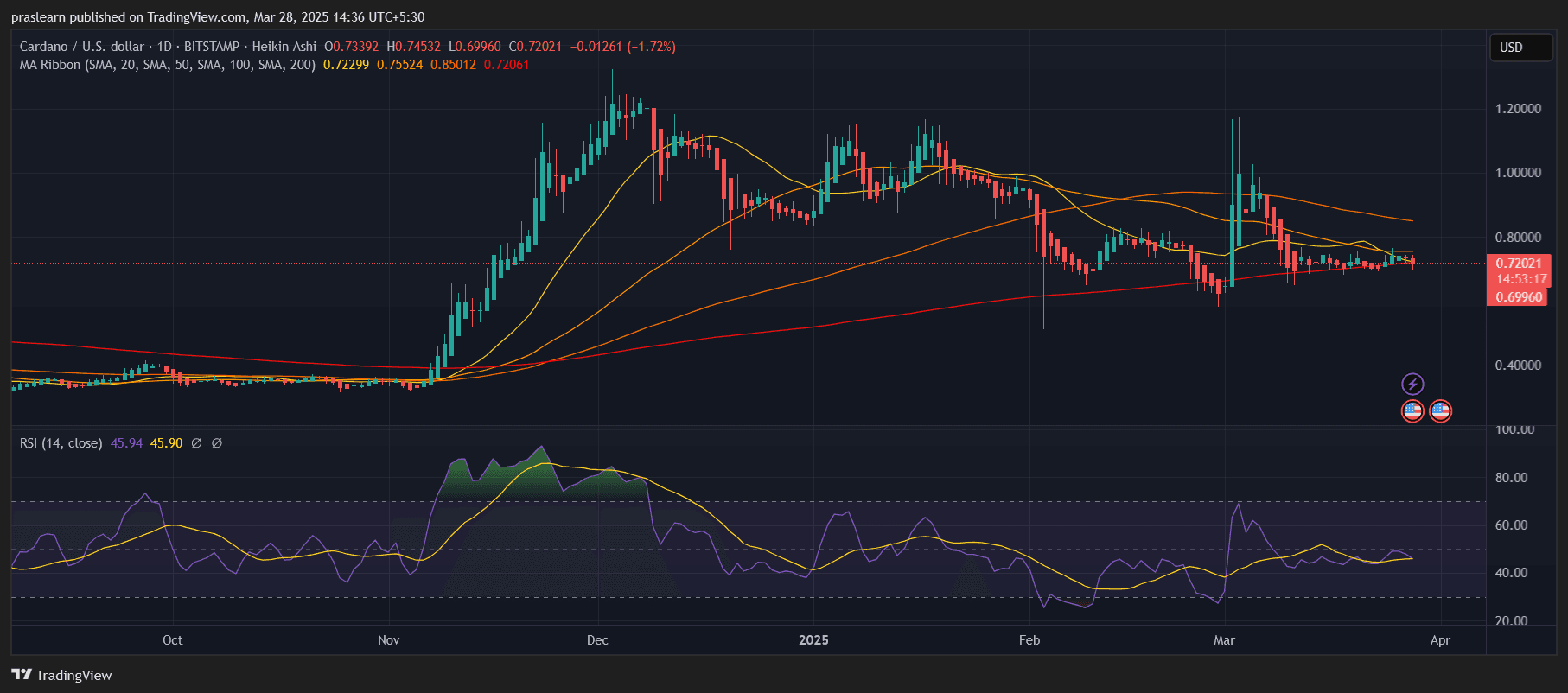

Cardano Aiming for $10? Big Move Coming?

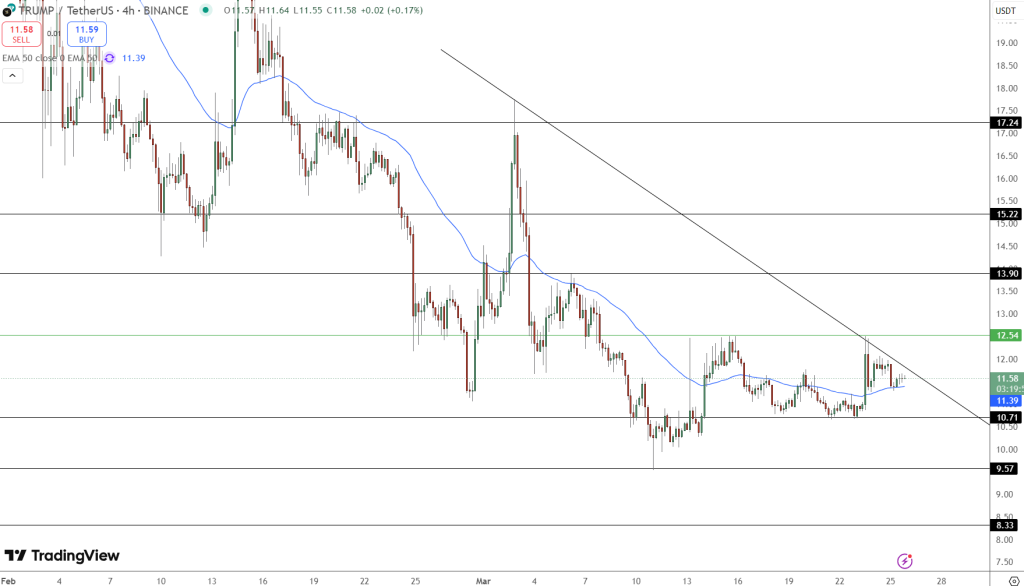

Will XRP Crash? Here’s What the Chart Is Warning Us About