Bitget Daily Digest (March 25) | Oklahoma House of Representatives passes a strategic Bitcoin reserve bill, Dogecoin Foundation establishes official reserves

远山洞见2025/03/25 09:12

By:远山洞见

Today's preview

1. The U.S. January FHFA House Price Index (MoM) will be released today, with the previous value at 0.40%.

2. FOMC permanent voting member and New York Fed President John Williams will deliver opening remarks at an event.

3. AltLayer (ALT) unlocks approximately 240 million tokens, representing 8.6% of the circulating supply, valued at around $9.8 million.

4. Venom (VENOM) unlocks approximately 59.26 million tokens, representing 2.9% of the current circulating supply, valued at around $7 million.

Key market highlights

1.

The Oklahoma House of Representatives has passed a bill to establish a strategic Bitcoin reserve, allowing the state to allocate up to 10% of public funds to Bitcoin or any digital asset with a market cap over $500 billion. Meanwhile, Kentucky has officially signed HB701, known as the Bitcoin Rights of Bill, safeguarding residents' rights to use digital assets, self-custody wallets, and run blockchain nodes.

2. The Dogecoin Foundation has established an official Dogecoin reserve via its newly formed commercial entity and has purchased the first batch of

10 million DOGE at current market prices. Its commercialization partner, House of Doge, plans to unveil its first batch of strategic partners in the coming months. Additionally, the Dogecoin Foundation will collaborate with major sporting events to promote Dogecoin and educate users on self-custody wallets.

3. US-based

Ethereum ETFs have just seen their longest streak of daily outflows since launch. According to Bloomberg, nine ETFs recorded net outflows for 13 consecutive days, totaling around $415 million. In contrast, US-based

Bitcoin ETFs have shown

signs of recovery following a period of weakened investor demand.

4. U.S. President Donald Trump has announced plans to impose tariffs on imported cars in the coming days. He also stated that some countries will receive exemptions from the reciprocal tariffs starting next week. Additionally, he posted on social media

that a 25% tariff will be imposed—effective April 2—on countries purchasing oil or gas from Venezuela, opening another front in the global trade war.

Market overview

1. BTC briefly hit $88,000 before a short-term pullback, with the broader market showing mixed trends. Tokens related to

AI agents—such as $ARC, $BUZZ, and $ALCH—saw sharp gains, emerging as the standout sector. Meanwhile, hot BSC projects like $BUBB have begun to retrace.

2. U.S. equities posted gains for a second consecutive day. The Nasdaq rose over 2%, with Tesla surging nearly 12% — its biggest single-day jump since the day after the election. AMD also rose 7%, while crude oil climbed more than 1% to a new monthly high.

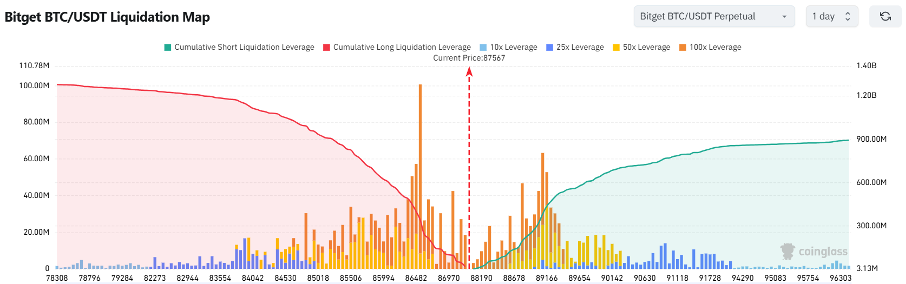

3. Currently standing at 87,567 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 86,567 USDT could trigger

over $342 million in cumulative long-position liquidations. Conversely, a rise to 88,567 USDT could lead to

more than $94 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

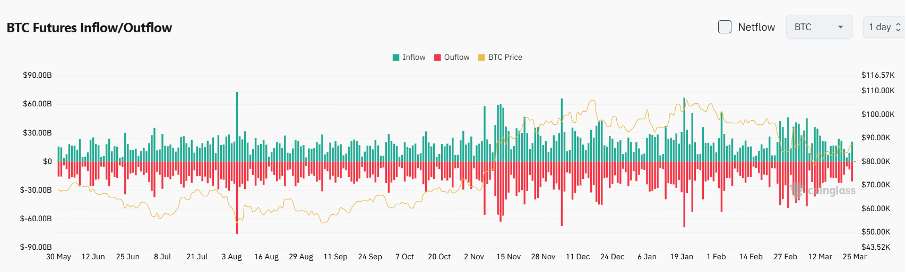

4. Over the last 24 hours, BTC spot saw $20.9 billion in inflows and $20.6 billion in outflows, resulting in

a net inflow of $300 million.

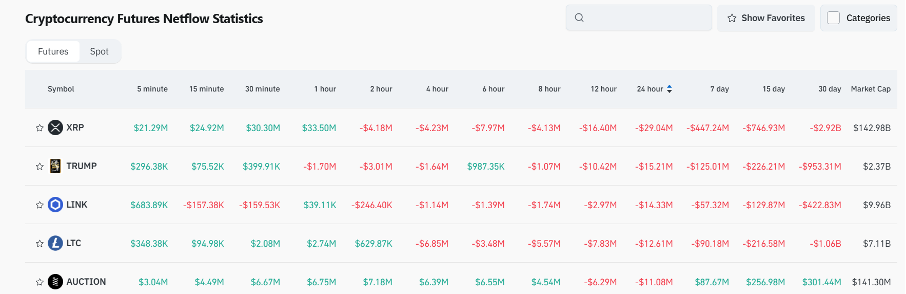

5. Over the last 24 hours,

$XRP, $TRUMP, $LINK, $LTC, and $AUCTION led in

net outflows in futures trading, signaling potential trading opportunities.

Institutional insights

CryptoQuant: The bull market score remains relatively low. A breakout above 60 could mark the beginning of a sustained BTC rally.

Greeks.live: $90,000 is currently the key resistance level for BTC. Market sentiment remains broadly bearish.

Bernstein: Coinbase is expected to take the fight back to Binance, with a wave of MA activity sweeping across the crypto landscape.

News updates

1. Fed's Bostick expects only one rate cut this year, down from the previous forecast of two.

2. U.S. President Donald Trump may grant tariff exemptions to many countries.

3. The Oklahoma House of Representatives passes the Strategic Bitcoin Reserve Act.

4. Trump proposes tariffs targeting automobiles, pharmaceuticals, and other industries.

Project updates

1. CZ states that the USD1 stablecoin launched by WLFI is not yet tradable, cautioning the community against scams using the same name.

2.Abu Dhabi's ADGM and Chainlink partner to develop compliant frameworks for tokenized assets.

3. Conflux disclosed that a vulnerability was found in the opcode but the issue has been resolved and no user funds were lost.

4. DefiLlama clarifies that there is a data error in the community circulation of the seven-day DEX trading volume on BNB Chain to have surpassed that of Ethereum.

5. dYdX launches its first $DYDX buyback program, with 25% of the protocol's net fees revenue dedicated to monthly buybacks.

6. Kaito founder: Airdrop based on AI to filter long-term supporters, with a 50% higher holding rate in South Korea.

7. PancakeSwap ranks first in weekly DEX trading volume, with a weekly increase of over 40%.

8. World Liberty Financial (WLFI), backed by President Trump's family, has acquired more MNT tokens amid over $1 million unrealized losses.

9. BNB Chain announces that participating tokens in the $100M Permanent Liquidity Program must be 100% native on BNB Chain.

10. Santiment data shows that $DOGE network activity has dropped to its lowest level since October 2024.

Highlights on X

1. CJ: Predator vs.

prey

: the most sophisticated on-chain game in the Sonic ecosystem

@SheepCoin69 on the Sonic network introduces a highly sophisticated and self-contained game theory model. Players buy sheep with $S, mint a wolf using a sheep plus 100 $S, eat others' sheep with their wolves for yield, and protect their sheep with sheepdogs to generate APY. This creates an ecosystem model where funds self-recycle. The game hinges on the dynamics of deflation and yield between wolves and sheep, player timing, offense-defense plays with multiple accounts, and tactical use of the sheepdog. Unlike Ponzi schemes that rely on constant new inflows, this system leverages preset rules and variables driven by on-chain activities, fostering user strategic interaction and market dynamics.

2. 0xLIZ: Cracking the GMGN metric with on-chain market making: $AGON case study of implicit manipulation and gaming

Taking a closer look at the $AGON project, this deep dive shows how project insiders outmaneuver key tracking metrics such as dev sell and bubble map on platforms like GMGN through techniques like wash trading, multi-address masking, and bundled transactions, to secretly control the distribution of tokens. With cold wallet transfers, coordinated behavior across addresses, and batch transactions in the same block, insiders can quietly shuffle tokens, maintain price control, and avoid attention. The case highlights the cat-and-mouse nature of on-chain data analysis and serves as a warning to memecoin gold diggers: no indicator is foolproof. To protect principal and profit in this PvP-style market, you need to stay adaptive and think like the whales.

3. Lao Bai: ETH vs. Solana —

scaling

race, tech evolution, ecosystem governance, and potential breakthroughs

Ethereum is advancing scalability through two main approaches, Based Rollups (enabling inter-rollup communication via Layer 1 sequencing) and Native Rollups (publishing state witnesses to Layer 1 for a sharding-like architecture). The aim is to improve user experience and eliminate liquidity silos. However, implementation faces technical hurdles and resistance from existing Layer 2 ecosystems. On the Solana side, the SIMD-0228 proposal—although rejected—sparked discussion on using inflation mechanisms to adjust staking rewards dynamically, showcasing strong community governance. Additionally, Solana's token extensions offer chain-level support for privacy, KYC, and SBT for compliant financial assets like RWA. Both Ethereum and Solana are demonstrating their capabilities across scalability, security, and compliance, shaping the next chapter of public chain competition.

4. TraderS: Short-term market outlook

Following last week's QT tapering, U.S. stocks saw a bounce: Dow Jones rose 1.2%, marking its biggest weekly gain in over two months. The SP 500 climbed 0.51%, breaking a five-week losing streak, the longest streak in over a year. The Nasdaq edged up 0.17%, ending a four-week decline. In other words, with tariff policies set to take effect on April 2, we're likely in a short-term recovery phase this week. My strategy is to moderately go long and anticipate BTC reaching $93,000–$95,000.

3

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Why is Dogecoin (DOGE) price up today?

Cointelegraph•2025/03/25 17:55

Bitcoin flips ‘macro bullish’ amid first Hash Ribbon buy signal in 8 months

Cointelegraph•2025/03/25 17:55

ETH price to $1.2K? Ethereum's PoS ‘deflation’ ends with fees at all-time lows

Cointelegraph•2025/03/25 17:55

Bitcoin sets sights on 'spoofy' $90K resistance in new BTC price boost

Cointelegraph•2025/03/25 17:55

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$87,879.2

-0.06%

Ethereum

ETH

$2,064.83

-0.98%

Tether USDt

USDT

$1

+0.01%

XRP

XRP

$2.45

-0.28%

BNB

BNB

$631.86

-0.68%

Solana

SOL

$144.8

+1.93%

USDC

USDC

$1

+0.00%

Dogecoin

DOGE

$0.1899

+2.28%

Cardano

ADA

$0.7469

+1.49%

TRON

TRX

$0.2285

-0.12%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now