RWA TVL Hit a New ATH Above $10B, Amidst UAE Tokenization Revolution

Key Points

- The RWA sector’s TVL surpassed $10 billion, with EthenaUSDtb, BlackRock BUIDL, and Maker RWA leaders.

- The news comes as Dubai takes a bold step with real estate tokenization.

According to the latest reports, the RWA sector continues hitting one ATH in TVL after another. Today, March 21, the TVL of RWA surpassed $10 billion.

This comes after reports show intensifying efforts in emerging tech developments in the UAE.

RWA TVL Topped $10 Billion

DeFi Llama data shows that the RWA sector’s TVL is now almost $10,2 billion.

DeFi Llama dataThe same notes reveal that Maker RWA is sitting at the top spot with almost $1,3 billion in TVL. Maker RWA is a collateral type in the Marker Protocol.

BlackRock BUIDL (the firm’s tokenized fund) is placed in the second position with over $1.23 billion in TVL, and EthENA USDTb takes the third spot with over $1,2 billion in TVL.

Top 3 RWA TVLs – Defi Llama dataOther names in the list with TVLs below $1 billion include Ondo Finance, Usual, Franklin Templeton and more.

The RWA sector’s achievement comes following important related news from Dubai, UAE.

Dubai’s Real Estate Revolution Welcomes Tokenization

According to new reports, Dubai just took a bold step ahead with real estate tokenization. The Dubai Land Dept. (DLD) is launching a pilot project to convert real estate assets into digital tokens on the blockchain.

By 2033, the projections for tokenized properties could reportedly show numbers above $16 billion.

The DLD CEO, Marwan Ahmed Bin Ghalita, reportedly said that by converting real estate assets into digital tokens recorded on the blockchain, tokenization simplifies and enhances more processes including:

- Buying

- Selling

- Investments

The General Director of DLD said that Dubai’s latest move aligns with the DLD’s vision to become a global leader in real estate investment and use technology to develop innovative real estate products.

This move comes as the UAE shows more and more interest in emerging technologies.

UAE’s Rising Interest in Crypto and AI

We recently reported that the US Crypto and AI Czar, David Sacks, who was appointed by President Trump in 2024, met with Sheikh Tahnoon Bin Zayed Al Nahyan to explore emerging technologies:

- The transformative effects of AI across various sectors

- The expanding role of digital currencies in reshaping financial systems

- The investment opportunities emerging at their converges

It was an honor to meet with Sheik Tahnoon to discuss AI and cryptocurrency. https://t.co/MzXOIPox09

— David Sacks (@davidsacks47) March 21, 2025

This follows another event worth mentioning – Abu Dhabi’s MGX recently invested $2 billion in Binance, marking the largest investment in a crypto company, and the crypto exchange’s first institutional investment.

All these moves show that the UAE is set to become a top hub in crypto and emerging technologies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Will Solana Skyrocket if Fidelity Files an ETF?

Ether’s supply shock is coming?

U.S. Spot Bitcoin ETFs Buy $750M in BTC This Week

U.S. Spot Bitcoin ETFs purchased nearly $750M in BTC this week, signaling strong institutional confidence.Institutional Investors Are Doubling DownWhy Are ETFs Buying So Much BTC?What This Means for Bitcoin’s Price

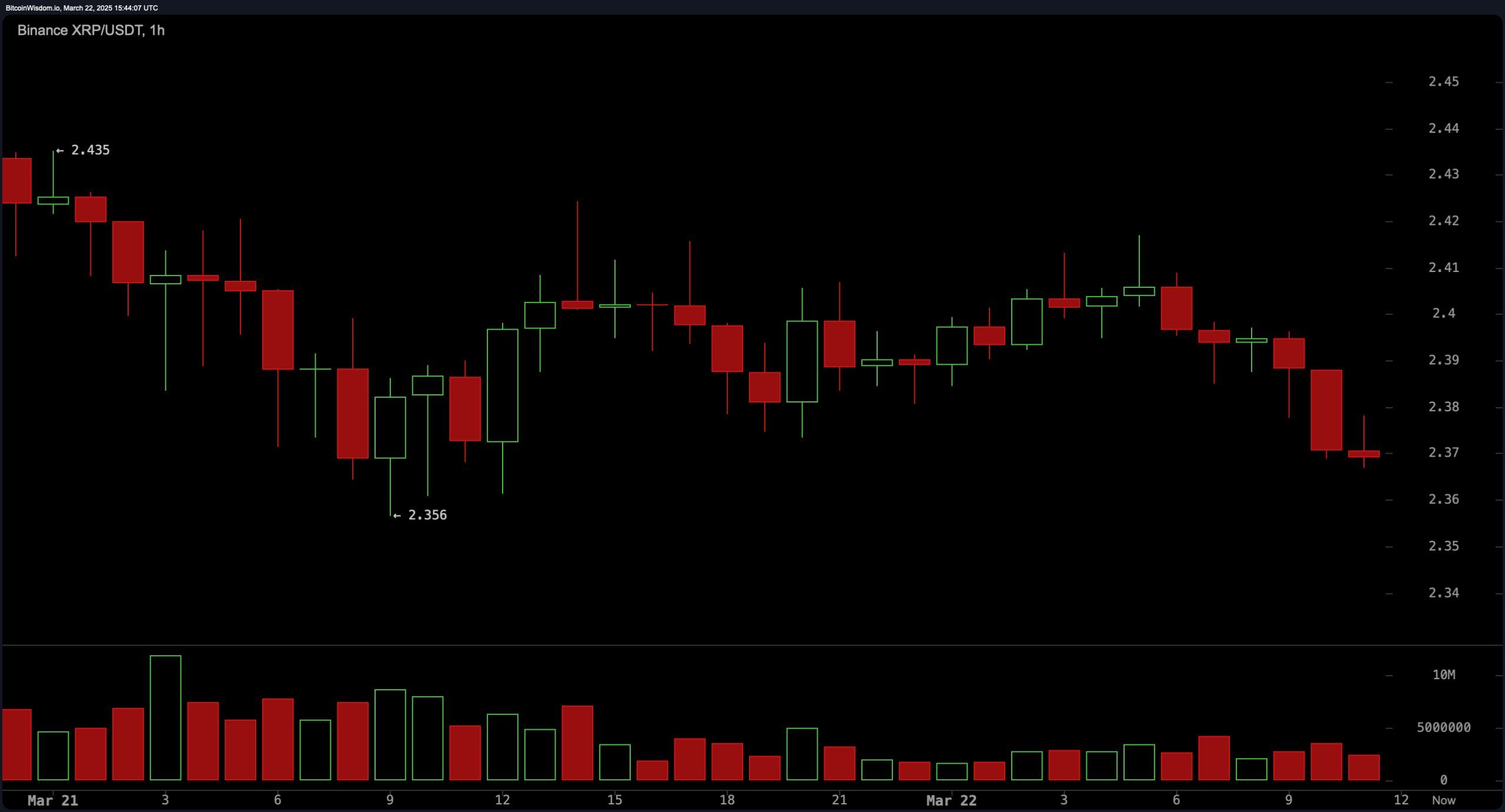

XRP Price Update: XRP Teeters on $2.35 Support—Next Move Critical