Strategic Ethereum Moves by Whale Signal Strong Market Shifts

- A whale acquired 7,074 ETH worth $13.8 million, signaling strong market confidence.

- The whale borrowed 5M USDT from Aave and deposited it into OKX to buy another 2,563 ETH.

- Ethereum’s price fluctuates with large market moves creating high volatility.

A whale made waves in the market by acquiring 7,074 ETH, valued at $13.8 million, in a single day. This move commenced with the withdrawal of 4,511 ETH (approximately $8.81 million) from OKX, followed by a deposit of the funds into Aave, a decentralized lending platform. The series of transactions received a great deal of scrutiny, mostly because Ethereum’s price fluctuated between $1,900 and $2,500.

Strategic Leverage and Liquidity Management

Further bolstering the whale’s position, a 5 million USDT loan was borrowed from Aave and subsequently used for acquiring another 2,563 ETH. This dual-pronged approach deeply explains the whale’s strategic use of leverage, tapping into Aave’s liquidity to capitalize on anticipated price movements within the Ethereum market. By withdrawing and borrowing high amounts from exchanges, the whale positions itself for potential short-term gains, aligning itself with market shifts.

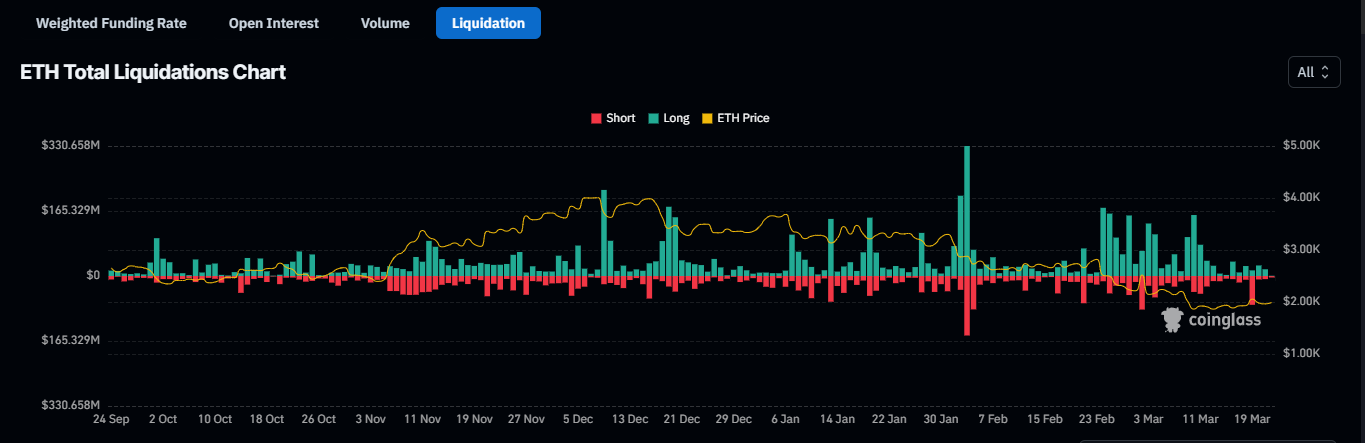

These moves, too, reflect Ethereum liquidation more broadly. According to data from Coinglass, there have been massive fluctuations in long and short liquidation activities, highly correlated with price volatility in Ethereum. Together with the liquidations that the whale calculated, it suggests that these large players are trying to profit from the volatility.

Related: Memereum Price Prediction: Poised to Rival Ethereum?

Market Trends and Liquidation Patterns

The Coinglass liquidation chart illustrates the volatility of Ethereum, showing spikes in long liquidations, particularly in late January and early February, when ETH’s price experienced notable corrections. Conversely, short liquidations remained relatively stable but saw increases during price downturns. This pattern coincides with the whale’s activities, as large players adjust their positions amid price fluctuations, positioning themselves for maximum advantage.

Source: Coinglass

These prices for Ethereum bring wild days, with the latest rate being $1,990.23, showing a 1.34% increase over the last 24 hours. Also, data from CoinMarketCap depicts that the asset was recovering steadily after dipping below $1,950, showing a market sentiment of uncertainty. With a market cap of $240.09 billion and a circulating supply of 120.63 million ETH, Ethereum acts as an old giant within the crypto ecosystem, giving importance to currency fluctuations. The whale’s actions, with the accompanying price variations of the token, demonstrate calculated risk-taking and strategic positioning typical of large market participants especially noted during periods of volatility.

The post Strategic Ethereum Moves by Whale Signal Strong Market Shifts appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Will Solana Skyrocket if Fidelity Files an ETF?

AUCTION's 24-hour decline widened to 60%, temporarily reported at $24.18

Investors are still buying crashing LUNA tokens

BTC breaks through $85,000