AVAX Traders Watch for Signs of Recovery Amid Whales Accumulating and Market Uncertainty

AVAX traders are cautious right now, but might that change soon?

-

Big investors (whales) are buying more AVAX and moving it off exchanges, showing great interest.

-

Chances of a price recovery depend on market activity and investor demand.

Avalanche (AVAX) is under pressure right now, with its price going down on the charts over the last few days. However, even though the altcoin’s price has been dropping, there have been some signs that the market might turn around soon. Needless to say, traders are watching closely to see if AVAX will recover.

At the time of writing, AVAX was priced at $18.71, after falling by 2.13% in the last 24 hours. Over the past week, it has dropped by nearly 10% as more people started selling.

Here, it’s worth noting that the downtrend is still strong right now. And, AVAX is likely to struggle to stay above important price levels.

What does whale activity say?

AVAX’s price has been falling, and one big reason can be recent changes in the Avalanche Foundation. Earlier this month, three board members resigned, making people worry about the project’s future. Even though the team says everything is still on track, investors are unsure.

Additionally, broader market trends are influencing AVAX. Bitcoin (BTC) is staying above $84,000, and if it keeps going up, AVAX might also recover along with other cryptocurrencies.

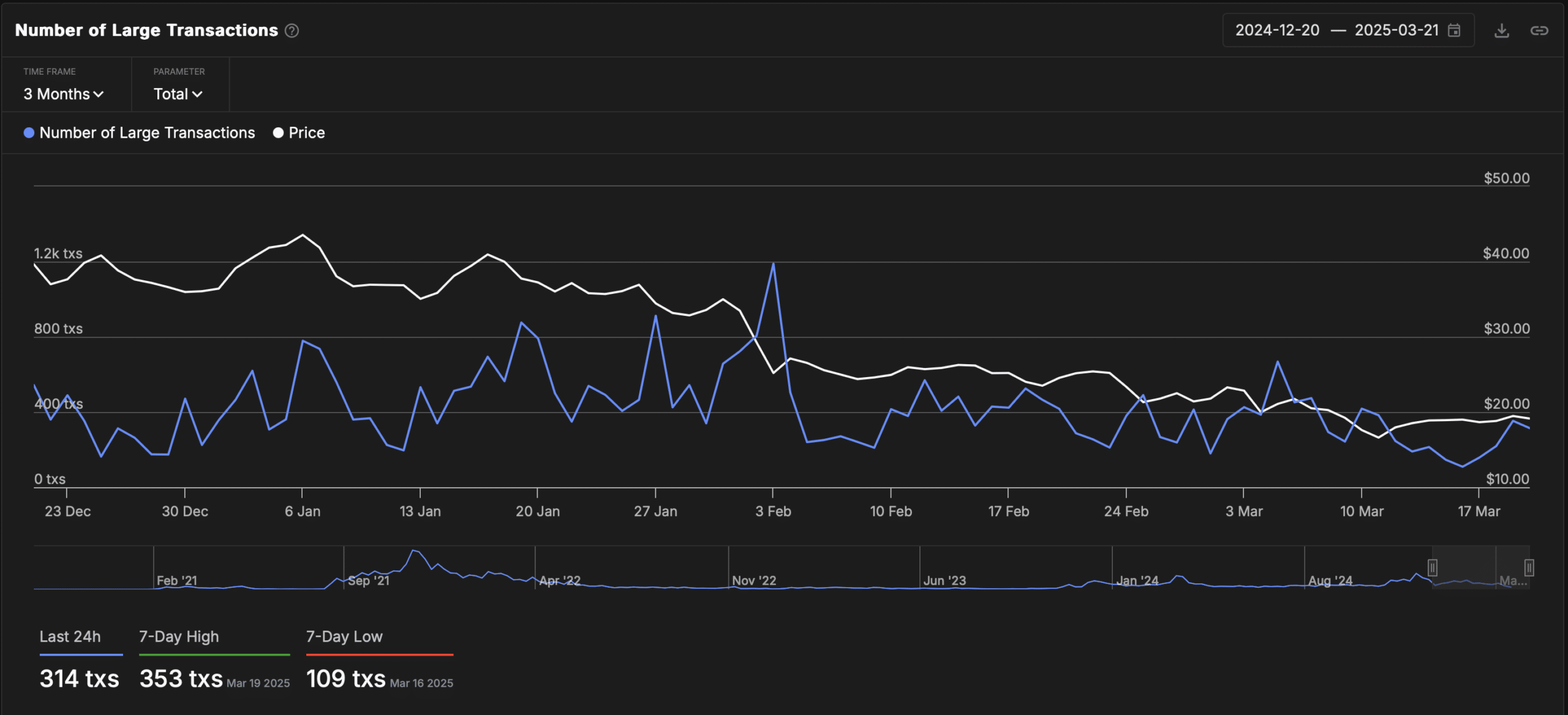

Source: IntoTheBlock

Despite the price drop, however, whale activity revealed that large investors have been actively accumulating AVAX.

In the last 24 hours alone, there were 314 large transactions, with a 7-day high of 353 on 19 March and a 7-day low of 109 on 16 March – showing a sharp hike in accumulation. This growing buying pressure could signal a price reversal as market sentiment shifts.

AVAX’s volume and Open Interest trend

At press time, AVAX’s trading volume was at $213.47 million – a 38.92% drop. However, a spike could indicate renewed buying interest.

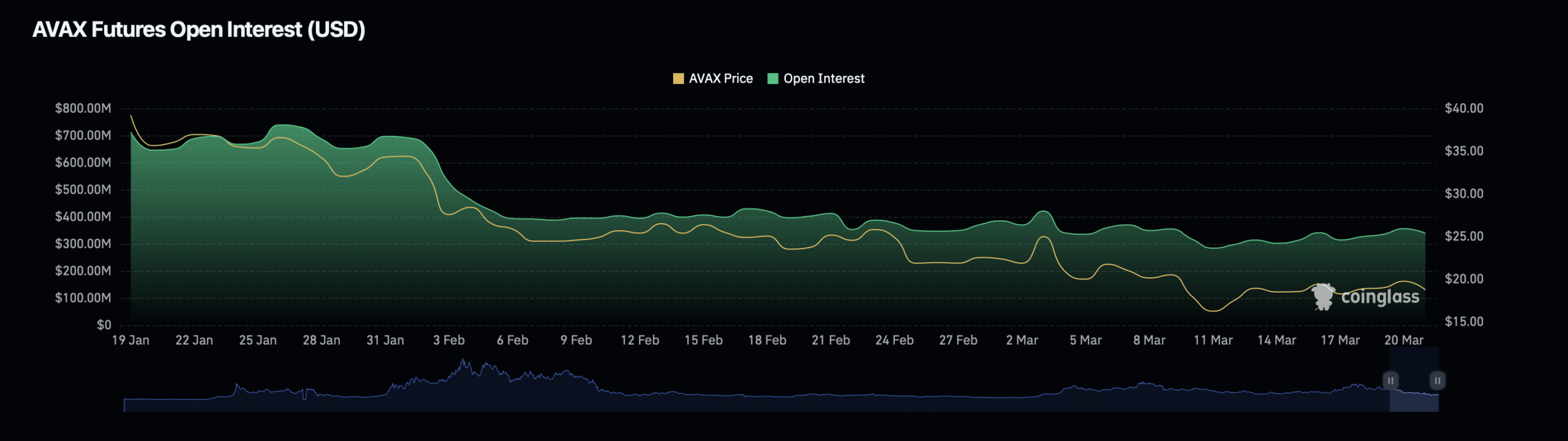

Meanwhile, Open Interest, which tracks the number of active futures contracts, stood at $341.27 million. However, it has been dropping lately.

Source: Coinglass

This means fewer traders are now opening new positions, which shows they are being cautious about the market. If Open Interest starts increasing along with the price, it could mean more traders are getting involved, and the trend might take a turn for the better.

To put it simply, AVAX is at a crossroads right now. While bearish trends dominate, signs of accumulation and key technical indicators underline a possible rebound around the corner. If Bitcoin continues its strong performance and AVAX breaks its resistance, a recovery could follow. However, failure to hold support could lead to further losses.

Conclusion

Overall, while AVAX faces a challenging environment with recent losses and market uncertainty, the notable increase in whale activity and the potential for a market turnaround present a glimmer of hope for traders. Investors are advised to monitor key levels and market dynamics closely as they navigate these fluctuating conditions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

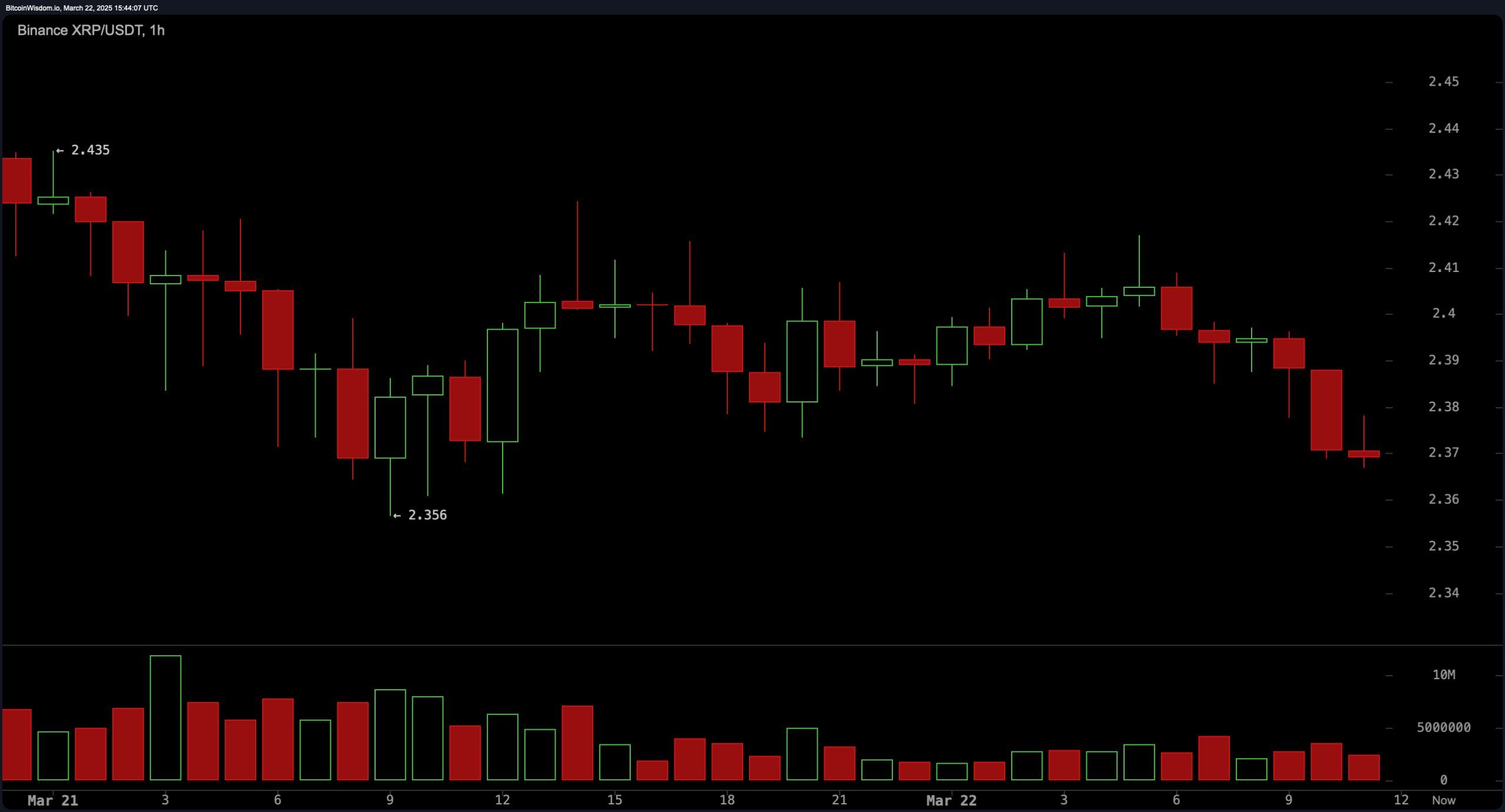

XRP Price Update: XRP Teeters on $2.35 Support—Next Move Critical

Weekly Crypto Regulation News Roundup: SEC Ends Ripple Case, Trump Calls for Stablecoin Regulation

Regulatory realignment unfolds as the SEC steps away from a prolonged crypto case while policy makers rally for simple stablecoin rules to reshape market oversight and boost investor confidence.

BaFin Bans Ethena’s USDe Token in Germany Over Approval Process Flaws

German regulators’ latest clampdown forces crypto issuers to rethink internal controls—a potential catalyst for industry-wide reform that could reshape how synthetic tokens meet EU compliance standards.

Crypto Industry Super PAC Endorses Republican Candidates in Florida Special Elections

The network includes Fairshake, Protect Progress, and Defend American Jobs, the latter taking the lead in campaign spending.