Bitcoin Faces Short-Term Challenges Amid Whale Activity and Resistance Levels

-

Bitcoin (BTC) faces critical resistance challenges as it trades below key technical levels, indicating potential bearish momentum in the market.

-

Despite an initial surge in whale accumulation, which reached a three-month high, recent activity has stabilized, hinting at cautious optimism among large holders.

-

To regain bullish momentum, BTC must decisively break the $85,000 resistance; otherwise, downside risks loom if it fails to hold above $81,000.

This article analyzes Bitcoin’s current market position, highlighting key resistance levels and whale behavior while assessing future price potential.

BTC’s Technical Indicators Suggest Bearish Outlook

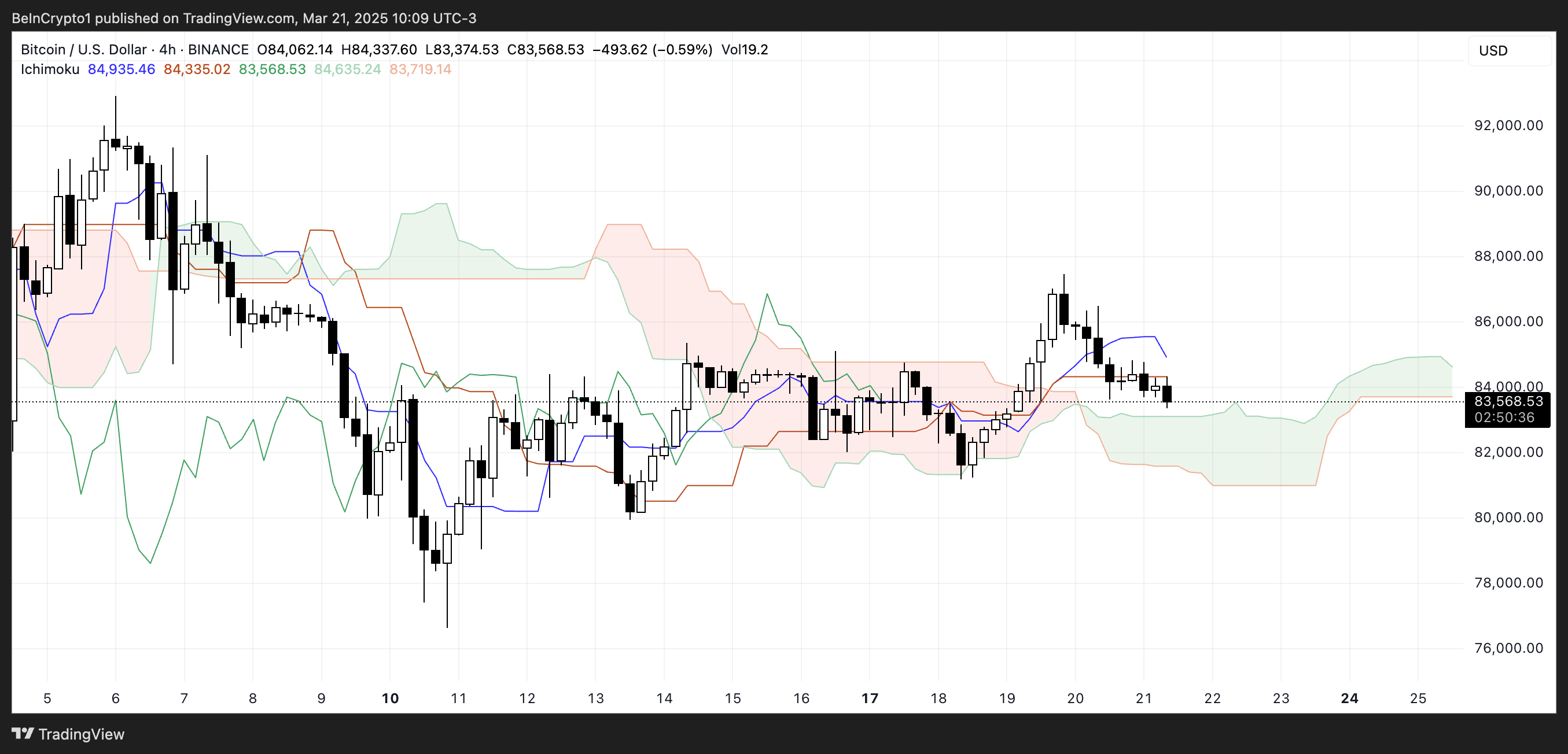

Bitcoin is encountering substantial resistance as it trades below the Ichimoku Cloud and critical Exponential Moving Averages (EMAs), indicating a bearish short-term outlook. The recent price action has prompted concerns, particularly as BTC struggles to maintain momentum against vital support levels.

Currently, the price is beneath both the Tenkan-sen (blue line) and Kijun-sen (red line), crucial indicators of trend strength and direction. A flat and thin Ichimoku Cloud ahead suggests a lack of decisive momentum, potentially leading to sideways trading or further declines unless BTC can reclaim higher price levels.

The Lagging Span (green line) is positioned below the price action, reinforcing the current bearish sentiment. Immediate support may emerge as BTC approaches the lower boundary of the cloud. However, if buyers do not defend this crucial level, downward momentum may exacerbate, urging traders to closely monitor future price developments.

Current Trends in Bitcoin Whale Accumulation

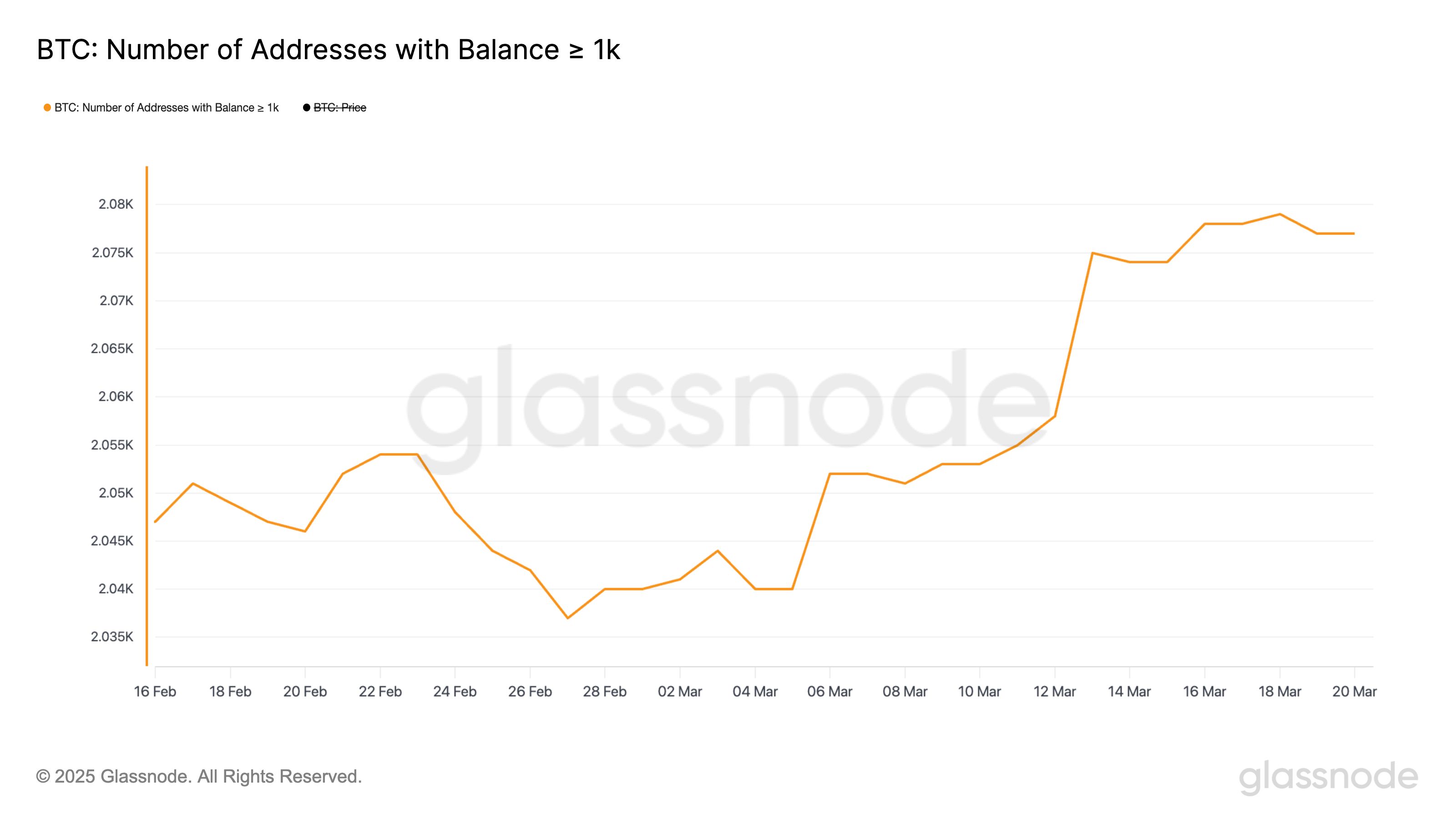

Recent data indicates a notable rise in the number of Bitcoin whales, defined as wallets holding at least 1,000 BTC. The count surged from 2,040 on March 5 to 2,079 by March 18, marking the most active whale accumulation since December 2024.

While this accumulation spurt signals growing confidence, the count has recently stabilized at 2,077, suggesting that large holders may be pausing for a reassessment after rapid accumulation. This stabilization hints at a recalibration among investors regarding future price expectations.

Understanding whale dynamics is vital, as the significant holdings these addresses carry can exert considerable influence over Bitcoin’s price movements. An increase in whale numbers often denotes confidence among major investors, and their actions can lead to upward price pressure in the market.

Resistance Levels: Can Bitcoin Break $90,000 This Month?

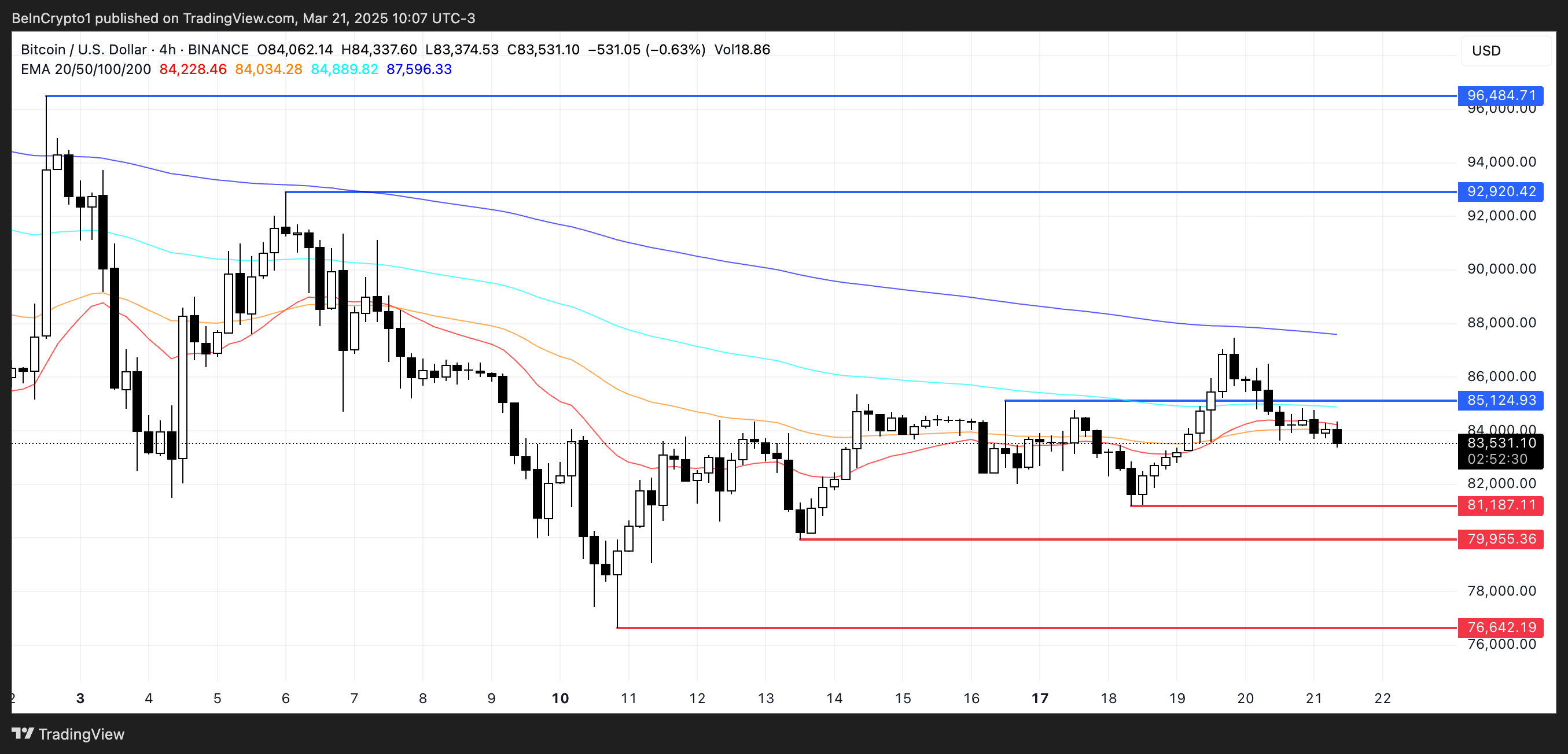

Bitcoin is currently consolidating within a defined range, with immediate resistance at $85,124 and support at $81,187. The close proximity of the EMA lines indicates a market in flux, with the potential for either a breakout or further retracement. The post-FOMC meeting price spike has begun to show signs of weakening, leading to a guarded outlook for the near term. Analyst Nic Puckrin provides a cautious perspective:

“The slight ‘Powell pump’ we saw in crypto markets after the FOMC meeting has brought Bitcoin back above its 200-day moving average, which is a bullish sign. However, whether it can maintain this trajectory is uncertain. A key resistance level to observe is around $92,000; surpassing this could extend the rally toward previous all-time highs, although excessive uncertainty remains a challenge for such a movement,” he states.

Should Bitcoin successfully breach the $85,000 resistance, it could pave the way for an advance toward the target ranges of $92,920 to $96,484, contingent on renewed bullish momentum. Conversely, failure to uphold support at $81,187 could spell trouble, with a potential drop to prices around $79,955 and possibly even $76,642 if sellers gain further control.

Conclusion

As Bitcoin navigates critical resistance levels and whale accumulation patterns stabilize, the outlook remains cautious. A balanced approach, observing market developments and key technical indicators, will be crucial for traders in the coming weeks. Maintaining support at critical levels will be key to avoiding further downside risks while providing opportunities for future growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu Faces Challenges Ahead of Potential Bitcoin Rally as Short-Term Sell-Offs Mount

Frank Founder Charlie Javice faces jury decision on genius or fraud claims in $175M JPMorgan trial

Share link:In this post: Frank Founder Charlie Javice could receive a 30-year prison sentence for fraud. JPMorgan Chase claims Javice and Amar fabricated data to get them to close the deal. Javice’s legal team believes the bank was more interested in her expertise than Frank’s user data.

Will Solana Skyrocket if Fidelity Files an ETF?

XRP vs ADA in 2025: Which Crypto Will Lead the Next Bull Run?