Technical Indicator Flashes Hidden Sign of Emerging Bitcoin Strength, According to Crypto Trader

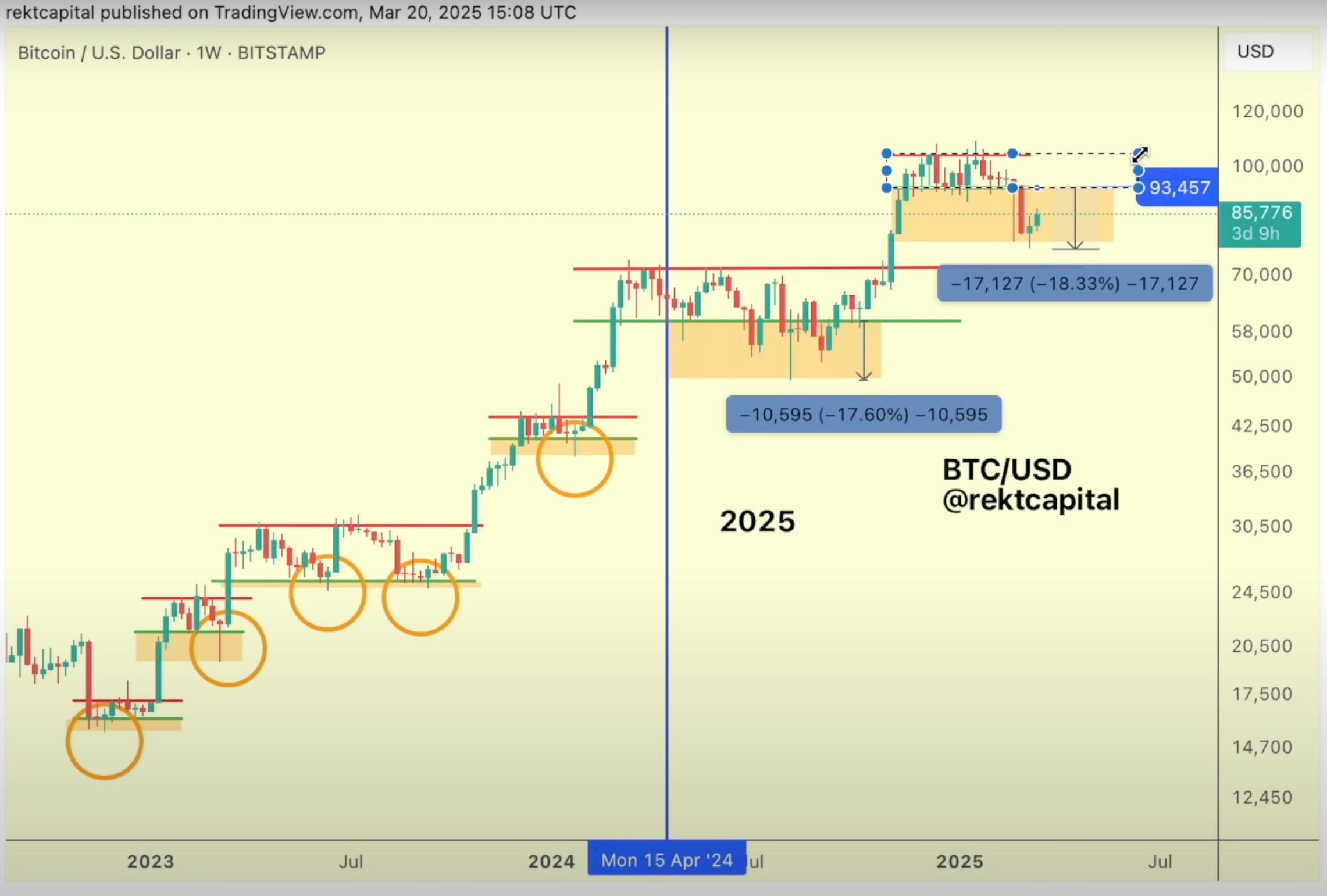

An analyst who nailed Bitcoin’s pre-halving correction last year says a key indicator is flashing a bullish signal for BTC .

The analyst pseudonymously known as Rekt Capital tells his 107,000 YouTube subscribers that the Relative Strength Index (RSI) indicator is breaking out of a months-long downtrend, suggesting Bitcoin may soon soar to the upside.

The RSI is a momentum oscillator used to determine whether an asset is oversold or overbought. The RSI’s values range from zero to 100 with the level between 70 to 100 indicating that an asset is overbought while the zero to 30 level indicates that an asset is oversold.

“What’s interesting about this entire period right now is that this has been a downtrend on the RSI, a daily downtrend dating back to really mid-November 2024. So breaking this downtrend is pretty pivotal, because it means that the RSI doesn’t want to be trending downwards anymore.

And this is actually very likely a hidden sign of emerging strength in Bitcoin’s price action, because now the RSI wants to enter a new macro uptrend after downtrending for effectively some five months or so, and now we are seeing the RSI try to confirm this breakout and breach of the downtrend so that it can rally higher. And this comes on the heels of really just price action building a bullish divergence.”

Source: Rekt Capital/YouTube

Source: Rekt Capital/YouTube

He also says Bitcoin may soon break through resistance at $88,500.

“We need to watch out for further continuation, which is going to be reclaiming $88,500 to get us back closer and closer to reclaiming this re-accumulation range [around $100,000]. And many people have been talking about this being a bear market, but it does look like it is a downside deviation period very similar to what we’ve seen back in the past.”

Source: Rekt Capital/YouTube

Source: Rekt Capital/YouTube

Bitcoin is trading at $83,998 at time of writing, down 2.3% in the last 24 hours.

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Have financial markets reached peak uncertainty?

Share link:In this post: Trump’s unclear April 2 tariffs and new policies have pushed markets into peak uncertainty. Fed officials and investors have little confidence in economic forecasts right now. Most S&P 500 losses came from big tech stocks, while the rest of the index is holding up.

Starlink and Italian government’s deal has stalled, in disapproval of Musk’s Doge role

Share link:In this post: Discussions between government and Starlink halted on security concerns and Musk’s role in the Trump administration. Opposition politicians questioned the logic of engaging a foreign business over sensitive matters. However, there are chances negotiations may resume

Trump’s proposed 200% tariff on European liquor imports stokes worries among California’s winemakers

Share link:In this post: Trump’s proposed 200% tariffs on European wine worry California winemakers already struggling with low demand and crop losses. Large companies may benefit from refunds, but smaller wineries fear disrupted sales and distribution. Some see potential benefits for U.S. wines, but many fear economic harm if European alcohol prices skyrocket.

Trump’s economic policies put $5,000 DOGE dividend checks on hold

Share link:In this post: Trump delays DOGE dividends, prioritizing tariffs and tax cuts over $5,000 stimulus checks. Economists warn that cash payouts may worsen inflation. The plan’s future depends on the country’s economic performance.