Research Report | Bedrock Project Detailed Analysis & BR Market Valuation

I. Project Introduction

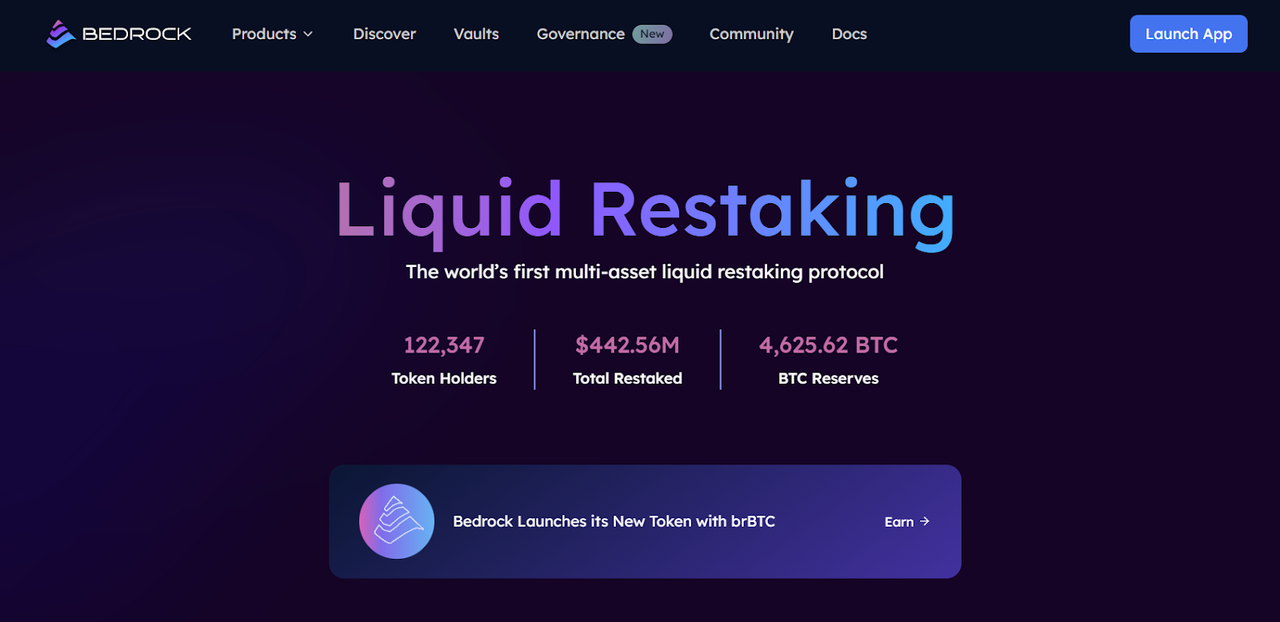

Bedrock is a liquid restaking protocol (LRP) designed for multi-asset staking, enabling the restaking and yield generation of major assets such as BTC, ETH, and IOTX. Backed by RockX, a prominent blockchain infrastructure provider, Bedrock aims to offer PoS asset holders an efficient way to optimize capital utilization while earning native on-chain yields in a non-custodial manner.

As Bitcoin gradually moves toward BTCFi (Bitcoin DeFi), Bedrock has introduced products like uniBTC and brBTC, aligning with the evolution of BTCFi 1.0 and 2.0. uniBTC is designed for restaking applications within the Babylon chain, facilitating unified staking for various BTC derivative assets. Meanwhile, brBTC acts as a key gateway to BTCFi 2.0, integrating multiple restaking protocols and yield sources while maximizing returns through intelligent dynamic allocation strategies.

Bedrock prioritizes modularity and interoperability in its product design. Its LRT (Liquid Restaking Token) offerings, including uniBTC, brBTC, and uniETH, follow a non-rebasing model, ensuring that users' holdings remain constant while the token's value appreciates over time. Additionally, Bedrock allows users to mint restaking tokens using a variety of derivative assets, progressively expanding its support to Ethereum, BNB Chain, and other major Layer 1 and Layer 2 networks.

The project has successfully completed two rounds of Babylon Cap phase BTC staking and gained significant market attention following the launch of brBTC. Bedrock's native token, BR, is set for its Token Generation Event (TGE) in March 2025, with a community-focused token distribution model designed to strengthen its early market presence and leadership in the BTCFi restaking space.

II. Project Highlights

1. Multi-Asset Support Across BTC, ETH, and IOTX Ecosystems

Bedrock is among the few liquid restaking protocols that support multiple assets. It facilitates restaking for native ETH within the EigenLayer ecosystem while also enabling restaking for various Bitcoin derivative assets (such as WBTC, FBTC, and cbBTC) and IOTX from the DePIN sector. By utilizing a unified protocol framework, Bedrock connects diverse on-chain staking scenarios, providing asset holders with liquidity unlocking and yield enhancement solutions.

2. Well-Defined Product Suite Supporting BTCFi’s Evolution

Bedrock has developed a comprehensive range of products, including uniBTC, brBTC, uniBTC Vaults, uniETH, and uniIOTX, forming a product suite aligned with BTCFi's growth. uniBTC primarily serves Babylon’s native staking use cases, while Vaults focus on optimizing yield strategies. brBTC, as the flagship BTCFi 2.0 product, integrates restaking rewards, multi-chain compatibility, and real-world applications, further advancing Bitcoin’s financialization.

3. Dynamic Yield Optimization with Multi-Asset Allocation

brBTC employs a multi-asset collateralization and dynamic restaking mechanism, allowing users to mint brBTC using assets like WBTC, FBTC, BTCB, and uniBTC. The protocol automatically distributes funds across multiple restaking platforms (Babylon, Kernel, Symbiotic, etc.), optimizing returns based on real-time on-chain yield conditions. Additionally, it integrates DeFi strategies, such as lending and stablecoin collateralization, to diversify and sustain yield sources.

4. Strong Ecosystem Partnerships and Institutional Backing

As a key participant in Babylon’s staking Cap phase, Bedrock accounted for nearly 30% of the initial BTC staking quota and secured the highest Babylon points reward in the Cap-2 phase. The project has garnered investment from leading institutions like OKX Ventures, LongHash Ventures, and Comma3 while forming strategic partnerships with DeFi projects such as CIAN, Veda, and Mellow. These collaborations have significantly bolstered Bedrock’s influence within the BTCFi ecosystem.

III. Market Valuation Outlook

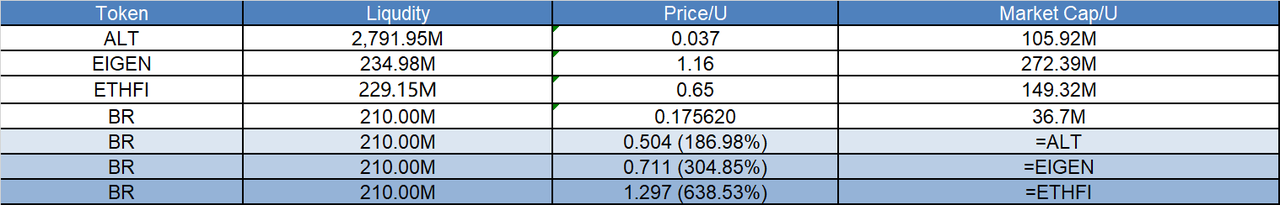

As a multi-asset liquid restaking protocol, Bedrock holds a pivotal role in the BTCFi 2.0 narrative. Its product ecosystem—including brBTC, uniBTC, and veBR—parallels EigenLayer’s impact on Ethereum’s restaking landscape while incorporating elements from AltLayer (Rollup ecosystems) and Ether.Fi (decentralized staking). By benchmarking against similar market protocols, we can estimate Bedrock’s potential valuation.

Currently, Bedrock has a circulating supply of 210 million BR tokens, each priced at $0.17562, translating to a market capitalization of approximately $36.97 million. By comparing this with the market capitalizations of EigenLayer, AltLayer, and Ether.Fi—three well-established liquid restaking protocols—we can project Bedrock’s potential growth trajectory.

IV. Tokenomics

Total Token Supply

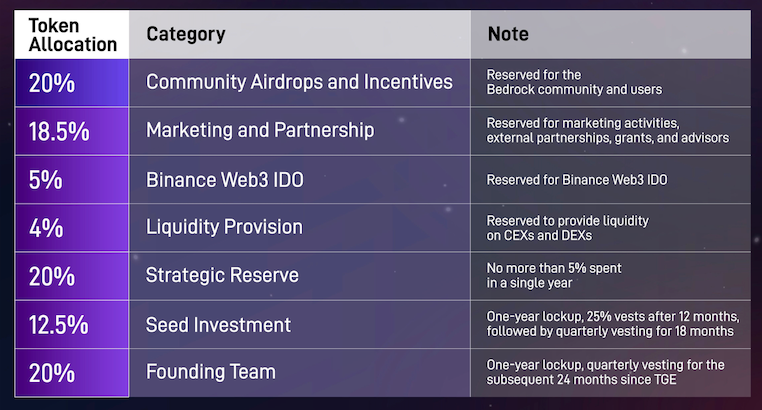

- Total Supply: 1 billion BR

- Initial Circulating Supply: 210 million BR (21%)

Token Distribution

-

Community Airdrops Incentives – 20% (200 million BR)

- 5.5% unlocked at TGE (first-season airdrop), with the remaining 14.5% reserved for future airdrops, released linearly over 48 months.

-

Marketing Partnerships – 18.5% (185 million BR)

- Allocated for marketing, partnerships, grants, and advisor incentives, released linearly over 48 months.

-

Strategic Reserve – 20% (200 million BR)

- Reserved for long-term protocol development, with a maximum of 5% used annually to maintain supply stability.

-

Founding Team – 20% (200 million BR)

- Locked for the first year, followed by a 12-month vesting period with quarterly releases over 24 months.

-

Seed Early Investors – 12.5% (125 million BR)

- 12-month lockup, with 25% released initially and the remainder vested quarterly over 18 months.

-

Binance Web3 IDO – 5% (50 million BR)

- Fully unlocked at TGE and distributed to Binance Web3 IDO participants.

-

Liquidity Provision – 4% (40 million BR)

- Reserved for CEX and DEX liquidity, released linearly over 48 months.

Token Utility

-

Staking BR to Earn veBR for Governance Rewards

- Users can stake BR to receive veBR, increasing governance voting power and staking rewards.

- veBR holders can vote on governance proposals, including yield distribution and ecosystem incentives.

-

Participation in the Loyalty Program

- Users can join the Bedrock Loyalty Program to gain exclusive status and unlock additional future rewards.

- Early participants receive extra long-term incentives, maximizing the benefits of holding BR.

-

Engagement in Diamond Season 2

- BR holders, uniToken holders, and active community members can earn rewards through the Diamond Season 2 campaign.

- This initiative enhances ecosystem engagement and encourages deeper participation in BTCFi.

-

DeFi Utility Liquidity Mining

- BR can be used for liquidity mining on DEXs and other DeFi platforms, generating additional yield.

- Future applications may include staking, lending, and stablecoin minting within the DeFi ecosystem.

V. Team Fundraising

Team Information

Zhuling Chen is the CEO of Bedrock, bringing extensive experience in blockchain, PoS staking, and DeFi. With a strong technical and financial background, he has contributed to multiple public blockchain and financial infrastructure projects. Leading the Bedrock team, he is focused on advancing BTCFi 2.0 by developing cross-chain liquid restaking solutions to maximize the financial utility of Bitcoin and other major assets.

Fundraising Information

On May 2, 2024, Bedrock completed its latest funding round, attracting investment from top-tier institutions such as OKX Ventures, LongHash Ventures, Comma3 Ventures, Waterdrip Capital, Amber Group, Arche Fund, and LBank Labs. Additionally, strategic investors like Babylon co-founder Mingchao (Fisher) Yu and IoTeX founder Raullen Chai have joined, bringing not only financial support but also valuable industry resources to expand the Bedrock ecosystem.

VI. Potential Risks

-

Smart Contract Risks

- Despite audits from PeckShield and Blocksec, Bedrock’s smart contracts may still have undiscovered vulnerabilities.

- Risks such as oracle price manipulation, liquidity pool exploits, or governance attacks could affect user funds.

-

Market Adoption Risks

- BTCFi is still in its early stages, and the long-term demand for BTC restaking remains uncertain.

- Bitcoin’s staking rate is lower than Ethereum’s, making BTCFi adoption dependent on yield competitiveness and protocol stability.

VII. Official Links

- Website: https://www.bedrock.technology/

- Twitter: https://x.com/bedrock_defi

- Telegram: https://t.me/Bedrock_Official

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Recent Surge Towards $90,000 Faces Possible Pullback Amid Tariff Uncertainty

Solana’s Recent 20% Surge Suggests Potential to Test Key Resistance Levels Amid Rising DEX Activity

Bitcoin trader sees gold 'blow-off top' as XAU nears new $3.3K record

Bitcoin is in no mood to copy gold's bull run yet, but on the horizon is a "terminal" end to the record XAU/USD winning streak, a trader predicts.