44% are bullish over crypto AI token prices: CoinGecko survey

Nearly half of crypto pundits in a recent survey are bullish over crypto AI tokens prices — which could bode well for the $23.6 billion crypto market sector.

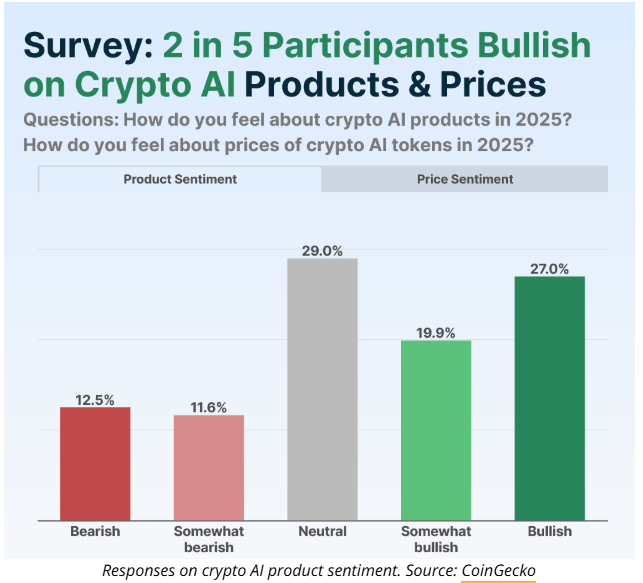

Of the 2,632 respondents surveyed by CoinGecko between February and March, 25% were “fully bullish,” and 19.3% indicated they were “somewhat bullish” for crypto AI tokens in 2025.

Around 29% of respondents were neutral on the subject, while a combined 26.3% were either somewhat bearish or bearish.

The survey response was similar when it came to crypto AI products, which comes as the “use cases combining crypto with AI have improved and are seeing more widespread adoption,” said CoinGecko’s crypto research analyst Yuqian Lim.

“This perhaps shows that crypto participants are not differentiating between crypto AI’s investing or trading potential and the technology itself,” said Lim.

“Such market sentiments might in turn reflect expectations that now is the time for crypto AI to move beyond the conceptual stage and mature as a sector.”

CoinGecko’s cryptocurrency tracker shows that the top artificial intelligence coins by market capitalization are around $23.6 billion, led by Near Protocol , Internet Computer (IICP$5.72and BittensorTAO$253.73.

There’s also a separate group of AI agent coins, such as Artificial Super Intelligence , Virtuals Protocol (VIRTUAL), ai16z (AI16z) and others, which command a market cap of $4.5 billion.

CoinGecko surveyed 2,632 participants between Feb. 20 and March 10 and grouped participants whether they were long-term crypto investors or short-term traders.

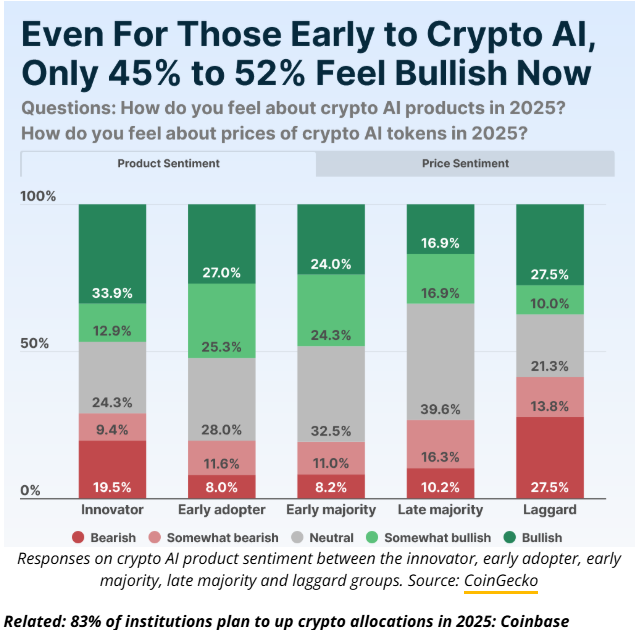

It also asked participants to categorize themselves on whether they saw themselves as early or late adopters and laggards of crypto AI.

It found that some of the earliest adopters — known as “innovators” — had a higher share of bearishness compared to some of the later adopters. “Laggards” were the most bearish, in line with expectations.

Spencer Farrar, a partner at the AI and crypto-focused venture capital firm Theory Ventures, recently told Cointelegraph that these AI applications are “a bit frothy” at the moment, but more utility could come down the line.

Farrar expects to see further experimentation with crypto AI tokens, as they allow retail investors to speculate on smaller market cap ideas that largely aren’t as accessible in the stock market.

“Things tend to start off like this in the open-source world; you see a ton of tinkering, and then perhaps we’ll see something really big come of it.”

Crypto AI verticals that Farrar’s firm has a close eye on include decentralized GPU provider protocols, decentralized data providers, payment infrastructure for AI agents leveraging blockchain tech and crypto trading bots.“There’s also an opportunity for crypto to be used as a video to authenticate content as AI-generated or human-generated,” Farrar added.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trade wars push blockchain into supply chain solutions

Corporations hold $57 billion in Bitcoin

Trump administration walks back tariff ‘exemption’ on electronics

Trump says he’s “flexible” on electronic tariffs, and that more developments are “coming up”

Charles Hoskinson Weighs in: Is Bitcoin Surging to $250K?

Unpacking Charles Hoskinson's Bold Bitcoin Prediction in Light of Current Market Trends