How Much Do US Interest Rates REALLY Matter?

In 2022, the Federal Reserve rapidly increased interest rates in response to soaring inflation that was from . Over the course of the year, the Fed raised rates from near zero (0.25%) in March, 2022 to 4.50% by December, 2022, marking one of the fastest tightening cycles in history.

Inflation had surged to 9.1% by mid-year, prompting the Fed to take aggressive action to stabilize prices. This shift in monetary policy had a profound effect on financial markets, particularly stocks and cryptocurrencies, both of which saw sharp declines in value.

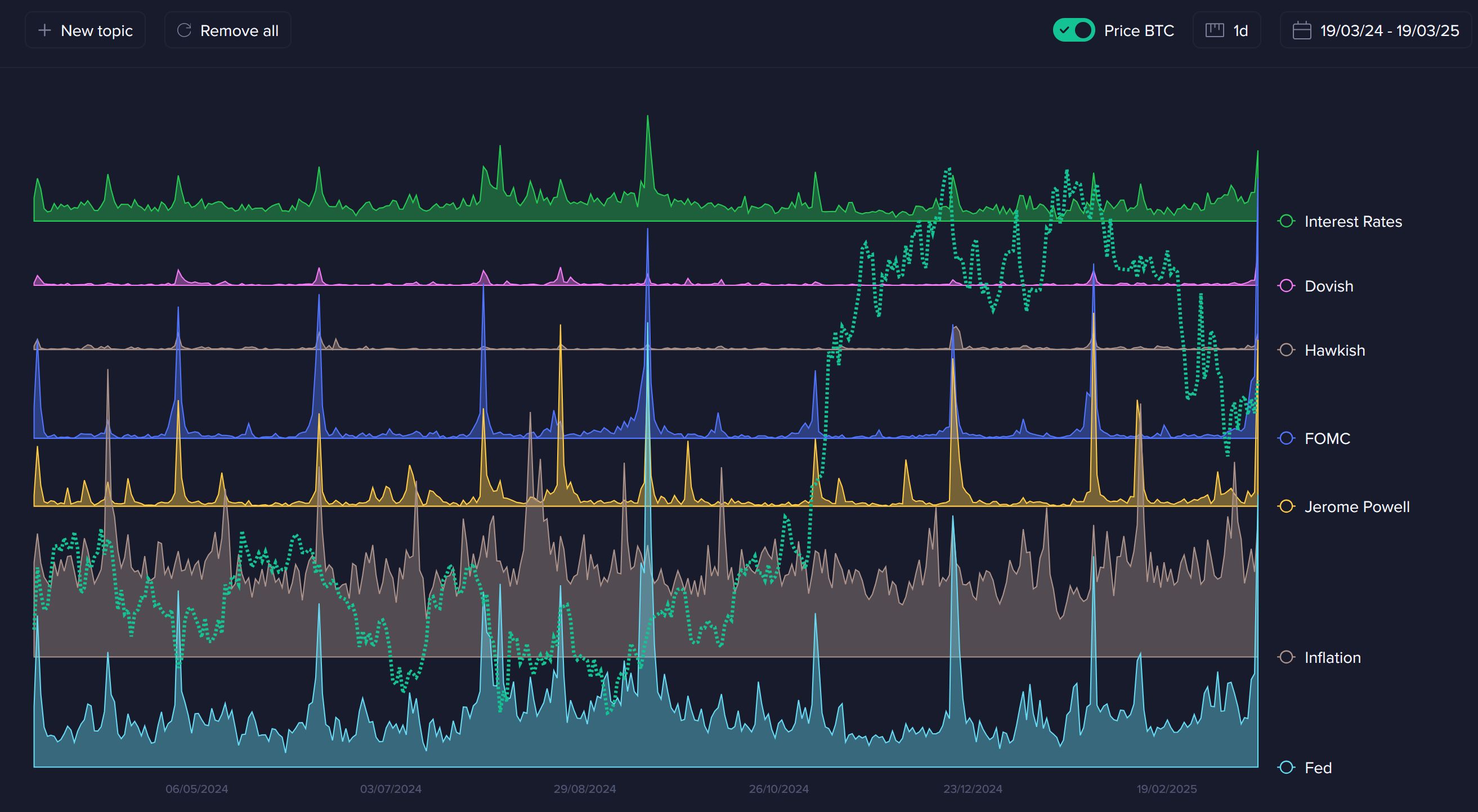

This was a brutal year for crypto and equity markets alike, and is still a fairly recent memory for a lot of traders. And over the past year, we continue to see the crowd's sensitivity to each FOMC meeting come into play. Below is an image of common keywords related to every Federal Open Market Committee meeting:

Though not always the case, we can see that the dotted green line does have many profound turning points whenever these meetings occur and Jerome Powell speaks. With each of these FOMC meetings, differing results have occurred under different US and global circumstances.

Going back to the past 12 months, there have been nine FOMC meetings during this stretch. Below is a list of the meeting results, in the context of how interest rates were adjusted, and how crypto markets reacted:

1. March 19-20, 2024

- Inflation Assessment: The FOMC noted that inflation remained somewhat elevated but showed signs of moving closer to the 2% longer-run goal.

- Interest Rate Decision: The federal funds rate was maintained at 5.25%–5.50%.

- Price Impact: Bitcoin initially reacted positively, en route to a then new all-time high above $72K. However, prices then took a nosedive throughout April as FOMO traders paid a steep price for getting overzealous.

2. May 1, 2024

- Inflation Assessment: Inflation continued to exhibit a gradual decline, aligning more closely with the Committee's target.

- Interest Rate Decision: No change; the rate remained at 5.25%–5.50%.

- Price Impact: This time, traders were determined not to fall for any traps. And prices proceeded to bounce immediately following this Fed decision, after what was looking like a worrisome bearish stretch.

3. June 11-12, 2024

- Inflation Assessment: The Committee observed further moderation in inflation, approaching the 2% target.

- Interest Rate Decision: The target range was held steady at 5.25%–5.50%.

- Price Impact: Bitcoin immediately plummeted -21% over the next three weeks until its price, along with the rest of crypto finally bottomed out on July 4, 2024.

4. July 30-31, 2024

- Inflation Assessment: Inflation metrics indicated continued progress toward the 2% goal.

- Interest Rate Decision: The rate was kept unchanged at 5.25%–5.50%.

- Price Impact: Bitcoin and altcoins again plummeted immediately after these meetings. After BTC dropped -20%, prices finally hit their bottom on August 5, 2024.

5. September 17-18, 2024

- Inflation Assessment: Inflation was nearing the Committee's longer-run objective, with expectations of sustained stability.

- Interest Rate Decision: The FOMC reduced the target range by 25 basis points to 5.00%–5.25%.

- Price Impact: The next 10 days following this meeting, Bitcoin jumped +10% and crypto markets began to really surge, beginning a bull cycle that lasted all the way until January 19, 2025.

6. November 6-7, 2024

- Inflation Assessment: Stable inflation trends continued, aligning with the 2% target.

- Interest Rate Decision: Another 25 basis point reduction was implemented, setting the range at 4.75%–5.00%.

- Price Impact: Coinciding with the election of pro-crypto candidate Donald Trump on November 5, 2024, markets blasted off. Bitcoin hit a new all-time high and every asset enjoyed major surges in market caps.

7. December 17-18, 2024

- Inflation Assessment: Inflation remained stable at the 2% target.

- Interest Rate Decision: The Committee maintained the rate at 4.75%–5.00%.

- Price Impact: The timing of this meeting halted a rally that was bringing Bitcoin to a then new all-time high of nearly $108K, and traders instead watched crypto's top asset fall to $91K over the next three weeks.

8. January 28-29, 2025

- Inflation Assessment: Inflation was stable, consistent with the Committee's longer-run goal.

- Interest Rate Decision: No change; the rate remained at 4.75%–5.00%.

- Price Impact: Crypto markets retraced considerably almost immediately, as the nosedive across nearly all assets was already in full effect prior to the FOMC meeting.

9. March 18-19, 2025

- Inflation Assessment: The FOMC observed that inflation remained somewhat elevated, with projections adjusted to 2.7% for the year, up from the previous 2.5% forecast.

- Interest Rate Decision: The Committee decided to maintain the target range for the federal funds rate at 4.25%–4.50%.

- Price Impact: Crypto markets, on this short sample size thus far, have risen.

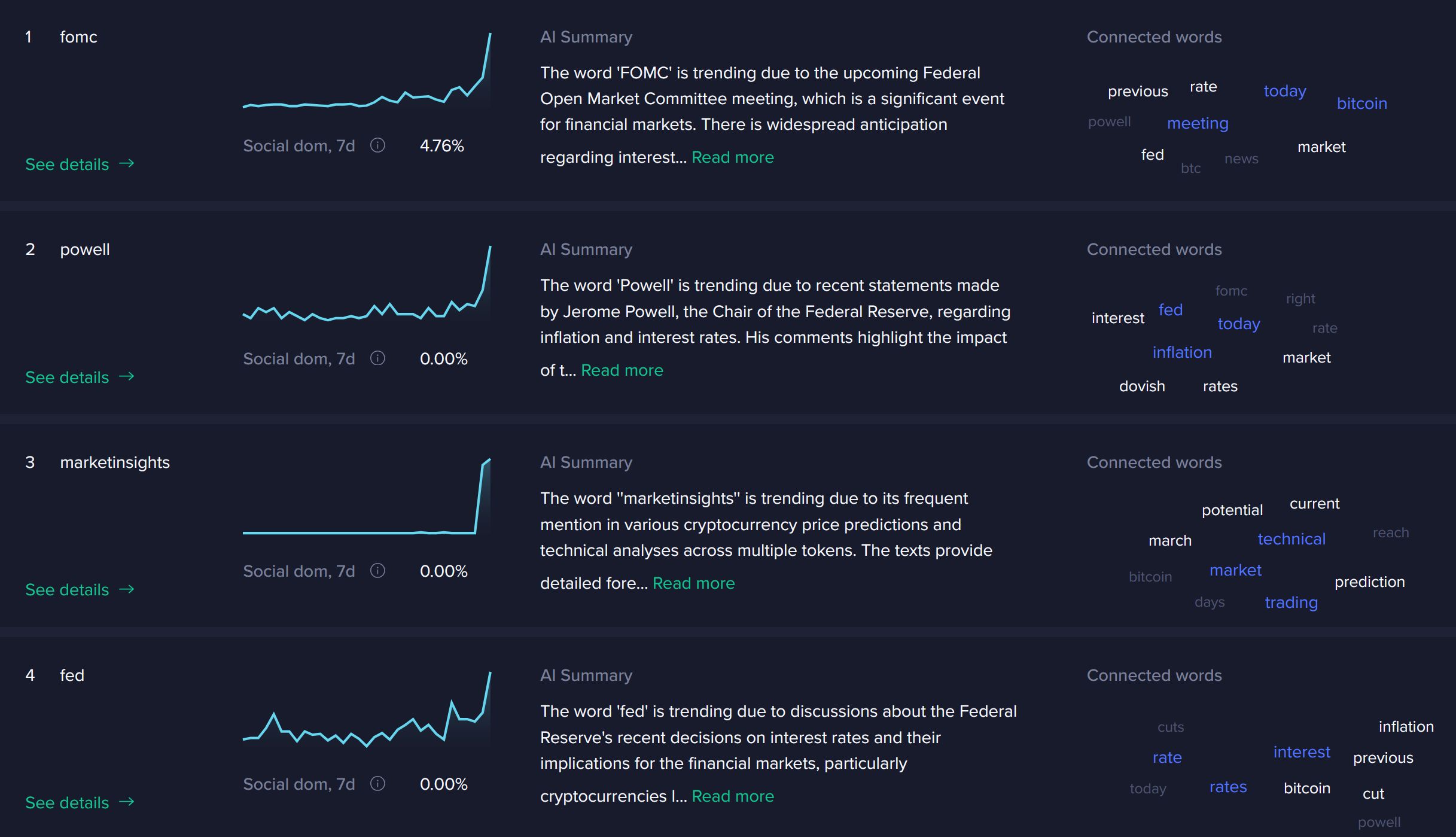

We can see that the top trending words, as of today, are filled with

And from the perspective of just keywords related to 'FOMC' and 'Fed', we can see that this latest March 19, 2025 Fed meeting did not create nearly as big of waves as the mid-December and late January meetings (which both signaled price tops). This latest FOMC meeting concluded with Jerome Powell announcing unchanged interest rates for the time being, and this was the most likely outcome traders were anticipating. As a result, the social volume wasn't quite as massive as previous instances.

As has been the case since the 2022 interest rate rises really began to impact cryptocurrencies, we are continuing to see a close correlation between crypto prices and traditional markets.

Some see this as the new normal, while others believe it may just be temporary until cryptocurrency really reaches its full capacity and adoption. Regardless, whether we like it or not, Bitcoin and altcoins are going to be very much impacted (in both directions) by how US and global economies fluctuate. Understanding this, as well as how the crowd reacts to each passing FOMC meeting throughout 2025 and beyond, can absolutely have a profound impact on your trading and investing bottom line.

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bessant and Musk sparked a power struggle, and the head of the IRS will be removed from office

DAC Platform and Fomoin Partner to Gamify Web3 Engagement and Rewards

Andreessen Horowitz’s Crypto Unit (a16z) Purchases $55M in ZRO Tokens