Onyxcoin (XCN) Price Tumbles as Active Addresses Drop and Short Bets Surge

Onyxcoin (XCN) is struggling as active addresses plummet and short positions rise, with bearish sentiment pushing the price lower. A further drop to $0.0076 could be likely.

Onyxcoin (XCN) has maintained its downward trajectory, plummeting by 10% over the past week as bearish sentiment grips the market.

With more traders turning away from the altcoin, its active address count has seen a sharp fall, signaling a loss of interest in the asset and low network participation.

XCN Struggles as Short Sellers Take Control

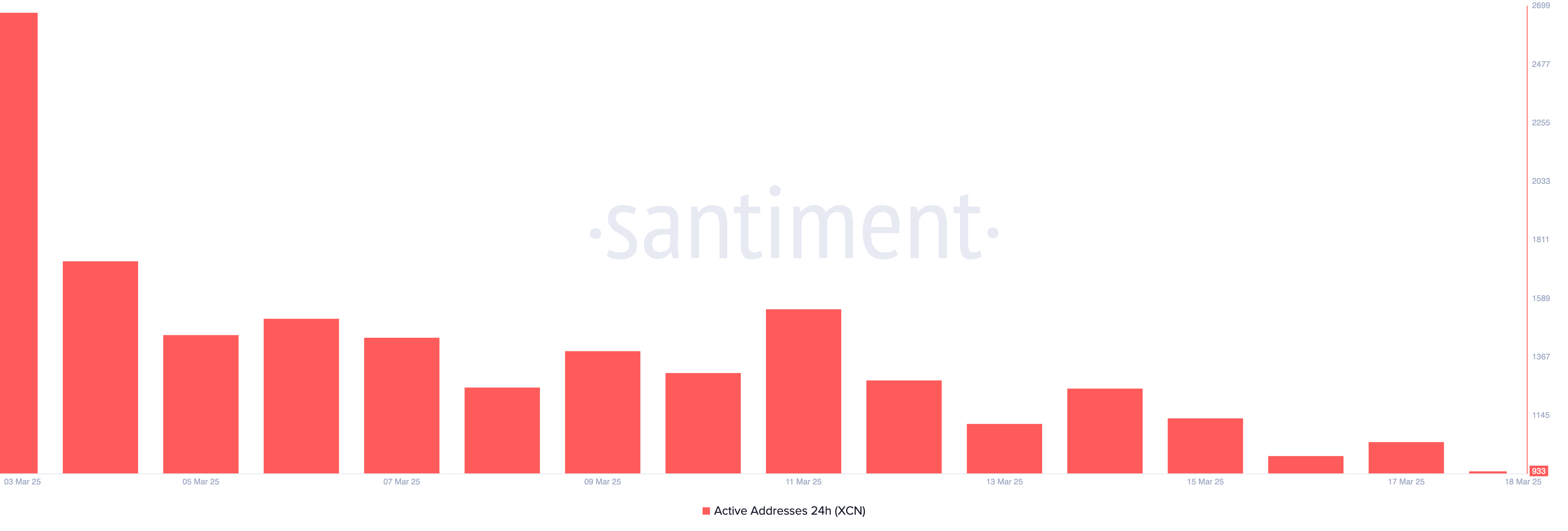

Since early March, Santiment’s data has revealed an aggressive fall in XCN’s daily active address count.

According to the on-chain data provider, on March 3, 2,673 unique addresses completed at least one transaction involving XCN. Since then, this figure has steadily declined, hitting a low of 1,044 on March 18.

XCN Active Addresses. Source:

Santiment

XCN Active Addresses. Source:

Santiment

This decline highlights waning network activity on Onyxcoin and the reduced demand for its altcoin, reinforcing the bearish sentiment surrounding XCN.

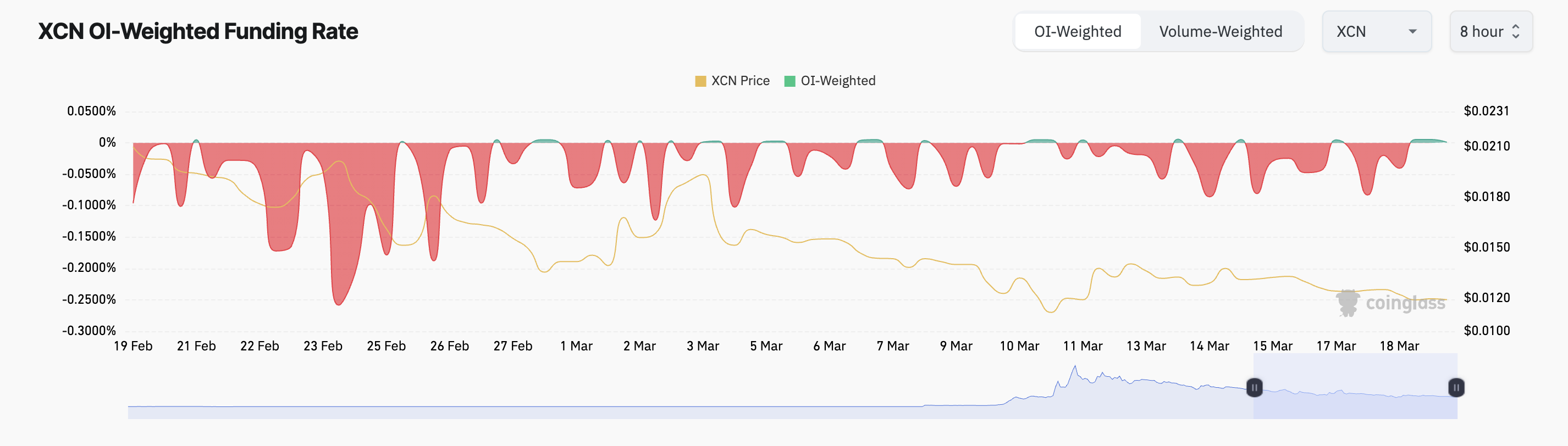

Moreover, the month has been marked by a significant rise in the demand for short positions, as reflected by the altcoin’s predominantly negative funding rate.

XCN Funding Rate. Source:

Coinglass

XCN Funding Rate. Source:

Coinglass

An asset’s funding rate is a periodic fee exchanged between its long and short traders in perpetual futures contracts. When the funding rate is mostly negative, short sellers dominate the coin’s futures markets.

The rising demand for XCN shorts highlights the market’s bearish outlook. Sellers are maintaining control and limiting any potential short-term recovery.

XCN Faces Strong Selling Pressure

The token’s Chaikin Money Flow (CMF) supports this bearish outlook. At press time, the momentum indicator is below zero at -0.19.

The CMF indicator measures fund flows into and out of an asset. When its value is negative, selling pressure outpaces buying activity. This indicates the likelihood of a further price decline as demand remains weak. In this scenario, XCN’s price could slip to $0.0075.

XCN Price Analysis. Source:

TradingView

XCN Price Analysis. Source:

TradingView

Conversely, the token’s price could rocket toward $0.022 if buyers regain market control.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Strategy Announces $2.1 Billion Equity Program for STRF Stock

Eric Trump Expands Leadership in Bitcoin Sector

Eric Trump Claims Bitcoin Global Accumulation Surge

[Enhanced Rewards] Become a VIP—Claim 960 USDT in Airdrops!

![[Enhanced Rewards] Become a VIP—Claim 960 USDT in Airdrops!](https://img.bgstatic.com/multiLang/web/8b9bd29bcbc19d1c2fcc44431aab4006.png)