Possibilities for Bitcoin (BTC): Assessing Potential Accumulation Amid Market Fear and Short-Term Resistance Levels

-

The cryptocurrency market remains tumultuous, with Bitcoin’s (BTC) recent downturn stirring a mix of fear and opportunity among investors.

-

Despite a projected bearish target of $72,000, the Bitcoin Rainbow Chart suggests current levels may present a compelling buying opportunity.

-

According to a recent report from COINOTAG, Bitcoin’s price bounce to $86.3K could be imminent if market conditions stabilize.

This article examines Bitcoin’s current price dynamics, market sentiment indicators, and future forecasts, providing insights for investors navigating this volatile landscape.

Market Dynamics: Bitcoin’s Recent Price Movements and Indicators

Bitcoin [BTC] has recently demonstrated notable volatility, showing a 6.89% increase from its low during the 1-day trading session on March 10, closing at $78.6K. This price action has brought Bitcoin to key resistance levels around $84K, creating a backdrop of uncertainty for traders. As analysis suggests potential short-term consolidation, investors are closely monitoring price movements.

Investor Sentiment: Caught Between Fear and Opportunity

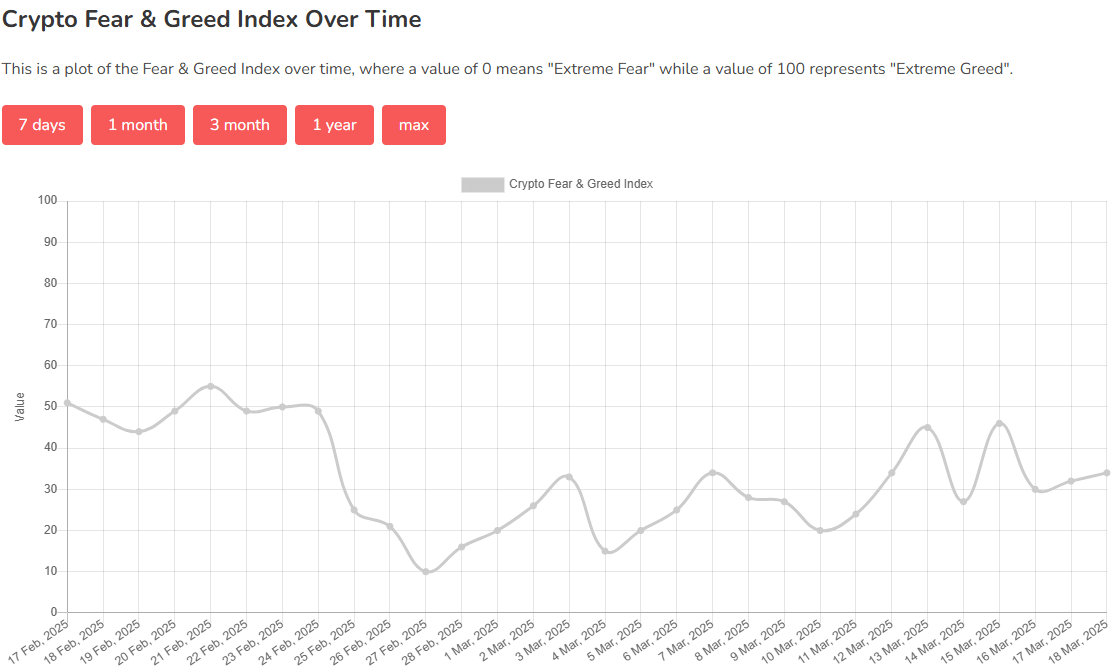

The Bitcoin Fear and Greed Index, which currently sits at 34, is indicating a fear sentiment amongst traders. This figure has fluctuated recently, dipping as low as 24 on March 11, which reflects a high degree of apprehension in the market. Typically, periods of fear can present valuable opportunities for investors, as historical analysis shows that buying during these times can lead to favorable outcomes.

Source: Alternative.me

Buy Bitcoin While Fear Grips the Wider Market

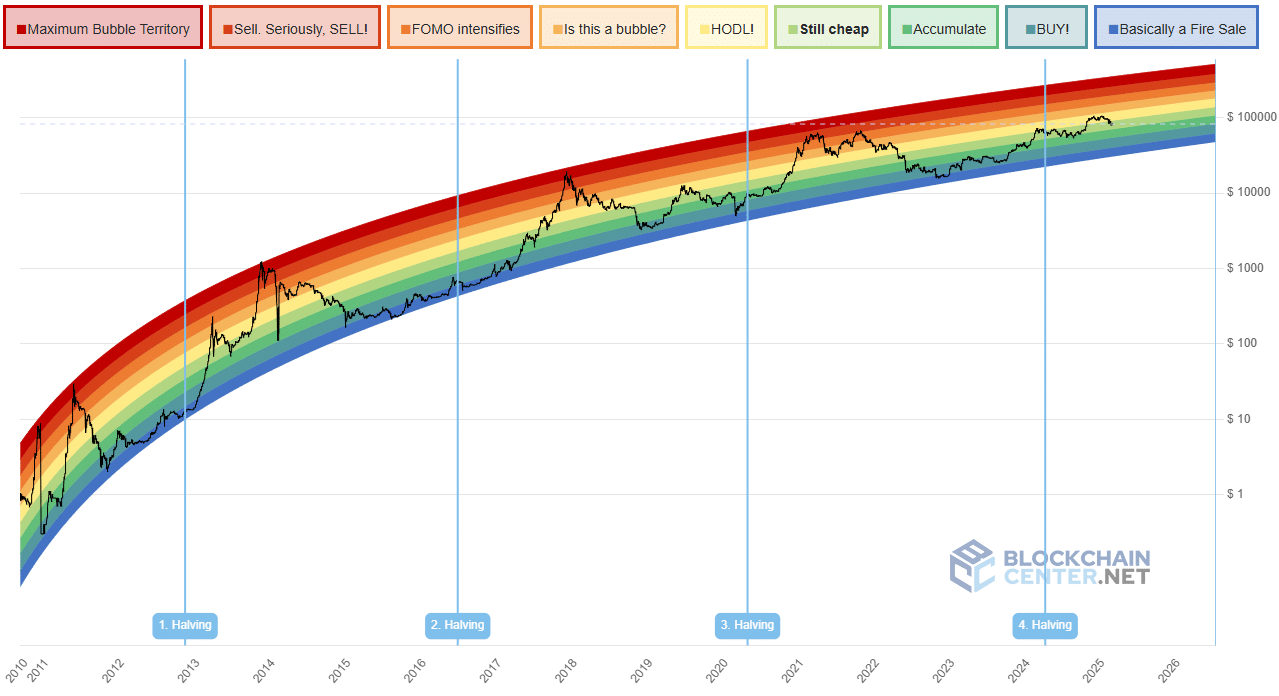

Source: Blockchain Center

The Bitcoin Rainbow Chart establishes a visual framework indicating that BTC is currently priced attractively relative to its historical performance. While its valuation tool does have limitations, particularly concerning reliance on historical data, it does suggest that the cryptocurrency is currently “still cheap.” Such indications have emerged amidst a broader market downturn, which may intrigue risk-averse investors.

Technical Analysis Insights: What the Charts Reveal

A close examination of the short-term 6-hour chart indicates a bearish structure for Bitcoin, identifying the $85K level as significant resistance. The A/D (Accumulation/Distribution) indicator demonstrates an uptrend, suggesting increased buying interest. Although the Awesome Oscillator reveals a moderately bullish momentum, this is insufficient to drive substantial price trends at this time.

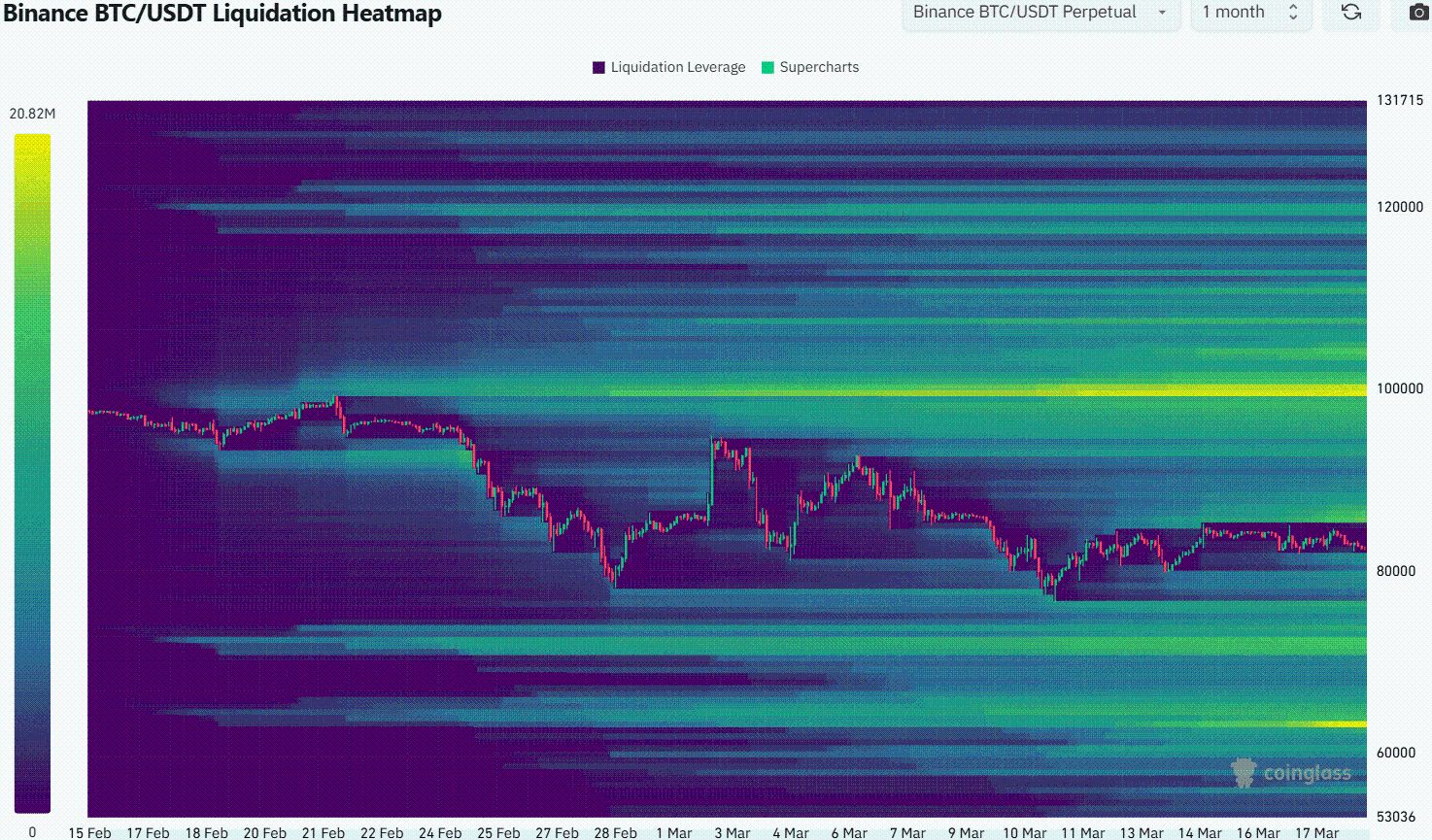

Source: Coinglass

The 1-month liquidation heatmap identifies key liquidity clusters, notably around $100K and the $72.3K-$71.7K range. In contrast, levels approaching $86.3K and $76.3K are also pivotal areas for potential price action. The bearish trend suggests a possible decline before any significant market recovery occurs, although there remains the potential for a price response higher if local resistance at $85K is surpassed.

Conclusion

The current landscape for Bitcoin represents a blend of risk and reward. While bearish indicators prevail, key insights suggest that investors should remain vigilant and consider additional BTC purchases while fear continues to permeate the market. Understanding the underlying factors and technical signals can empower investors to make informed decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Buyer Battles Begin as BlockDAG Offers 25M BDAG Daily! LINK Price Prediction Leans Toward $25 & TRX Crypto Shows Strength

Catch the next big crypto as LINK price prediction targets $25, TRX crypto shows strength & BlockDAG drops Buyer Battles offering 25M BDAG daily fueling buying frenzy.Chainlink Price Prediction Targets $25 BreakoutTRX Crypto Draws Volume After USDT Mint & ETF HypeBlockDAG Launches Daily Buyer BattlesStrong Moves Are Happening Live

Digital Commodity Capital Adds XRP to Its Portfolio, Bolstering Institutional Interest

BlockDAG Drops Price Pre-Reveal as Fartcoin Gains Traction

XRP Price Target Debated; SHIB Burns and Unstaked Gains