Ripple Lawsuit Update: SEC May Reclassify XRP as Commodity, Legal Experts Weigh In

- XRP may be reclassified as a commodity, reshaping its legal future with the SEC.

- Ripple could face a reduced fine, altering the outcome of the SEC lawsuit.

- Legal experts highlight the ongoing injunction as a key obstacle for Ripple’s growth.

According to Andrew Parish, co-founder of Arch Public, the long-standing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) may soon conclude. Parish shared on X on March 17, 2025, that two SEC sources indicate the case is approaching its end. Initiated in December 2020, the lawsuit centers on the SEC’s claim that Ripple raised over $1.3 billion through unregistered XRP sales. Recent developments suggest a shift in the case’s trajectory sparking reactions from legal experts and the crypto community.

Judge Analisa Torres established in August 2024 that institutional XRP transactions by Ripple breached securities laws, resulting in a $125 million fine and an order to stop such deals. The court determined that programmatic sales made to retail investors were not unlawful under current regulations. The update from Parish matches rising predictions about an upcoming regulatory solution which should clarify both XRP’s status with regulators and Ripple’s operational abilities.

Potential Outcomes Shape XRP’s Future

Parish outlined key possibilities for the lawsuit’s conclusion. According to his view, XRP could acquire commodity classification from the SEC , which would transform its market regulations. The SEC’s proposed change in market classification would serve as the opposite of its initial stance while matching the court’s decision regarding retail sales treatment. Additionally, Parish hinted at a reduced fine, easing the financial burden on Ripple compared to the current $125 million penalty.

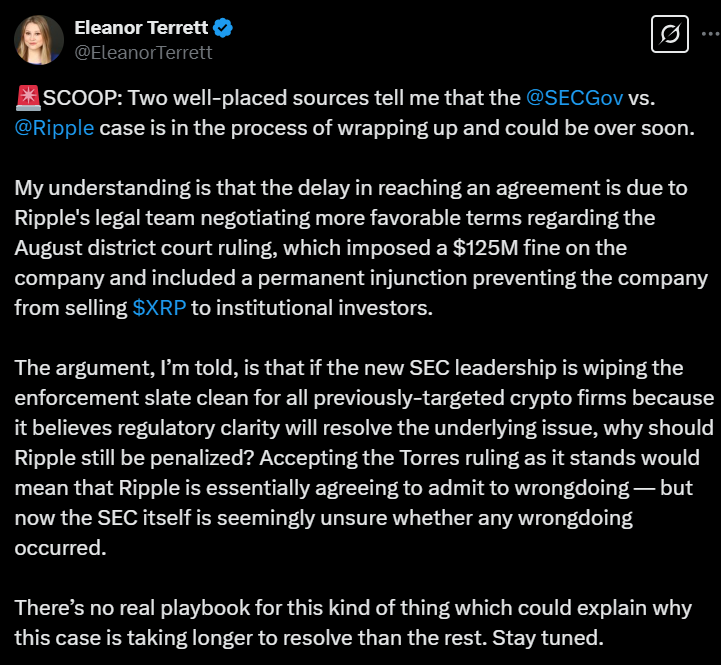

Parish noted that the SEC’s new leadership appears to recognize the case’s broader implications. A decision here could set a precedent for cryptocurrency regulation in the U.S., influencing how digital assets are handled moving forward. Meanwhile, the injunction restricting institutional sales remains a hurdle, with Ripple reportedly negotiating its removal, according to FOX Business journalist Eleanor Terrett last week.

Source; X

Source; X

Legal Experts Weigh In on Ripple Case Developments

Prominent attorneys have responded to Parish’s claims with skepticism and cautious optimism. A pro-XRP lawyer, John Deaton posted an eyes emoji on X, signaling surprise or doubt about the predictions. Another XRP advocate, Bill Morgan acknowledged positive aspects, like the commodity classification, but expressed concern over the unresolved injunction. He emphasized that this restriction continues to limit Ripple’s institutional market access.

Fred Rispoli, a legal expert, took a selective stance, trusting Parish’s sources only for favorable updates. “That’s not hypocrisy—it’s unbridled hope,” Rispoli remarked on X, reflecting his optimism for a positive outcome. These reactions highlight the uncertainty still surrounding the case, even as its end appears near. With XRP trading at $2.33 as of March 18, 2025, per market data, a resolution could spark significant price movement, experts suggest, potentially driving it toward $4.8, as predicted by analyst Egrag Crypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI crypto bot AIXBT Loses $100k of ETH in a Tricky Exploit

Polkadot, Cosmos, & Injective — Recommended Altcoins for 2025

Vitalik Buterin’s DHN Token Sale: A Closer Look at Market Movements

TRX Set to Launch on Solana as TRON Reaches $51M in Fees