Institutional Crypto Products See $1,700,000,000 in Outflows Amid Worst Streak Since 2015: CoinShares

Crypto asset management giant CoinShares says institutional investors pulled billions of dollars out of crypto last week.

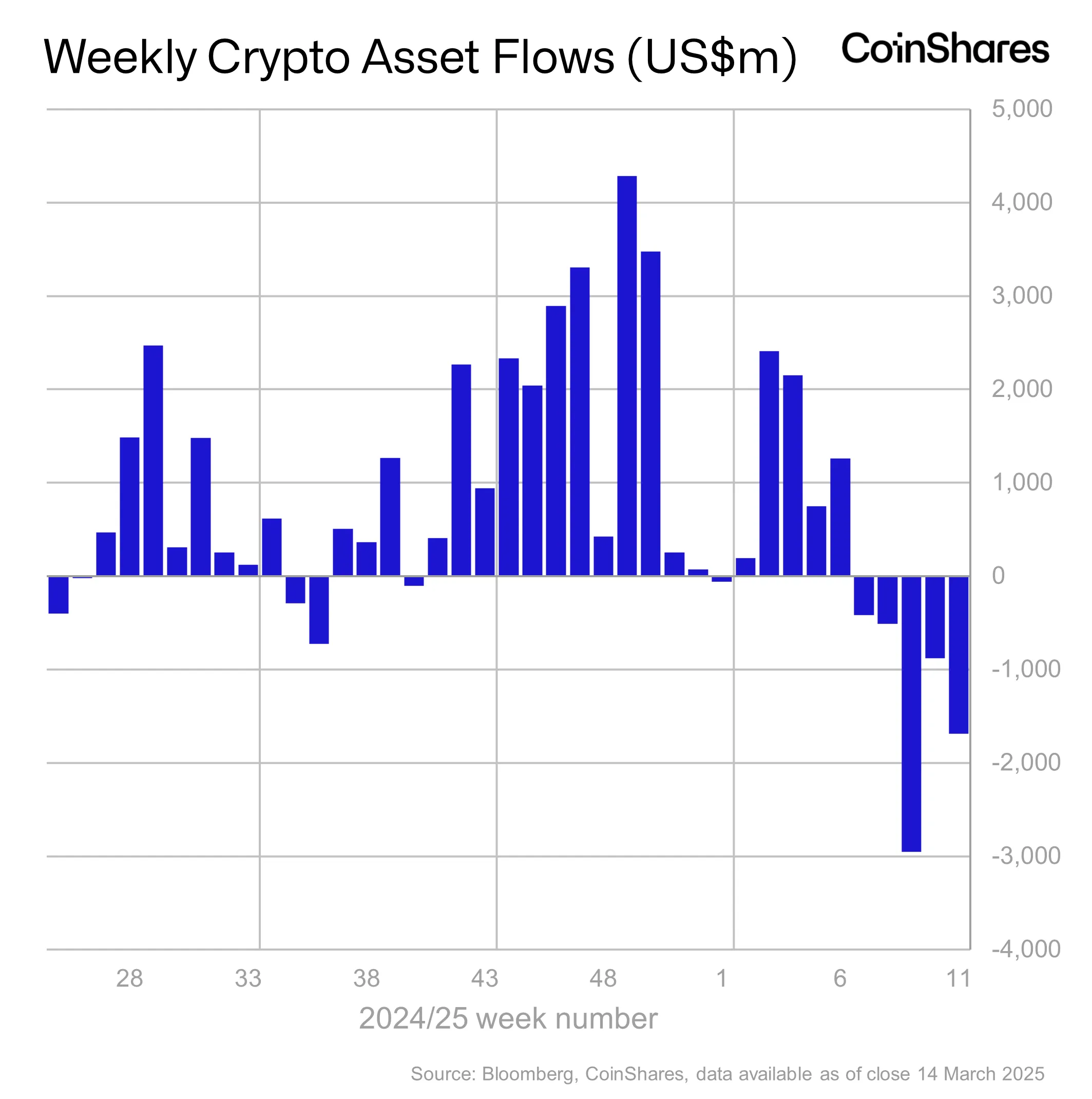

In its latest Digital Asset Fund Flows Weekly Report, CoinShares says crypto products are enduring their worst run of investor outflows in a decade.

“Digital asset investment products saw a 5th consecutive week of outflows, totaling US$1.7bn, bringing the total outflows over this negative funk to US$6.4bn. This also marks the 17th straight day of outflows, the longest negative streak since our records began in 2015.

Despite prevailing negative sentiment, year-to-date inflows remain positive at US$912m. Following this price correction and sustained outflows, total assets under management (AuM) have declined by US$48bn.”

Source: CoinShares

Source: CoinShares

Regionally, the United States provided $1.2 billion in outflows, 93% of all outflows. While Germany provided minor inflows of $8 million, Switzerland also saw outflows of $528 million.

Per usual, Bitcoin ( BTC ) bore the brunt of the outflows.

“Bitcoin saw a further US$978m outflows, bringing total outflows over the last 5 weeks to US$5.4bn. Investors continue to sell out of short-bitcoin positions, seeing US$3.6m outflows.”

Altcoins XRP and Cardano ( ADA ) led the way for inflows at $1.8 million and $0.4 million a piece. Leading smart contract platform Ethereum ( ETH ) products suffered $176 million in outflows.

Follow us on X , Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Strategy prices $711M offering of 10% perpetual strife preferred stock to fund Bitcoin purchases

Share link:In this post: Strategy priced its 10% Perpetual Strife Stock offering at $85.00 per share, planning to use its proceeds to acquire Bitcoin. The stock offering also features a 10% annual dividend rate of $100 per share. Strategy holds about 499 226 BTC, just 774 BTC shy of 500,000.

Solaxy Presale Nears $30M as Top Analyst Predicts 10x Gains for Early Investors

US Treasury Removes Sanctions on Tornado Cash

The US dollar index DXY rose 23 points in the short term and is now at 104.13