Key Notes

- Solana's on-chain activity has plummeted, with daily transactions dropping from 71,738 on January 23 to 24,505 by March 17.

- Additionally, its Total Value Locked (TVL) in DeFi applications has declined 41% since January.

- Solana's open interest (OI) in futures has dropped from $8.57 billion in January to $4.03 billion by March 17.

Solana SOL $127.2 24h volatility: 2.3% Market cap: $64.79 B Vol. 24h: $2.82 B price has come under strong selling pressure dropping another 3.5% today and slipping under $130 levels as of press time. Following the peak in January 2025, SOL has been hitting lower lows facing a brutal correction amid the crypto market downturn. Currently, it is trading at the multi-month support level of $125, while keeping traders on the edge of their seats.

Solana Price Can Possibly Crash 95% if This Happens

Popular crypto analyst Ali Martinez recently noted that the SuperTrend indicator has flipped bearish for Solana (SOL) on the weekly chart. The analysts cautioned investors that the last time this happened, Solana experienced a massive 95% decline in its price.

The last time the SuperTrend indicator flipped bearish on the weekly chart, #Solana $SOL saw a 95% drop! pic.twitter.com/IN1niDJSY3

— Ali (@ali_charts) March 16, 2025

This means that as of the current price, SOL could possibly tank to under $10 levels. This might seem unrealistic for now considering that Solana price has seen strong investors’ interest following its bottom in 2022. However, several on-chain indicators suggest that Solana has been losing its shine on multiple metrics.

Solana Network Activity Drop

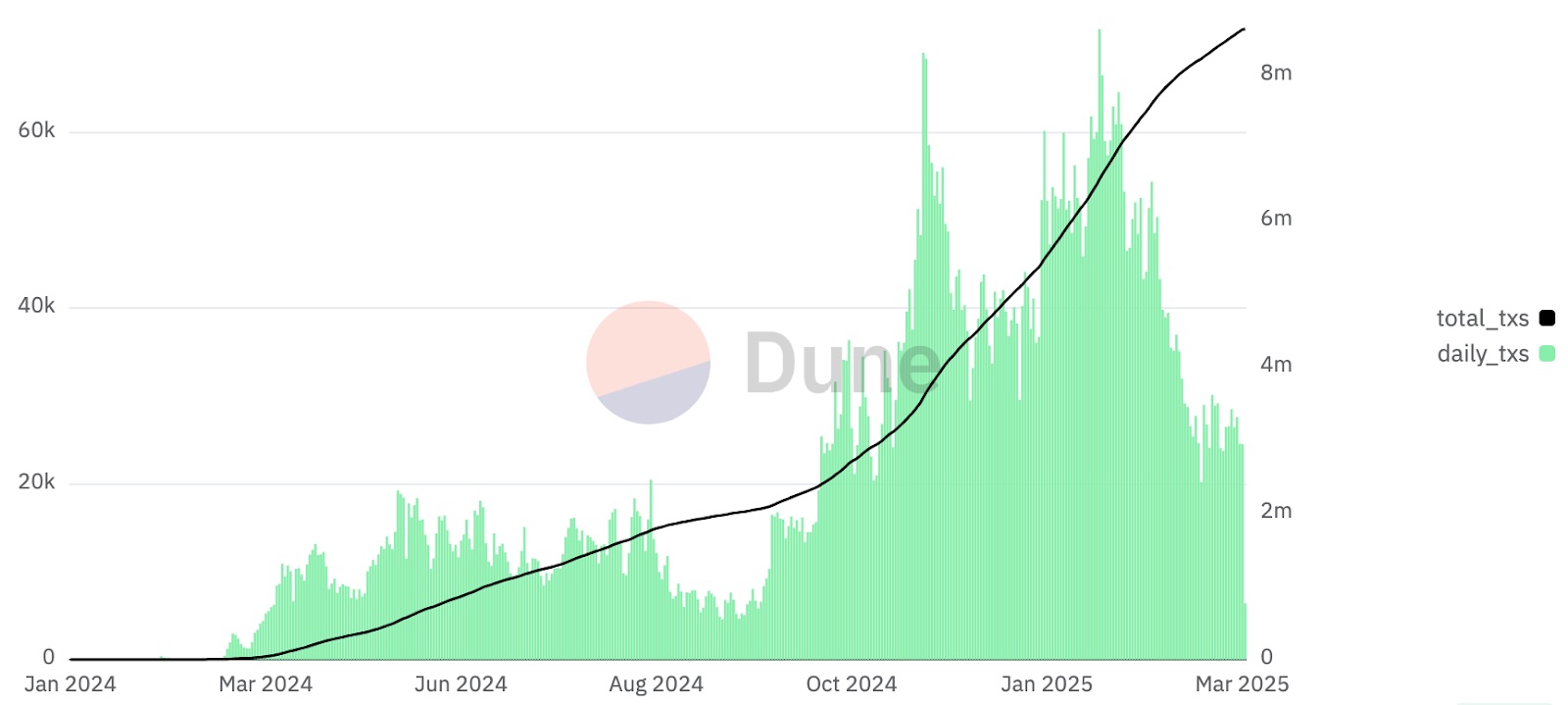

Data from Dune dashboard Pump.fun shows that the recent Solana price slump aligns with a significant drop in on-chain activity within its ecosystem. On Monday, March 17, Solana’s daily network transactions fell sharply to 24,505, a notable decline from the all-time high of 71,738 recorded on January 23.

This clearly highlights the waning user engagement on the blockchain that can lead to decreased revenue from transaction fees. The drop in network activity has contributed to Solana’s ongoing price correction, adding to the bearish sentiment in the market.

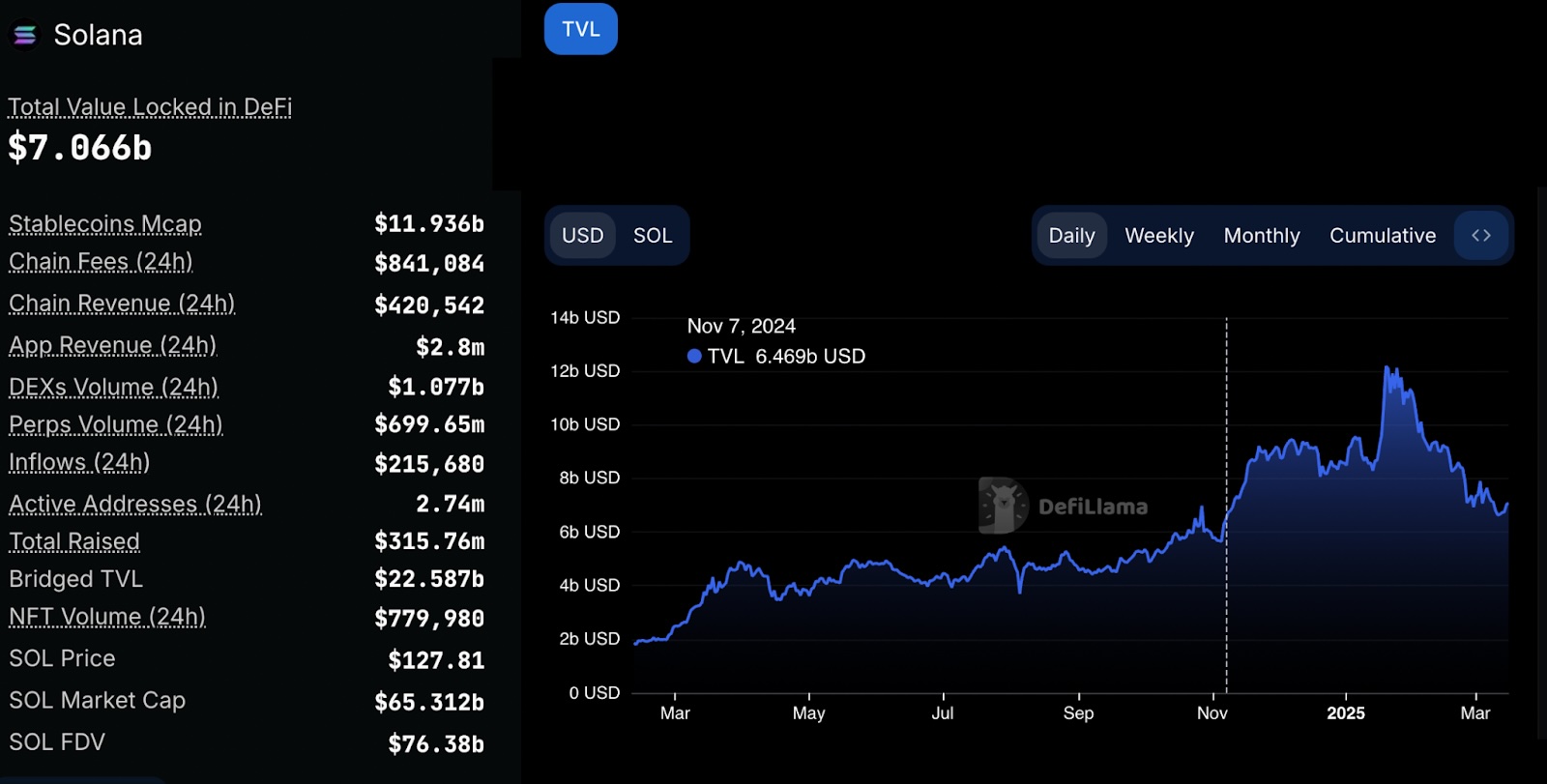

Additionally, there’s also been a significant drop in Solana’s total value locked (TVL) in its decentralized finance ( DeFi ) applications. As per the data from DeFiLama, the Solana TVL has been on a downtrend since mid-January.

Furthermore, the SOL TVL fell 45.5%, from $12.1 billion on January 19 to $6.63 billion by March 11. As of March 17, Solana’s TVL stands at $7 billion, marking a 41% decline from the January peak.

SOL Funding Rates Remain Negative

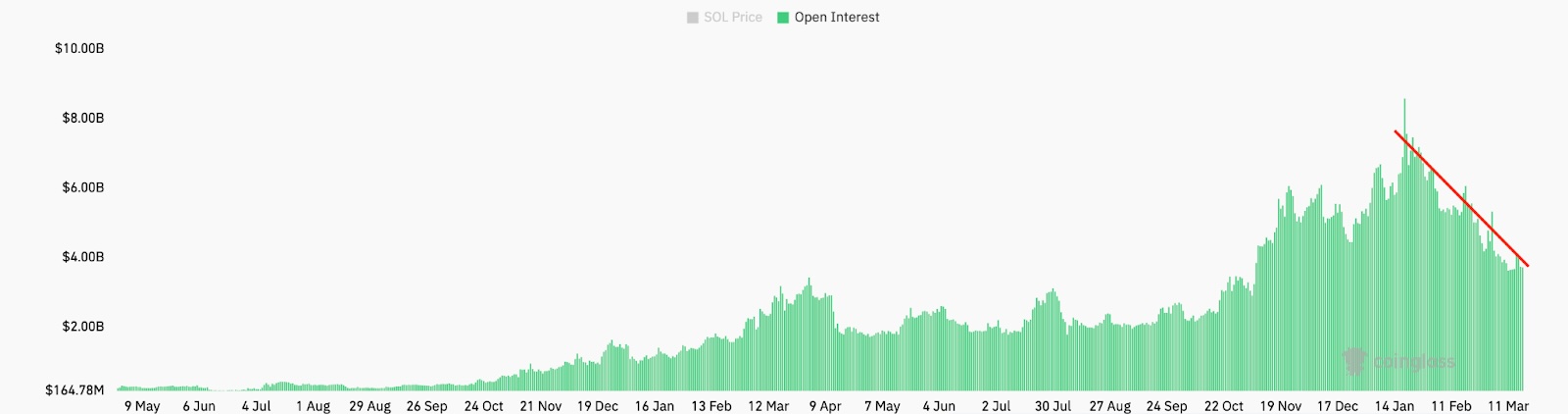

Solana’s open interest (OI) in the futures market is on a downward trajectory, accompanied by negative funding rates, shedding light on the challenges facing SOL price.

Key data points:

- Solana’s OI has dropped significantly, falling from its local peak of $8.57 billion on January 17 to $4.03 billion as of March 17.

- OI represents the total number of outstanding futures contracts, and this decline indicates a growing number of traders are closing their positions.

All these data points suggest that there’s not enough catalyst for the SOL price to move to the upside. A drop under $125 could straight away take Solana to the next support level of $100.

nextDisclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.