Layer-1 Project MultiversX Continues To Top the Crypto Gaming Sector in Terms of Development Activity: Santiment

The layer-1 blockchain MultiversX ( EGLD ) continues to lead the digital asset gaming sector in the realm of development activity, according to the crypto analytics firm Santiment.

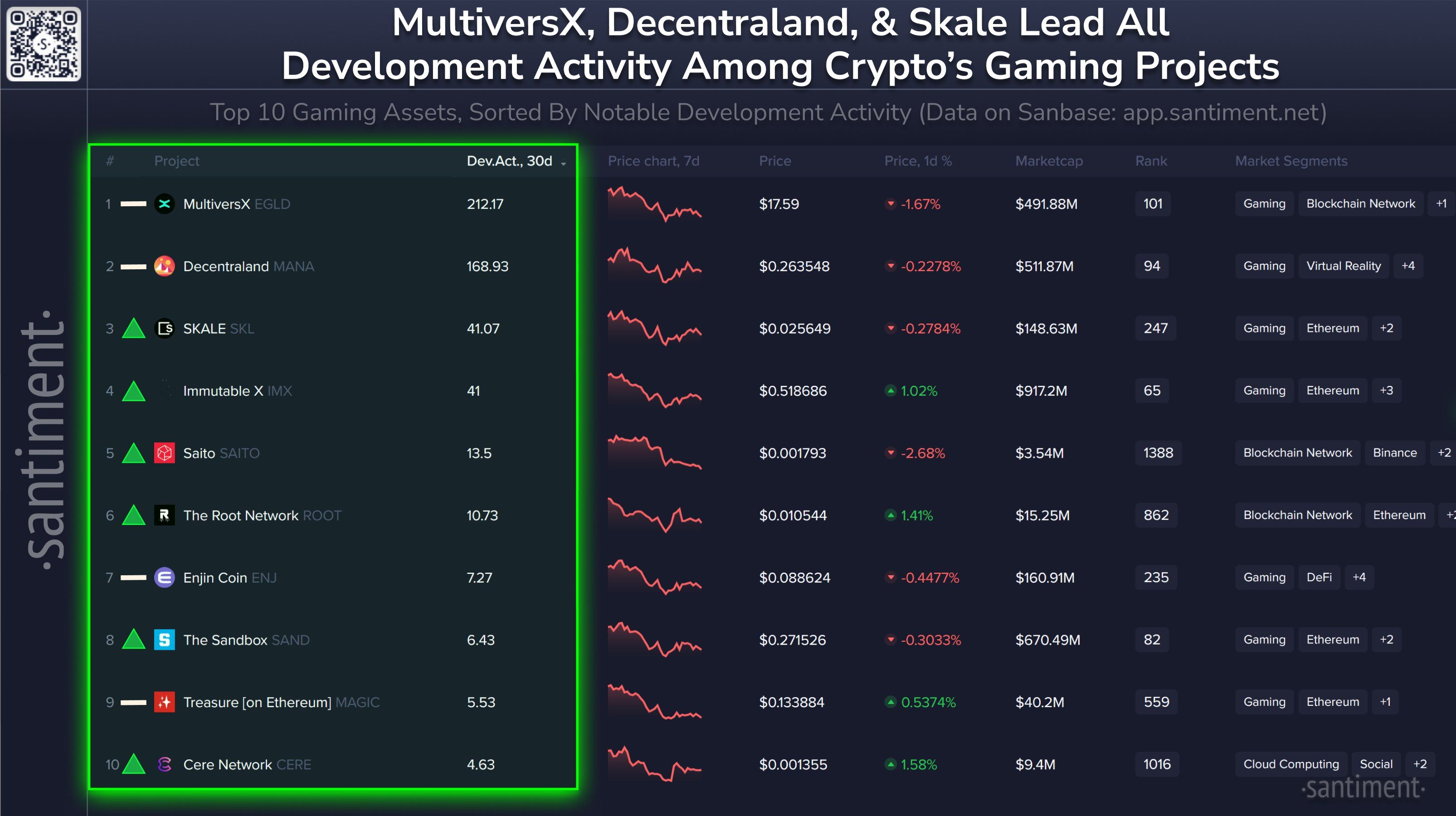

Santiment notes on the social media platform X that MultiversX, formerly known as Elrond, registered 212.17 notable GitHub events in the past 30 days.

The Ethereum ( ETH )-based virtual reality platform Decentraland ( MANA ) ranks second, clocking 168.93 events, and the Ethereum layer-2 protocol Skale Network ( SKL ) is a distant third with 41.07.

MultiversX and Decentraland have occupied the number one and two spots in previous months as well, according to Santiment .

Source: Santiment/X

Source: Santiment/X

Santiment notes that it doesn’t count routine updates and uses a “better methodology” to collect data for GitHub events based on a “backtested process.”

The analytics firm has previously said that heavy development activity centered around a crypto project is a positive indication that could mean that the developers believe the protocol will be successful. It also indicates that the project is less likely to be an exit scam.

MultiversX is a distributed, proof-of-stake blockchain network that is decentralized via more than 3,500 nodes. The project aims to help developers build next-gen applications.

The project’s native token, EGLD, is trading at $18.10 at time of writing. The 139th-ranked crypto asset by market cap is up more than 3% in the past 24 hours.

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Spot Bot adds PAWS/USDT

PAWSUSDT now launched for futures trading and trading bots

Noble to Introduce Ethereum-Compatible AppLayer for Stablecoin Development, Leveraging Celestia’s Blockchain Technology

AERGOUSDT now launched for futures trading and trading bots