Bitcoin bounces to $84k: Is following the crowd a losing strategy?

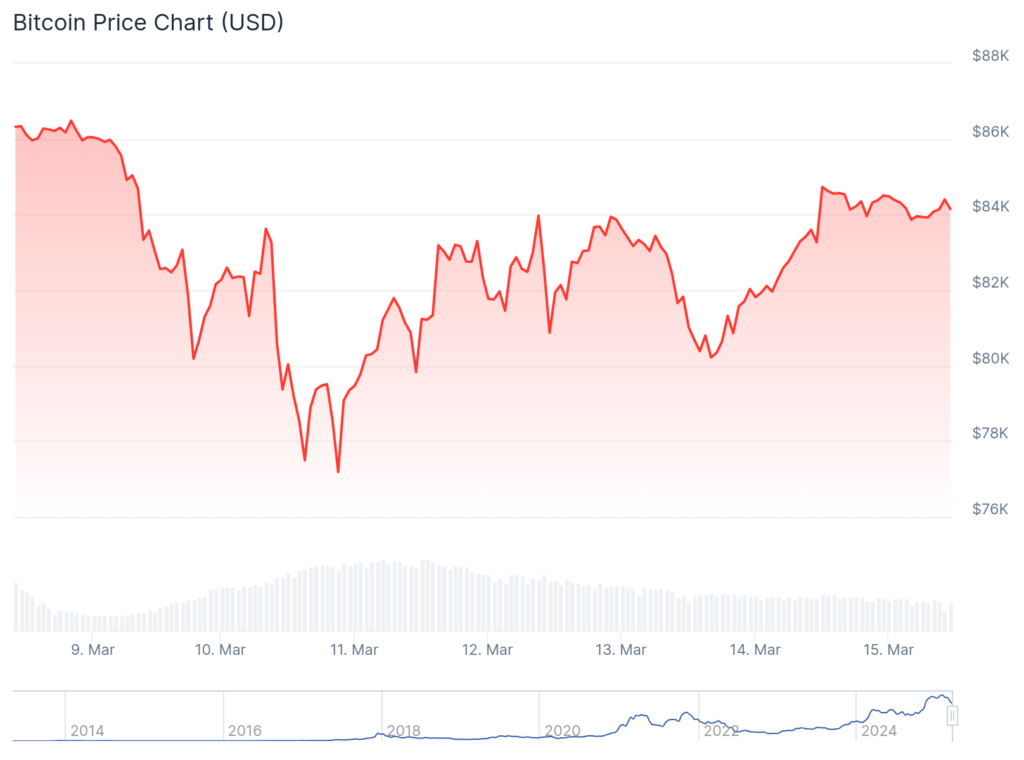

Bitcoin’s recovery to $84,500 on Friday exemplifies why following crowd sentiment often leads to poor trading decisions.

The recent market movements contradict common predictions during periods of extreme fear or greed.

Data analysis from Santiment reveals that social media reached peak negativity when Bitcoin ( BTC ) dipped to $78,000 earlier in the week. There was also online chatter about further declines. This pattern mirrors late February’s market behavior when a temporary price surge in early March followed retail traders’ bearish outlook.

“Bitcoin’s rally back to $84.5K Friday shows what happens when the Monday crowd claims it’s time to sell,” Santiment noted. “Predictably, FUD hit its peak as $BTC was down to $78K, with predictions pouring in for lower prices all across social media.”

The research highlights Bitcoin’s recent stability within a defined range, having neither fallen below $70,000 nor broken above $100,000 over the past month. This stability creates clear sentiment markers: predictions below $70,000 means excessive fear, while forecasts above $100,000 signal overexuberance.

“Historically, markets move the opposite direction of the crowd’s expectations,” Santiment explained. They noted that clusters of bearish predictions ($10K-$69K) often follow upward reversals, while groupings of bullish forecasts ($100K-$159K) usually signal downturns.

Technical analysis supports this sentiment-based approach. Crypto analyst Rekt Capital pointed out that “the signs for a weakening resistance were there.”

He noted that the recent price movement is filling the CME gap between $82,245 and approximately $87,000. He suggests that a daily close above resistance could catalyze further upward momentum.

The current market structure also presents potentially bullish technical signals. Another analyst, Merlijn The Trader, highlighted Bitcoin’s approaching “golden cross.”

This is a technical pattern where the 50-day moving average crosses above the 200-day moving average.

This indicator has historically preceded substantial rallies:

- 139% in 2016

- 2,200% in 2017

- 1,190% in 2020 following previous occurrences.

When sentiment reaches extremes, positions become overcrowded on one side, creating the conditions for sharp reversals. As traders collectively lean bearish, selling pressure exhausts, leaving primarily buyers to influence price action.

At last check, Bitcoin was down 0.2% for the day, trading at $84,145. It’s down 22.7% from its all-time high of $108,786.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Will List Bubb (BUBB) in the Innovation and Meme Zone.

Real-World Assets Cross $10 Billion in Total Value Locked: DeFiLlama

KAVA Price Soars 11%, Becomes Crypto’s Top Gainer

Valhil Capital Founder Pursues $500 Billion XRP Payback for Holders from SEC